Bitcoin’s hike brings shorts nothing but pain: What now?

- Brief positions round $27,600 may very well be vulnerable to liquidation if Bitcoin breaks $28,000.

- The value enhance has not led to widespread profit-taking, which means members have been nonetheless bullish on the value motion.

Bitcoin’s [BTC] rise within the $28,000 route has left quite a lot of shorts liquidated, in accordance with a latest revelation by Coinglass.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

In line with the crypto derivatives portal, the one-week Bitcoin liquidation heatmap confirmed that quite a few shorts holding the $27,450 place have been worn out of the market.

GM!☕️#BTC liquidation heatmap (1 week)

At 27450, a lot of shorts have been liquidated.

Subsequent deal with the liquidation ranges of 26500 and 27660.https://t.co/Nu9kTJMzy2 pic.twitter.com/OaeSzdQJ1N

— CoinGlass (@coinglass_com) October 16, 2023

Liquidation happens when a place has run out of margin cowl, which means that the commerce needs to be settled by means of compelled closing. Alternatively, the Bitcoin liquidation heatmap is a visible illustration of probably liquidation ranges based mostly on earlier worth tendencies.

Longs season to thrive

From Coinglass’ publish above, the expected liquidation level may very well be round $27,660, and this will likely occur if BTC breaks $28,000. However what are the probabilities?

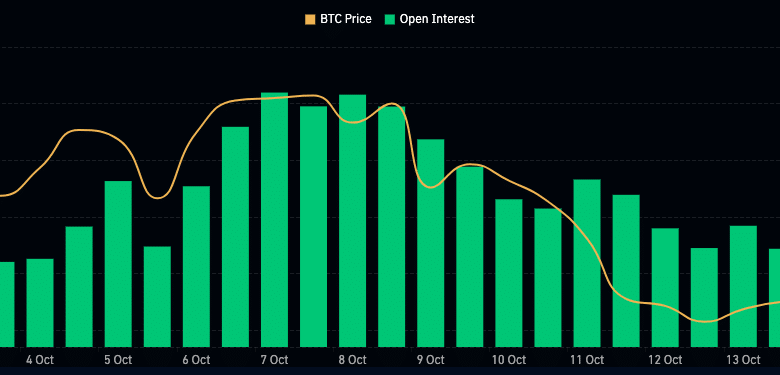

One metric that gives perception right into a doable projection is Bitcoin’s Open Interest, alongside the value motion. Open Curiosity is outlined as the quantity of lengthy and brief positions on a derivatives alternate.

Excessive Open Curiosity typically means sturdy participation available in the market, which additionally interprets to excessive liquidity. One other fascinating half is {that a} excessive Open Curiosity opens the floodgates for elevated volatility.

In the meantime, low Open Curiosity alerts low liquidity and lowered participation available in the market.

In line with Coinglass, Bitcoin’s Open Curiosity has considerably elevated throughout the final 12 hours. With the BTC worth additionally on an uptrend, there’s a chance of an increase past $28,000 relatively than a fall beneath $27,000.

Supply: Coinglass

Apparently, the typical derivatives dealer additionally shared the identical sentiment, as indicated by the Funding Rate. As a measure of market sentiment, funding charges observe open brief or lengthy positions.

When the Funding Price is adverse, it means shorts are paying longs a funding price and the typical sentiment is bearish. However at 0.01%., Bitcoin’s press time Funding Price meant that merchants have been bullish on the value motion.

Supply: Santiment

Potential upside for BTC

Nonetheless, utilizing solely metrics linked to the Futures market in assessing the potential BTC route may very well be dangerous. Subsequently, it’s also essential to judge spot market exercise. Right here, the Exchange Influx and Trade Outflow come into play.

The Trade Influx measures the variety of BTC despatched from exterior wallets into exchanges. Alternatively, the Trade Outflow is the variety of BTC despatched from exchanges to non-exchange addresses.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

At press time, Bitcoin’s Trade Influx was 2360 whereas the outflow was 2412. Though this was a small distinction, the metric revealed that there was much less profit-taking available in the market regardless of the value rise.

Supply: Santiment

Just like the alerts from the Open Curiosity, BTC has extra uptick possibilities than a downtrend. Nonetheless, it will solely be doable if large promoting stress doesn’t seem, and excessive curiosity available in the market stays.