Bitcoin can see a price correction thanks to this factor

- Bitcoin was shifting in direction of the “Accessing Tops” indicator at press time

- As soon as the coin touches or rallies above this indicator, a decline may be anticipated to observe

The approval of a spot-based Bitcoin ETF by the US Securities and Trade Fee (SEC) will possible lead to a downward correction in Bitcoin’s [BTC] worth, CryptoQuant analyst Binh Dang present in a brand new report.

Is your portfolio inexperienced? Try the BTC Profit Calculator

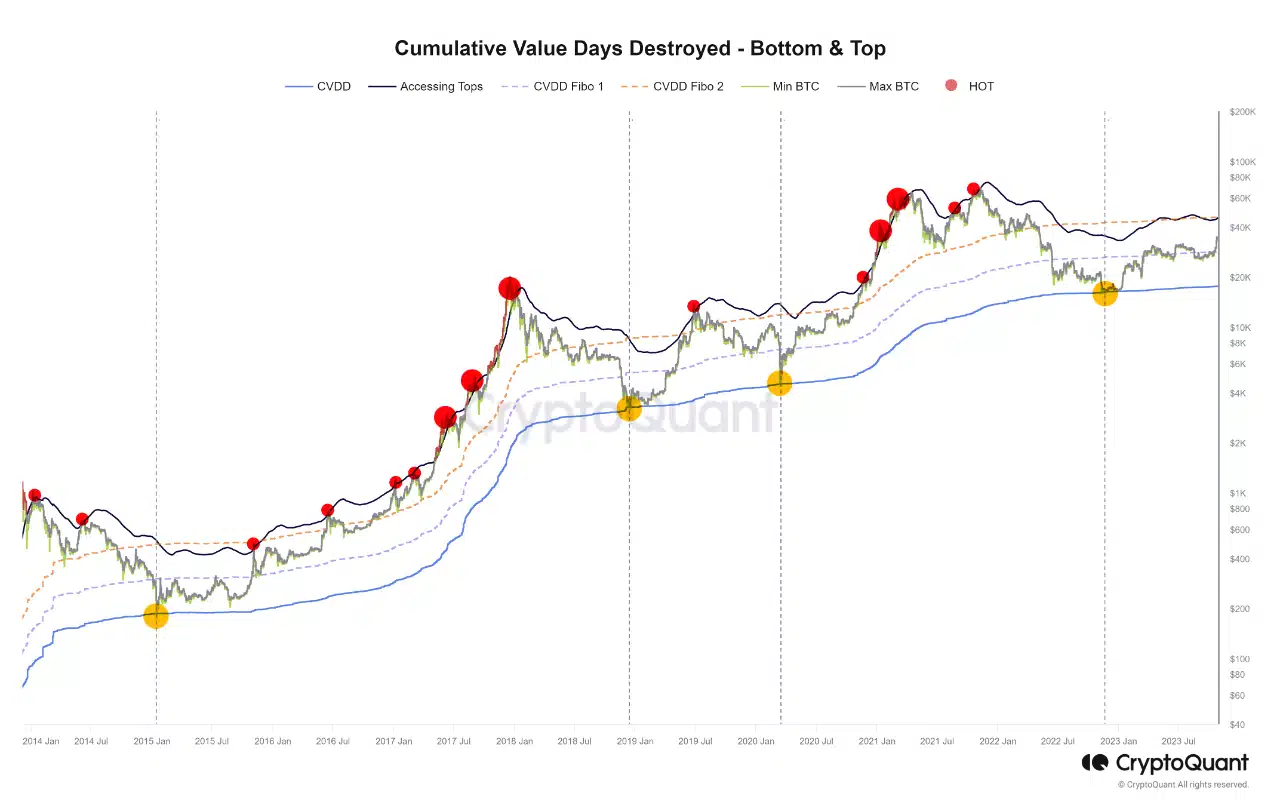

Dang mixed BTC’s Cumulative Worth-Days Destroyed metric and its market worth 50-day shifting common to create an indicator referred to as “Accessing Tops.” For the uninitiated, CVDD measures the coin’s exercise and motion over time to establish market bottoms.

Dang famous that this indicator is used to establish potential market corrections. When the coin’s market worth touches or exceeds this indicator, it’s a signal that the market could also be due for a pullback.

Within the final month, BTC has witnessed a major surge in its worth. Exchanging palms at $34,296 at press time, the coin’s worth has grown by 27% within the final thirty days, in accordance with information from CoinMarketCap.

Notably, BTC had began approaching the “Accessing Tops” indicator in the previous couple of weeks.

In line with Dang, the overall market is at present optimistic as a result of potential approval of Bitcoin’s spot-based ETFs. This has led traders to accentuate their accumulation in anticipation of promoting above their cost-basis.

Dang opined that such approval may trigger BTC’s worth to rally above the “Accessing Tops” indicator, at which level it will appropriate and development downwards.

He acknowledged:

“A minimum of for now, with the momentum of the idea that there’ll quickly be accredited spot ETFs, and if there is no dangerous information, will get solely excellent news, the very best additional doable peak might happen when short-term traders determine to carry positions and proceed to push BTC as much as attain the indicator threshold.”

The decline may happen ahead of anticipated

An evaluation of BTC’s worth actions on a every day chart revealed that the coin’s worth may witness a correction earlier than the SEC’s spot ETF utility approvals.

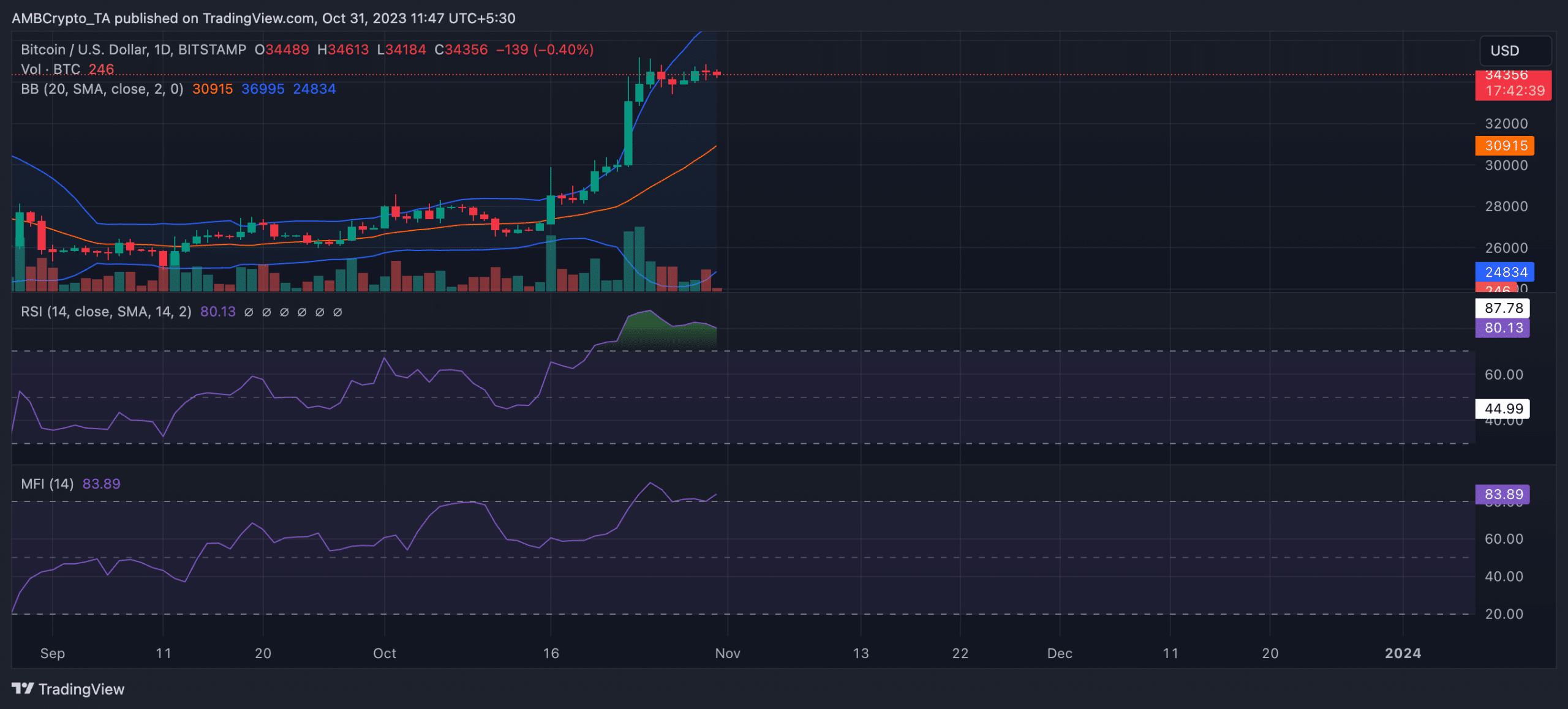

Readings noticed from the Bollinger Bands indicator confirmed that BTC’s worth remained severely risky at press time.

In actual fact, the coin’s worth traded near the higher band of the indicator, suggesting that the market was overbought and {that a} pullback was imminent.

When the hole between the higher and decrease bands of the Bollinger Bands is huge, it signifies that the worth of the asset in query is shifting away from the common.

Learn Bitcoin’s [BTC] Price Prediction 2023-2024

Likewise, the coin’s Relative Energy Index (RSI) and Cash Stream Index (MFI) confirmed the overbought nature of the BTC market. At press time, the coin’s RSI was 80.13, whereas its MFI was 83.89.

Purchaser exhaustion and profit-taking are frequent at these ranges; therefore, warning is suggested.