Evaluating BTC’s Q3 mining report as it sheds light on these patterns

- Bitcoin’s hashrate stood at 17% in January; it later grew to 27% in October.

- On one other observe, a number of public Bitcoin miners are aggressively increasing to adapt to the Bitcoin halving that takes place subsequent yr.

The latest bull run out there has put the highlight again on Bitcoin [BTC]. We determined to take a look at its relationship vis-à-vis the efficiency of the crypto mining sector.

Hashrate Index lately released its Q3 2023 Bitcoin mining report. The report make clear the completely different features of crypto mining throughout July-September 2023.

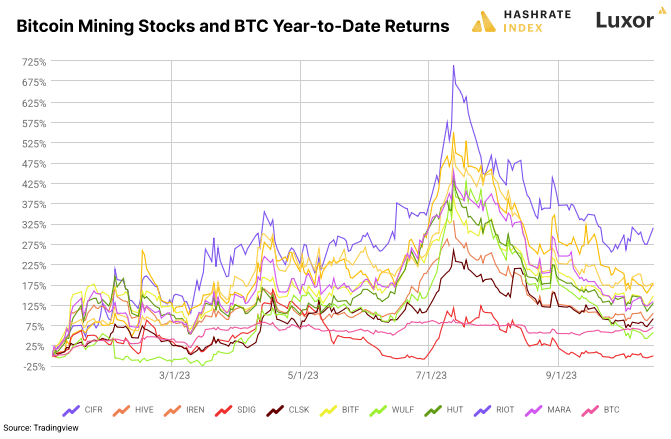

The shares of public Bitcoin mining corporations began off on the appropriate foot in July as BTC was buying and selling north of $30K throughout most days within the month. However the second it dropped to the value vary of $25K-$26K, the efficiency of the shares additionally started to deteriorate.

Supply: Hashrate Index

As we will observe, the inventory efficiency is carefully correlated to the value motion of the king coin.

As per the report, Bitcoin’s seven-day common hashrate grew by 56% through the first 5 months of 2023. Then, through the months of June, July, and August, its hashrate fell by a modest 1.3%. In September, it out of the blue elevated by 12%. Finally, it reached an all-time excessive (ATH) in mid-October after rising 6% up to now this month.

Supply: Hashrate Index

The report’s authors write they’re comparatively sure that it’s a seasonal sample through the summer season. US-based miners curtail their mining actions throughout these months. The nation homes round 40% of Bitcoin’s world hashrate.

Texas, the mining hub of the US, is extraordinarily scorching in the summertime. Miners working within the area curtailed their actions through the season.

What manufacturing and hashrate progress inform us

The report additionally make clear the Bitcoin manufacturing (models produced) and hashrate (EH/s) of the main Bitcoin mining corporations.

Marathon Digital grew its operational hashrate from 7.3 EH/s to over 19.1 EH/s year-to-date (YTD). It has the biggest lively hashrate among the many public Bitcoin miners working in North America. The report commented that the agency may obtain its goal of 23 EH/s if it deploys its present inventory of S19 XP rigs to interchange their S19j Professionals.

Supply: Hashrate Index

Riot Platforms noticed a big drop in its Bitcoin manufacturing. The hashrate of the agency additionally didn’t develop as anticipated. The principle cause for this modest efficiency was the power curbing its operations through the month.

Supply: Hashrate Index

Iris Power dramatically elevated its hashrate from 1.57 EH/s to over 5.55 EH/s this yr. The rationale behind this progress is the mining agency procuring new machines to interchange the ASICs. Nevertheless, its Bitcoin manufacturing dwindled throughout the previous couple of months.

Supply: Hashrate Index

Core Scientific noticed a big drop in its hashrate capability as a result of its restructuring throughout its Chapter 11 chapter. Throughout the chapter proceedings, it bought all of its BTC to pay collectors and canopy operational and chapter prices. Its Bitcoin manufacturing was, nonetheless, not so disappointing.

Supply: Hashrate Index

Jaran Mellerud, one of many report’s contributors, drew our consideration to the rising share of public Bitcoin miners to Bitcoin’s hashrate over months. In January, public miners contributed 17% of the whole hashrate; it grew to 27% in October.

The general public miners account for 27% of #Bitcoin‘s hashrate, an amazing progress from 17% in January 2022.

The general public miners’ share of Bitcoin’s hashrate will continue to grow as well-capitalized public miners buy the belongings of distressed non-public miners following the halving. pic.twitter.com/GLczGHZTad

— Jaran Mellerud 🟧⛏️ (@JMellerud) October 21, 2023

One factor to remember is that the subsequent Bitcoin halving can be nearing, scheduled to happen subsequent yr. A variety of public Bitcoin mining corporations are aggressively increasing to be able to be ready for the event.

The report concludes that the US nonetheless retains probably the most hashrate out of any nation. North America alone retains roughly 45% of the worldwide hashrate. Europe—significantly, the Nordic area—has additionally grow to be a preferred vacation spot for public Bitcoin miners.

Supply: Hashrate Index