Why Bitcoin miners have themselves an early Christmas

Posted:

- Transaction charges made up almost 37% of the overall mining income over the weekend.

- Mining income hit the very best stage because the peak bull market of November 2021.

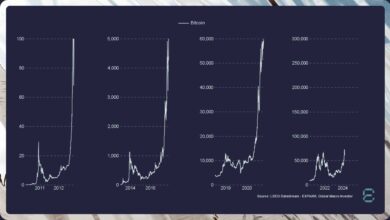

Bitcoin [BTC] miners racked up greater than $23.7 million in transaction charges on a single day in the course of the weekend, as Ordinals frenzy continued to push demand for blockspace.

As per on-chain analytics agency CryptoQuant, Bitcoin’s payment income on sixteenth December was the very best ever.

Supply: CryptoQuant

Miners’ earnings shoot up

The steep rise in transaction charges boosted miners’ general income, which additionally contains the mounted block subsidy of 6.25 BTC. On the identical day, miners made greater than $63 million, the very best because the peak bull market of November 2021.

To get a good thought in regards to the community demand, transaction charges made up almost 37% of the overall income acquired by miners on the day, the second-highest because the earlier Ordinals frenzy in early Might.

Supply: CryptoQuant

Miners will not be promoting but

Miners, as everyone knows, spend a hefty sum in organising subtle infrastructure for creating blocks and securing the Bitcoin community. The depend on mining income to cowl these exorbitant prices, which run into hundreds of {dollars}.

Attributable to this, miners’ steadily liquidate their holdings. The most recent surge of their coffers fueled robust expectations of comparable sell-offs. Nonetheless, this wasn’t the case.

AMBCrypto didn’t discover substantial spikes within the motion of cash from miners to exchanges. This implied that miners may very well be eyeing some extra worthwhile days earlier than they begin offloading their baggage.

Supply: CryptoQuant

Bitcoin turns into the largest NFT chain

The Ordinals idea has taken the blockchain world by storm in 2023. Pioneered by Bitcoin in early 2023, different EVM and non-EVM chains have mimicked the expertise and launched their very own inscriptions.

Ordinals work by embedding photos or different information instantly on the chain. They can be utilized to create digital belongings like non-fungible tokens (NFTs) and even fungible tokens utilizing the BRC-20 normal.

Ordinals’ main use case has been NFTs, catapulting Bitcoin into the elite league of NFT-friendly networks.

Learn BTC’s Value Prediction 2023-24

As per AMBCrypto’s evaluation of Cryptoslam information, Bitcoin has been the dominant chain for NFT trades over the past month, with gross sales price greater than $700 million.

Compared, conventional leaders like Ethereum [ETH] and Solana [SOL], might solely muster $389 million and $245 million respectively.