Bitcoin’s rally causes a split in trader behavior

- Hedge funds and asset managers took completely different approaches to BTC’s rally.

- Bitcoin’s Implied Volatility and MVRV ratio grew together with its value.

Bitcoin’s [BTC] rally has induced many liquidations of quick positions over the previous few months. On account of this sudden surge in value, there was a break up when it comes to decision-making amongst merchants.

A distinction in opinion

Asset managers have been going lengthy on Bitcoin at press time, hitting all-time highs. This recommended robust confidence, doubtlessly signaling a constructive outlook.

Asset managers often have a long-term method to investing. Their want to indicate returns is on a long-term foundation, they usually can take hits within the quick time period.

On the flip aspect, hedge funds are betting in opposition to BTC at document ranges. Conduct like this indicated skepticism or an expectation of a market correction.

Hedge funds usually have to indicate quarter-on-quarter progress for his or her buyers. On account of this, they take a short-term method to investing.

Large quick positions taken in opposition to BTC by these funds could present that they don’t have a lot religion in BTC rallying going ahead.

The conflict in sentiments inside CME Bitcoin Futures may result in elevated market volatility, with potential impacts on Bitcoin’s value dynamics.

Fascinating habits taking place inside CME #Bitcoin Futures.

– Asset Managers longs on $BTC at ATHs

-Hedge funds shorts in opposition to $BTC at ATHs pic.twitter.com/fQcIV3HWPt— Emperor Osmo🧪 (@Flowslikeosmo) December 3, 2023

Bitcoin IV on the rise

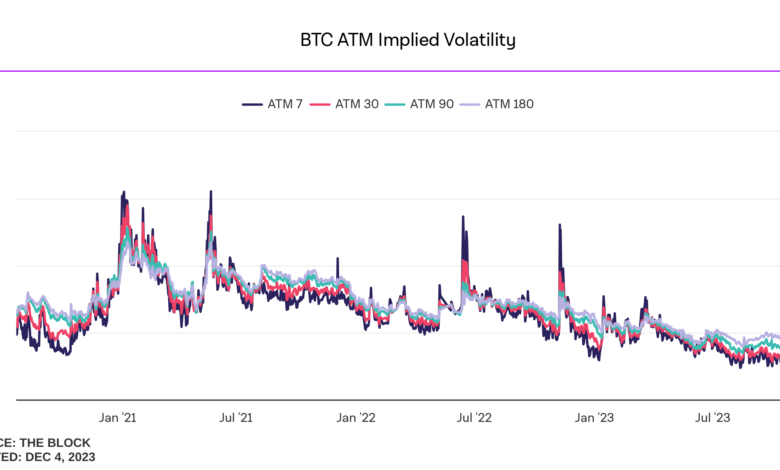

The Implied Volatility (IV) for Bitcoin additionally grew. This implied elevated uncertainty concerning the king coin’s future value and in addition indicated potential market swings.

Merchants could thus face extra threat and will require cautious technique changes to navigate the evolving Bitcoin panorama.

Analyzing IV is a typical technique. Hedge funds typically use it to evaluate BTC’s future value. When IV is excessive, these hedge funds anticipate a value lower.

So, by shorting BTC, they goal to revenue from a extra predictable market.

Solely time will inform if hedge funds or asset managers come out swinging on this sector.

Is your portfolio inexperienced? Take a look at the BTC Profit Calculator

At press time, BTC was buying and selling at $41,554.47, rising by 5.33% within the final 24 hours. Nevertheless, the variety of Each day Energetic Addresses fell throughout this era.

Furthermore, BTC’s MVRV ratio grew. This meant that the variety of addresses in revenue had risen at press time.