Is Bitcoin the new gold? What the data suggests

- Bitcoin’s co-relation with gold has reached new heights.

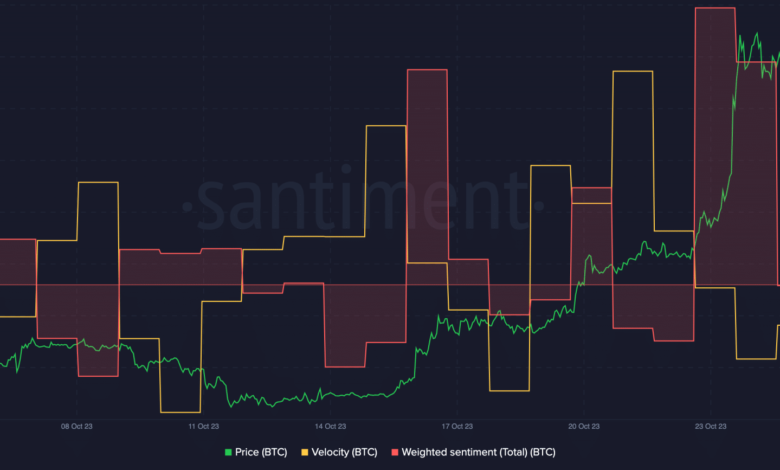

- At press time, merchants had a constructive outlook in direction of BTC.

Amidst financial uncertainty, merchants are looking for methods to safeguard their wealth. Often, gold has been their go-to selection throughout troubled occasions. Nonetheless, there’s been a current shift within the monetary panorama.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Gold rush

Bitcoin [BTC] was gaining recognition as an funding up to now few weeks. Moreover, its reference to gold reached its highest degree for the reason that banking disaster earlier this 12 months.

This correlation between BTC and gold boosted constructive sentiment round Bitcoin. It’s more and more being seen as a hedge in opposition to financial uncertainty.

BTC’s correlation to gold is the very best that it has been for the reason that banking disaster earlier this 12 months pic.twitter.com/tF5juTJx1k

— Will Clemente (@WClementeIII) October 28, 2023

On the time of writing, Bitcoin was priced at $34,100. Each its worth and buying and selling exercise skilled substantial surges in current days. Nonetheless, there was a drop in total sentiment about BTC.

This implied that destructive emotions and feedback about Bitcoin had been beginning to outnumber the constructive ones. This mismatch between Bitcoin’s worth and the sentiment surrounding could result in a bearish pattern sooner or later.

Supply: Santiment

Miners are blissful

One other necessary issue that would play an enormous position in Bitcoin’s promoting strain is the conduct of Bitcoin miners. These miners validate transactions and safe the community. Just lately, miner income grew considerably, indicating that miners had been incomes extra.

This spike in miner income is necessary for Bitcoin’s stability. When miners are making substantial earnings, they’re much less prone to promote their holdings. This in flip reduces promoting strain in the marketplace.

Supply: Blockchain.com

Moreover, mining problem has additionally noticed a big surge. This problem measures the computational effort required to mine new Bitcoins. As the issue degree rises, mining new cash turns into more difficult. This finally ends up impacting the general provide of Bitcoin.

With the rising mining problem, the creation of recent Bitcoins slows down. This might probably result in elevated shortage. This issue has beforehand been linked with upward worth actions.

Supply: Blockchain.com

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Merchants go lengthy

Turning to the sentiment of merchants, their perception was excessive. On the time of writing, lengthy positions made up 54.2% of all trades, in line with Coinglass. This recommended a bullish sentiment amongst merchants.

This hopeful outlook confirmed the rising curiosity in Bitcoin regardless of impartial worth actions. It’s but to be seen if these merchants will preserve their positions sooner or later.