DYDX falls 8% in 7 days, is this why?

- dYdX introduced new options on its blockchain.

- Nonetheless, DYDX was down by over 8%, and different metrics regarded bearish as nicely.

It has been two days since dYdX [DYDX] progressed from its beta stage to full production trading on the blockchain. Notably, Bitcoin [BTC], Ethereum [ETH], Solana [SOL], and Chainlink [LINK] might be obtainable to commerce on the platform.

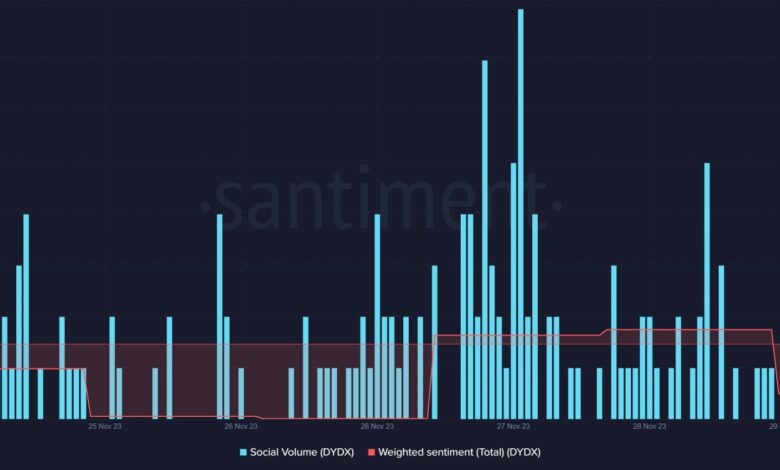

The launch made dYdX a subject of debate within the crypto group. This was evident from the appreciable spike in its Social Quantity over the previous couple of days.

Nonetheless, the launch didn’t go as anticipated, because the token remained beneath the bears’ affect. AMBCrypto gleaned that many of the above mentions may need been detrimental, as DYDX’s Weighted Sentiment registered an enormous drop, per Santiment.

Is DYDX’s declining value good for traders?

The launch didn’t have an effect on the token’s value positively. In line with CoinMarketCap, DYDX was down by greater than 8% within the final seven days. On the time of writing, it was buying and selling at $3.20 with a market capitalization of over $587 million.

A have a look at the token’s on-chain knowledge revealed what went incorrect. As per AMBCrypto’s evaluation, DYDX’s MVRV ratio dropped over the previous couple of days.

Its Community Development additionally declined, that means that fewer new addresses have been buying and selling the token at press time.

Nonetheless, its Change Outflow spiked on the thirtieth of November. This meant that traders used DYDX’s declining costs as a chance to build up extra of the token.

However will a rise in shopping for strain be sufficient to raise DYDX’s value within the coming days?

Practical or not, right here’s DYDX’s market cap in BTC’s terms

DYDX’s MACD displayed a transparent bearish benefit out there. Its Relative Energy Index (RSI) took a sideways path, suggesting that traders may count on just a few slow-moving days.

Nonetheless, DYDX’s Bollinger Bands revealed that its value was coming into a much less risky zone, lowering the probabilities of a continued downtrend. Its Cash Stream Index (MFI) additionally registered an uptick at press time — a optimistic signal.