Bitcoin: Are long-term trades back in full swing? This data suggests that…

- Bitcoin may very well be transitioning from a choice for short-term to long-term good points.

- Leverage merchants again off after latest liquidations.

Bitcoin [BTC] merchants have been ready for indicators that would point out that the cryptocurrency was making the swap from short-term profit-taking to a long-term outlook. At press time, the market confirmed some indicators that the swap would possibly already be in impact.

What number of are 1,10,100 BTCs price at the moment

Latest market information indicated that Bitcoin trades executed within the choices (derivatives) section have been shifting in favor of a long-term outlook. The evaluation of latest choices trades revealed that fairly a considerable variety of trades concentrate on long-term trades reasonably than short-term income.

Though the ETF information is over, there is not going to be any substantial advantages quickly and the hype has come to an finish. However BTC did appeal to market fund, with value up $1,000 in comparison with final week, whereas different cash have been weaker.

And searching on the choices information, bets on longer-term up… pic.twitter.com/kq9NNuojG5— Greeks.dwell (@GreeksLive) October 18, 2023

Bitcoin demand within the derivatives section usually aligns with the sentiment within the spot market. Therefore, the surge in derivatives demand can be utilized as a yardstick to evaluate the present state of the market. So, let’s check out how Bitcoin’s derivatives metrics have been fairing.

Bitcoin sees some restoration

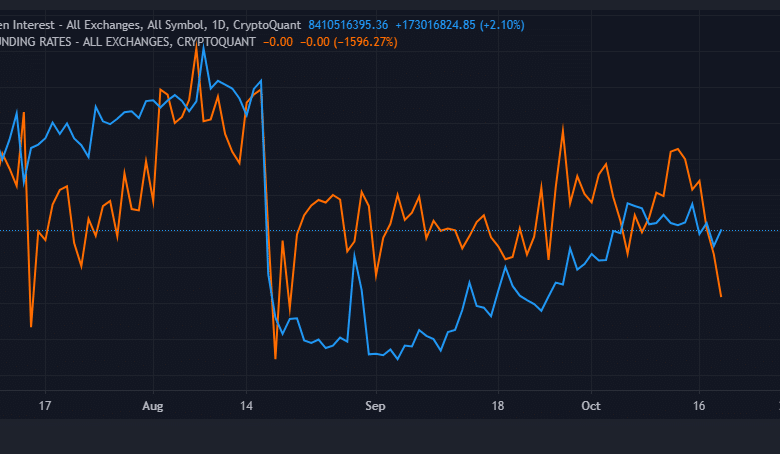

BTC’s open curiosity within the derivatives market dipped significantly in August. Nevertheless, it has since recovered by a substantial margin. Nevertheless, it did witness a slowdown since mid-October, and this may very well be resulting from a drop within the preliminary demand noticed within the days prior.

Supply: CryptoQuant

Funding charges additionally recovered from August lows. Nevertheless, the final three weeks noticed a drop in BTC funding charges. This will likely not essentially replicate the expectations of a long-term shift. Nevertheless, there may be a superb clarification for this.

It seems that Bitcoin’s newest value spike introduced with it a dip within the estimated leverage ratio. This advised that many merchants had bearish expectations and thus, funding charges might have favored quick positions previous to mid-October.

Supply: CryptoQuant

The sudden value shift in favor of the bulls might have thus led to traders pulling their funds from quick positions. That is what triggered a spike in brief liquidations which soared to a four-month excessive. This might have supported greater BTC costs.

Learn Bitcoin’s [BTC] value prediction 2023-24

There are a number of key observations that merchants ought to be aware primarily based on the above information. Open curiosity recovered barely according to the bullish sentiment. On the identical time, Bitcoin additionally confirmed resilience above the $28,000 value stage within the final 4 days regardless of proof of some short-term profit-taking.

These findings confirmed that Bitcoin merchants have been extra keen to HODL maybe in anticipation of restoration above the $30,000 vary. The dip within the urge for food for leverage means that BTC may be much less delicate to liquidations which will suppress its rally for now.