Ethereum: What rising institutional demand means for you

- ETH funds registered constructive development, confirming the return of institutional demand.

- Ethereum continued to expertise internet demand, delaying a possible retracement.

Over the previous few weeks, we now have seen the return of confidence in Ethereum [ETH], simply as has been the case with many prime cryptocurrencies. This confidence increase has led to a little bit of a FOMO state of affairs and, extra importantly, the return of institutional demand.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

ETH funds present a chance for buyers to realize publicity to the cryptocurrency. Such non-public funds are a lovely avenue for establishments, and thus they usually spotlight what the institutional class of buyers are doing.

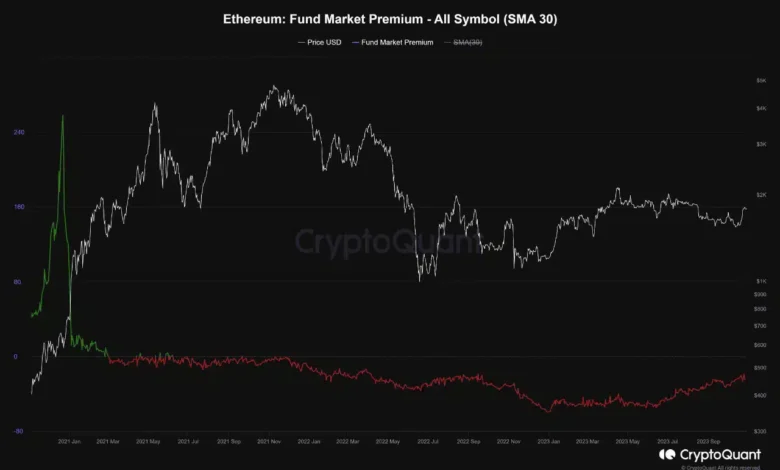

A latest CryptoQuant analysis confirmed that ETH funds had been in an upward trajectory at press time, as indicated by the Fund Market Premium. The evaluation revealed that ETH’s funds have been recovering since January 2023 and have maintained the identical trajectory to the current.

This was an necessary commentary, because it confirmed a restoration in ETH’s demand.

Supply: CryptoQuant

The identical evaluation famous that an upward pattern in Ethereum funds would chop the hole between the market worth of Ethereum contracts and the market worth. This rising trajectory was in tune with the rising confidence within the cryptocurrency within the derivatives market.

It mirrored the constructive development noticed in ETH’s funding charges within the final two months.

Supply: CryptoQuant

The previous few days have been notably fruitful for ETH’s Open Curiosity profile, based mostly on a 30-day evaluation. We additionally regarded into the purchase and promote profile and located that promote positions have been dwindling in the previous few days.

The variety of sells peaked at over 105,000 within the final two weeks of October. However, the buys peaked at barely above 57,000.

Supply: Hyblock

ETH bears wrestle to regain management

One would possibly anticipate a pullback for ETH within the subsequent few days, contemplating that it was not too long ago overbought after a sturdy rally. Nevertheless, the bears have been discovering it tough to subdue the worth.

A possible motive might be the truth that many ETH holders are opting to HODL relatively than taking short-term income. Notably, an evaluation of trade flows revealed that the prevailing demand ranges at press time had been increased than promote strain.

Supply: CryptoQuant

Learn Ethereum’s [ETH] Value Prediction 2023-24

It’s also price noting that ETH trade flows have cooled down significantly in comparison with the beforehand noticed mid-month surge. ETH exchanged arms at $1,785 at press time.

Whereas the bulls confirmed resilience and demand prevails, merchants ought to nonetheless train warning as a result of the market might nonetheless search correction.