How FOMO around Bitcoin ETFs can change the tides

- In contrast to earlier cycles, the present heated market might result in a correction.

- If Bitcoin’s worth decreases, excessive liquidity and volatility would possibly ship it again to the upside.

Following the worth improve to $30,000, the Bitcoin [BTC] community has entered right into a high-profit revenue interval. This info was disclosed by Alex Aldler Jr, an information analyst and Bitcoin analysis specialist.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Alder, utilizing the Bitcoin Realized Revenue/Loss metric, confirmed that there have been a whole lot of income made on-chain.

A realized revenue or loss happens when a cryptocurrency is bought for a better or cheaper price than it was bought. When the distinction between the full consideration and value foundation is constructive, it implies a realized acquire. However, a destructive distinction infers a realized loss.

A sizzling market can’t cease the swap

Based on the Bitcoin Realized Revenue/Loss chart shared by the analyst, a whole lot of market gamers had made excessive features. Traditionally, this hike was alleged to set off a major correction.

Nonetheless, Adler famous that it may not occur this cycle as a result of FOMO across the spot ETF functions and attainable approval.

The #Bitcoin community has entered a Excessive Revenue Stage interval. Earlier entries into this degree considerably slowed development and led to market corrections. Nonetheless, as a result of #ETF FOMO, this time issues may be totally different.#btc pic.twitter.com/SH1VrnX160

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 22, 2023

Though the U.S. SEC has made it clear that the approval could also be delayed till subsequent 12 months, many are nonetheless optimistic that one of many quite a few functions will get a go-ahead earlier than 2023 ends.

In consequence, market gamers have dedicated to staying lively out there. This resolute stance has additionally been essential to the BTC worth solely retracing barely in the previous couple of days.

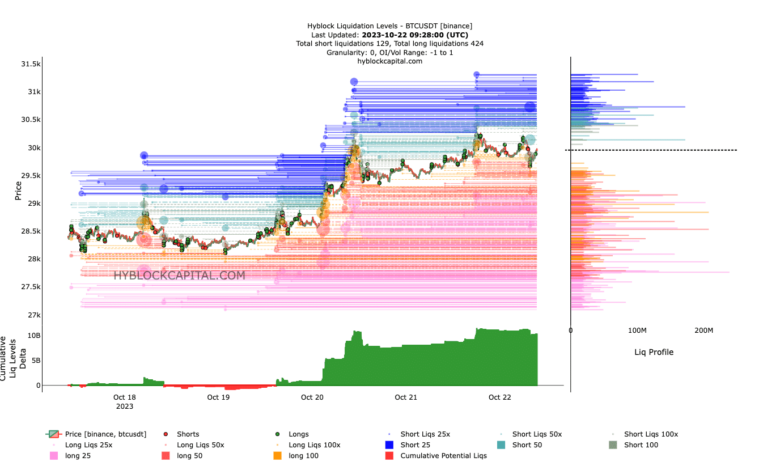

In the meantime, Bitcoin’s liquidation levels knowledge from HyblockCapital confirmed there have been aggressive shopping for at $29,886.

For context, liquidation ranges are estimates of potential worth ranges the place the place of leverage merchants may very well be closed after reaching preliminary margins. Additionally, the cumulative liquidation degree delta confirmed that there was a whole lot of strain on the purchase facet.

Supply: HyblockCapital

BTC might fall, but it surely’s not the end line

In consequence, the worth would possibly absolutely retrace, making a bearish bias within the course of. Ought to Bitcoin fall to $29,000, and liquidity improve once more out there, then it may very well be a time to open extra lengthy positions.

In one other publish on X (previously Twitter), Adler famous that lively addresses might proceed to extend on the Bitcoin community. This metric serves as a measure of crowd interplay round a coin.

In the course of the first quarter of the 12 months, Bitcoin lively addresses reached spectacular ranges. This led to excessive volatility whereas bringing features for BTC holders.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Though the analyst talked about that the exercise of the community has decreased in comparison with final week, he additionally famous that lively addresses would possibly resume their hypothesis quickly as a result of ETF FOMO.

Final week there was a file within the variety of transactions on the community; the quantity was equal to the spike seen in April.

Exercise decreased over the weekend, however I do not suppose it is going to impression the FOMO related to the potential approval of an ETF.#BTC pic.twitter.com/8cgfO915Ay

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 22, 2023

If exercise jumps once more, then volatility might develop into excessive and BTC might break the $30,000 resistance. In a case the place the quantity follows within the upward course, Bitcoin may considerably surge above the aforementioned resistance.