FTX unstakes SOL worth millions: Is Solana’s bull run in danger?

- SOL was up by greater than 23% over the past seven days.

- Metrics appeared bullish on SOL, however market indicators advised a special story.

Solana [SOL] displayed a formidable efficiency as its worth rallied in double digits in the previous couple of days. Although the uptrend gave traders confidence, the situation may not take lengthy to alter, particularly if latest builders are to be thought-about.

Learn Solana’s [SOL] Value Prediction 2023-24

Notably, notorious crypto alternate FTX would possibly make a transfer that may flip the tides in opposition to Solana’s favor.

Solana reveals promise

Solana’s worth surged by greater than 23% over the past seven days, displaying potential. Furthermore, in keeping with CoinMarketCap, within the final 24 hours alone, the token’s worth went up by over 6%.

On the time of writing, SOL was buying and selling at $38.16 with a market capitalization of greater than $16 billion, making it the seventh-largest crypto. The value uptrend was additionally accompanied by an increase within the token’s buying and selling quantity.

However regardless of the bullish momentum, Nansen’s newest tweet signaled hassle brewing on the horizon for SOL. Significantly, FTX had began to unstake SOL tokens value hundreds of thousands of {dollars}.

If the alternate decides to promote these tokens, we are able to anticipate SOL’s liquidity to go up, which may be adopted by a worth correction.

A further 1.6M SOL ($57.6M) began the method of unstaking yesterday

The handle: 9uyDy9VDBw4K7xoSkhmCAm8NAFCwu4pkF6JeHUCtVKcX

On the time of writing these funds have not left the pockets, but when they do that can carry the overall of SOL moved by FTX to simply beneath $90M pic.twitter.com/bTSYjSxI6p

— Nansen 🧭 (@nansen_ai) October 31, 2023

A further 1.6 million SOL, value greater than $57 million, began the method of unstaking on 31 October. Amidst this, the market’s confidence in SOL additionally appeared to have dwindled, which may additionally improve the probabilities of a worth correction within the days to observe.

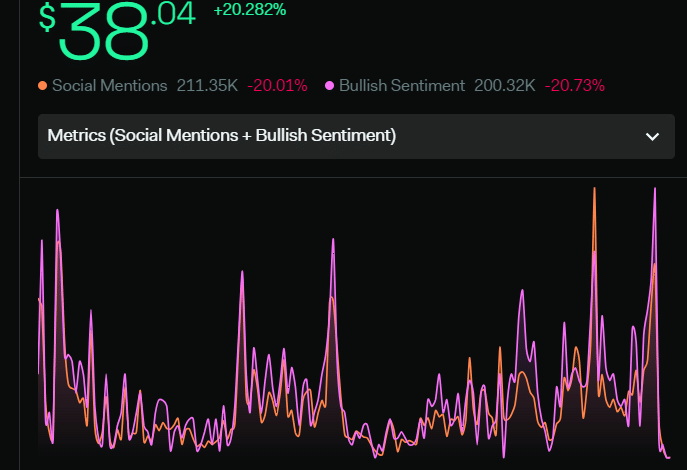

LunarCrush’s information revealed that SOL’s social engagement had dropped together with its bullish sentiment. One other bearish sign was Solana’s AltRank, which went up, rising the probabilities of a worth downtrend.

Supply: LunarCrush

Going ahead

Whatever the darkening skies, SOL’s place appeared comparatively secure at press time. This was evident from the truth that SOL’s Binance Funding Price was inexperienced. This meant that derivatives traders had been shopping for Solana at its increased worth.

Its Open Curiosity and Value Volatility 1w additionally elevated throughout this time.

Supply: Santiment

Is your portfolio inexperienced? Take a look at the SOL Revenue Calculator

Nonetheless, different issues reared their head on the time of writing; each the Cash Circulate Index (MFI) and Relative Energy Index (RSI) entered overbought zones at press time. This indicated rising promoting strain on the token.

However SOL’s MACD continued to help the consumers because it displayed a bullish crossover.

Supply: TradingView