How Ethereum responded to Grayscale’s spot ETF request

- Grayscale initiated Ethereum ETF conversion, probably increasing crypto accessibility for mainstream buyers.

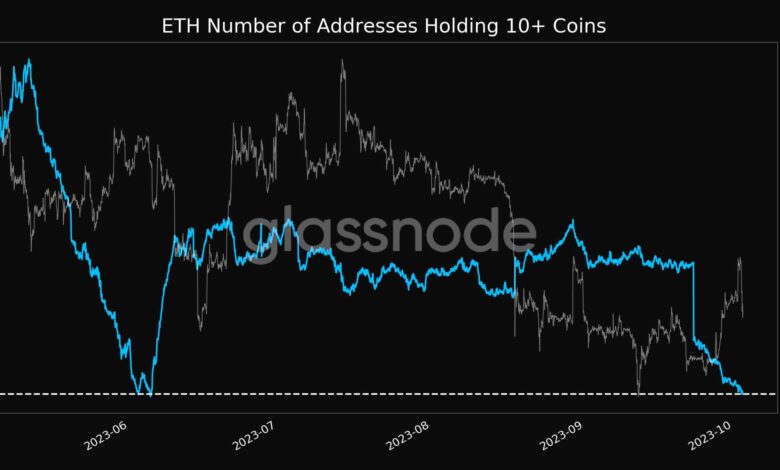

- Whale curiosity in ETH decreased regardless of ETF hype.

Grayscale Investments, one in every of world’s largest crypto asset managers, just lately made a major transfer within the ongoing Ethereum [ETH] ETF saga. They announced that NYSE Arca filed with the SEC to transform Grayscale Ethereum Belief (ETHE) right into a spot Ethereum ETF.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

This improvement follows the current SEC clearance of the primary Ethereum futures ETFs, marking a vital step in increasing Ethereum’s presence within the U.S. regulatory framework.

Grayscale makes it strikes, however whales shrink back

Michael Sonnenshein, the CEO of Grayscale, emphasised their dedication to offering buyers with clear and controlled entry to crypto by means of acquainted product buildings. Changing ETHE to an ETF is seen as a pure development on this endeavor, bringing Ethereum additional throughout the purview of U.S. regulatory authorities.

This important transfer might probably have a constructive influence on Ethereum by growing accessibility and acceptance amongst mainstream buyers.

Nonetheless, knowledge from Glassnode revealed that whale curiosity in Ethereum was waning. The variety of addresses holding 10 or extra cash just lately hit a three-month low, with solely 347,343 such addresses remaining.

Supply: glassnode

Growth exercise continues

Regardless of the worth fluctuations skilled by Ethereum, its developer neighborhood remained actively engaged in advancing the protocol. In a current developer assembly, numerous essential subjects had been mentioned.

One spotlight was the progress of testing for the upcoming Dencun improve. Though the aim was to launch Devnet-9, a testnet for this improve, it encountered some delays. This explicit testnet is pivotal because it prompts all 9 code adjustments associated to Dencun, making certain a seamless transition when carried out.

One other essential dialogue revolved across the audit outcomes for EIP 4788. This proposal entailed adjustments associated to the beacon block root within the Ethereum Digital Machine (EVM). A number of audits had been performed, uncovering necessary findings.

Notably, there have been issues concerning customers’ skill to question the good contract tackle utilizing particular timestamps, which might probably result in vulnerabilities.

Lifelike or not, right here’s ETH’s market cap in BTC phrases

Moreover, suggestions had been made to handle a specific a part of the code that exhibited conduct adjustments primarily based on sure parameters.

On the time of reporting, Ethereum was buying and selling at $1,675. Regardless of the worth surge, there had been a noticeable decline in community progress. This implied that the brand new addresses had been beginning to lose curiosity in ETH.

Supply: Santiment