Bitcoin: Who will dictate the price of BTC – short term holders or whales?

- Quick-term holders bought their BTC on the highest revenue margin since April.

- Whales then again have been spending closely.

Bitcoin’s [BTC] current value rally created a lot pleasure within the crypto world. Nevertheless, the next plateauing of BTC across the $34,000 to $35,000 mark raised questions on who will dictate its value within the brief time period.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Accumulations and Promote Offs

Quick-term holders and whales have been key gamers within the Bitcoin market. Quick-term holders have been presently promoting on the highest revenue margin since April, in line with Crypto Quant analyst Julio Moreno’s information.

Then again, whales are spending on the highest degree since June. This dynamic prompt that each short-term holders and whales are taking vital actions, probably impacting BTC’s value ranges. The course during which they proceed to maneuver might form Bitcoin’s close to future.

After the current #Bitcoin value rally we are able to see two fascinating developments On-chain:

– Quick-term holders are “promoting” on the highest revenue margin since April.

– Whales are “spending” on the highest degree since June.

This might be according to a pause within the rally. pic.twitter.com/aaoVhCotWl

— Julio Moreno (@jjcmoreno) October 27, 2023

dealer conduct

Moreover, Bitcoin choices open curiosity relative to perpetual swaps just lately reached an all-time excessive. This growth mirrored a surge in curiosity and exercise in Bitcoin choices buying and selling.

The rising choices market might introduce extra volatility and value uncertainty into the BTC market. Merchants and buyers have to intently monitor this development because it might considerably have an effect on value actions.

Bitcoin choices open curiosity relative to perpetual swaps simply reached an all-time excessive.

Not a foul thought to be taught some fundamentals on choices, as they will have a bigger influence on market construction transferring ahead. pic.twitter.com/TEuxFWBqSG

— Will Clemente (@WClementeIII) October 27, 2023

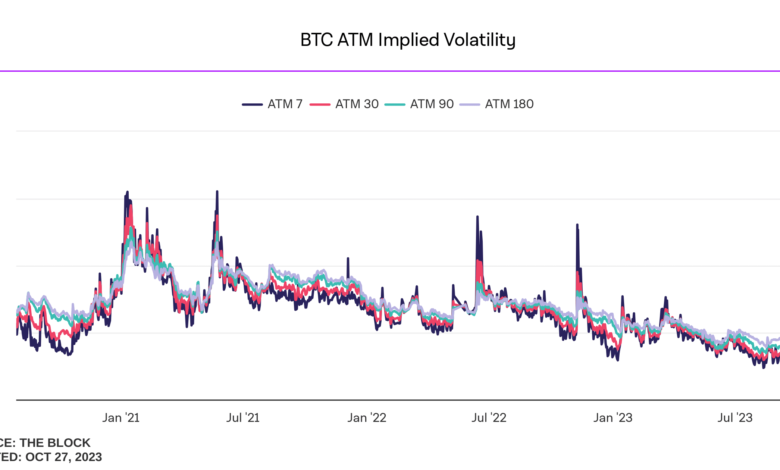

Implied Volatility (IV) for Bitcoin skilled a exceptional surge over the previous few days. IV represented the anticipated volatility of an asset’s value.

When IV will increase, it signifies that market contributors anticipate extra vital value fluctuations. This heightened IV might result in elevated value turbulence, making Bitcoin a doubtlessly riskier asset within the brief time period.

Supply: The Block

The 25 Delta Skew, a metric measuring choices market sentiment, has proven a slight decline over the previous few days. This implies that merchants could also be much less inclined to make bullish bets on Bitcoin.

Such shifts in sentiment can affect value actions. A diminished 25 Delta Skew may result in extra secure and even bearish value tendencies for Bitcoin.

Supply: Velo

Learn Bitcoin’s Worth Prediction 2023-2024

Worth stays stagnant

As for the king coin’s present state, it’s buying and selling at $33,400. Throughout this era, every day energetic addresses on the BTC community have skilled vital progress. This enhance in exercise exhibits that extra customers are participating with the Bitcoin blockchain.

It might be a sign of renewed curiosity in Bitcoin and the broader crypto market, which can have implications for its value course.

Supply: Santiment