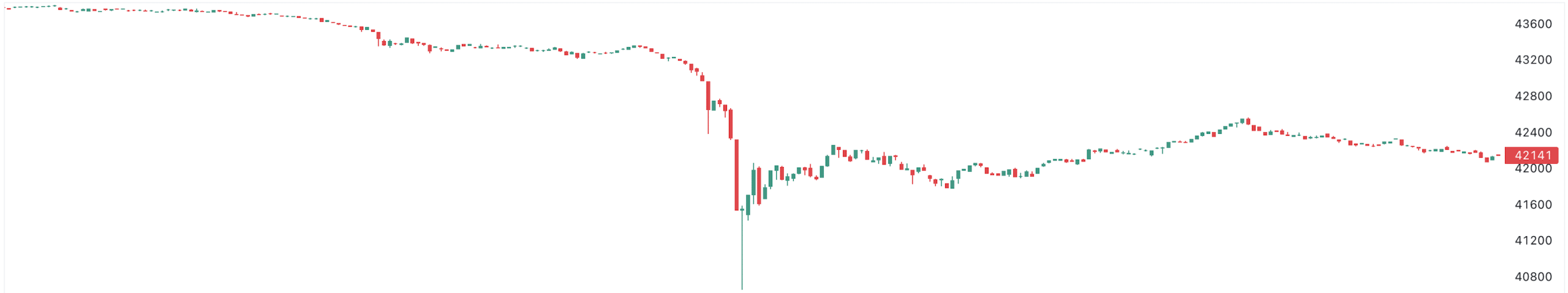

Bitcoin Price Drops Below $41,000 Amid Broader Market Correction

Bitcoin worth briefly dropped beneath $41,000 earlier in the present day, undoing nearly per week’s positive factors earlier than a bounce again. Different main cryptocurrencies together with Ethereum, XRP, Solana (SOL), and Cardano (ADA) had been additionally down over 5%.

In response to TradingView, the worth of Bitcoin made a pointy dip of 6% from $43,233 and declined to a lowest level of $40,659 at 2:13am on Dec. 11 (UTC). This sharp downturn rapidly erased the positive factors Bitcoin had remodeled the previous bullish week.

Bitcoin Worth and a Broader Market Correction

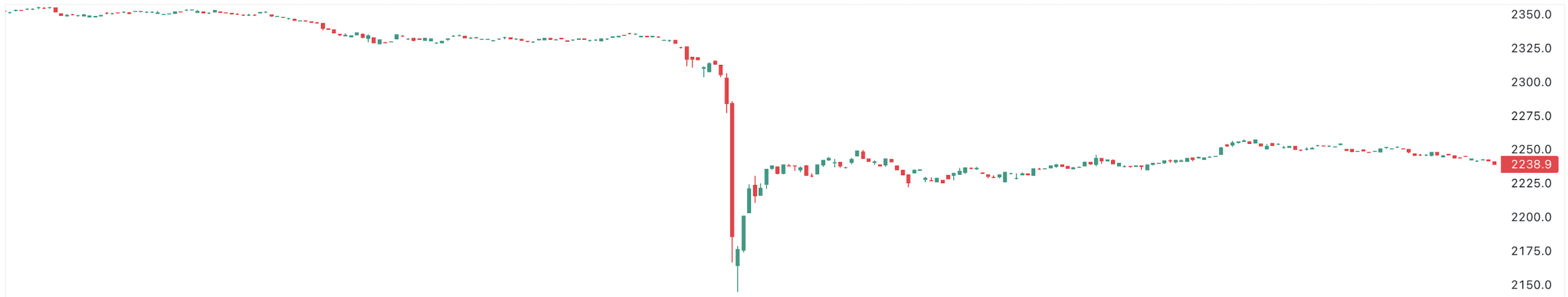

Ethereum fell from a earlier $2,330 to as little as $2,145, marking a 7.9% dip in the identical time-frame.

Within the meantime, main altcoins have additionally seen fluctuations as a broader market correction, together with XRP, Solana, Cardano, and Polkadot, all with a plunge marking a lack of over 5% in some unspecified time in the future, following the identical sample of Bitcoin and Ethereum.

On the time of writing, Bitcoin recovered to $42,141 based on TradingView, nonetheless indicating a decline of three.8% over the previous 24 hours. Ethereum bounced again to $2,239, down 4.7% from yesterday. Different altcoins talked about have rebounded to a corrected degree, too.

Over the previous week, Bitcoin has breached the $42,000 landmark, remained above $43,000 and been consistently hitting $44,000. As well as, Bitcoin has seen a powerful rally, hovering by 166% in 2023, considerably surpassing gold’s annual acquire of 9%.

Pending the U.S. Securities and Change Committee’s resolution of the primary spot Bitcoin exchange-traded fund (ETF), the trade has been optimistic with extra established monetary establishments becoming a member of the sport. In response to a Bloomberg report, the upcoming “supercycle” of crypto might push the worth of Bitcoin to doubtlessly exceed $500,000 sooner or later.

International Acceptance of Bitcoin

The worldwide acceptance of Bitcoin develops, too. Partnered with Bitcoin Suisse, an infrastructure supplier for crypto buying and selling, staking, and custody, the Swiss metropolis Lugano introduced that it is able to begin accepting tax funds in Bitcoin and Tether (USDT).

In the meantime, El Salvador introduced a citizenship-by-investment plan powered by Tether to permit individuals to accumulate citizenship by Bitcoin and USDT investments.