Crypto Spot Trading Volumes Climb To 8-Month Highs

Bitcoin’s surge previous $35,000 on the twenty fourth and twenty fifth of October took the crypto world unexpectedly, because it indicated what may be the start of a brand new bullish sentiment. Buying and selling volumes for the world’s largest cryptocurrency hit their highest ranges since March, displaying that curiosity in Bitcoin is booming as soon as extra.

Your entire crypto market noticed an influx of funds throughout the week, resulting in a surge in market cap. Data from CoinGecko reveals that the complete market cap elevated from $1.184 trillion on Sunday, October 22, to $1.312 trillion on Wednesday, October 25. Most of this influx went into Bitcoin, which noticed its share of the cryptocurrency market improve from 49.58% to 51.47 % throughout this identical time interval.

Chart From CoinGecko

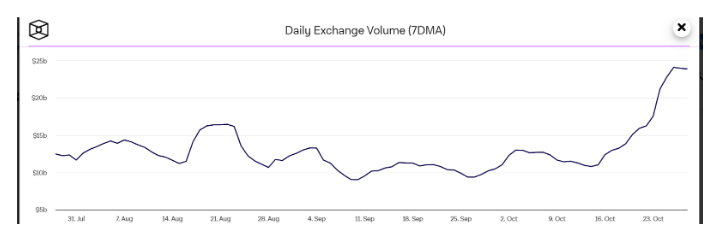

Each day Crypto Alternate Volumes Attain 8-Month Excessive

The latest growth in Bitcoin and cryptocurrency costs pushed Bitcoin day by day buying and selling volumes on crypto exchanges to their highest degree since March. According to The Block’s knowledge dashboard, the seven-day transferring common for spot change volumes throughout a number of exchanges hit $24.12 billion on Thursday and $23.98 billion on Friday, respectively. Compared, Bitcoin buying and selling quantity on exchanges was at $11.02 billion on the primary day of the month.

Chart from The Block

An identical metric from IntoTheBlock reveals Bitcoin transactions reaching 1.4 million BTC as bulls regarded to push Bitcoin to $35,000.

Chart from IntoTheBlock

Buying and selling volumes are an vital metric as a result of larger volumes recommend better curiosity and exercise in a market. It means extra individuals are actively shopping for and promoting, resulting in extra liquidity and volatility.

Whale exercise additionally elevated throughout this time interval, as indicated by on-chain trackers. Whale transaction tracker Whale Alerts has proven varied BTC transactions amounting to hundreds of thousands of {dollars} to and from crypto exchanges.

🚨 🚨 🚨 2,000 #BTC (68,255,228 USD) transferred from #Coinbase to unknown pocketshttps://t.co/SdIJ87ZxNT

— Whale Alert (@whale_alert) October 26, 2023

🚨 🚨 🚨 2,000 #BTC (68,560,116 USD) transferred from unknown pockets to #Coinbasehttps://t.co/MJNn4HwswP

BTCUSD buying and selling at $34,187 on the weekend chart: TradingView.com

— Whale Alert (@whale_alert) October 26, 2023

🚨 🚨 🚨 1,499 #BTC (51,276,429 USD) transferred from #Binance to #Coinbenehttps://t.co/lVaDk8pYio

— Whale Alert (@whale_alert) October 27, 2023

What’s Subsequent? Extra Bitcoin Motion?

Bitcoin has since fashioned a resistance degree round $35,000 and is now buying and selling in a variety. On the time of writing, Bitcoin is buying and selling at $34,150, nonetheless up by 14.47% in a 7-day timeframe. Whereas value motion appears to be transferring sideways for the time being, there are nonetheless hopes of continued momentum from the bulls to push BTC previous $35,000 within the new week.

Matt Hougan, CEO of crypto index fund supervisor Bitwise, has hinted at an extra influx of cash into Bitcoin. Hougan makes this prediction on spot Bitcoin ETFs to mission an influx of round $50 billion inside the first 5 years of its launch. Others like crypto monetary companies platform Matrixport have made extra optimistic claims.

Knowledge from analytics platform mempool.house has proven a sustained improve in exercise on the BTC community. If bulls proceed to take care of a robust push, we might see Bitcoin attain as excessive as $45,000 within the early days of November.

Featured picture from Shutterstock