Will Bitcoin start 2024 with a price correction?

- BTC was down by greater than 1% within the final seven days.

- Market indicators remained bearish on the king coin.

Bitcoin’s [BTC] worth has moved sideways within the current previous because it has did not register features. Whereas that occurred, a brand new evaluation identified a metric that may trigger hassle for BTC’s worth within the days to observe.

These datasets look bearish on Bitcoin

As we enter 2024, BTC’s worth motion stays sluggish. In keeping with CoinMarketCap, BTC was down by greater than 1.7% within the final seven days. Its day by day chart additionally remained crimson.

On the time of writing, BTC was buying and selling at $42,653.65 with a market capitalization of over $835 billion. Its buying and selling quantity additionally declined throughout that interval, that means that buyers are reluctant to commerce the coin.

Whereas this occurred, BlitzzTrading, an analyst and writer at CryptoQuant, posted an analysis concerning a key BTC metric.

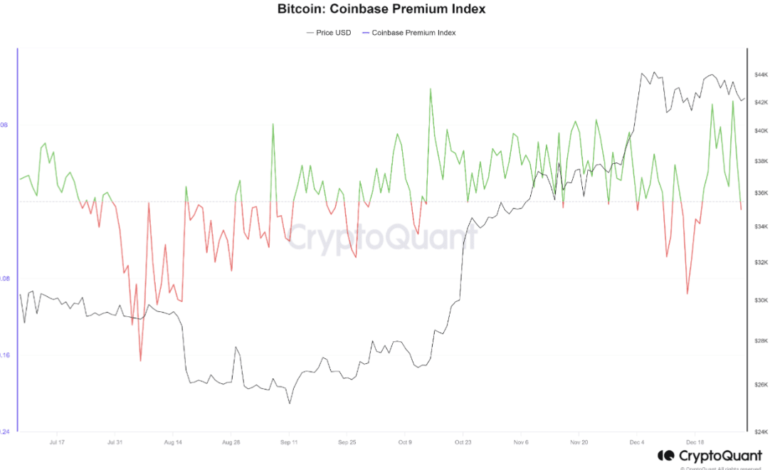

The evaluation talked about Bitcoin’s Coinbase Premium, which is an indicator that shows the costs of crypto property on Coinbase, a cryptocurrency change.

Supply: CryptoQuant

The index calculates the costs of particular crypto property on the Coinbase change, normally by evaluating them with costs on different exchanges.

Bitcoin’s Coinbase premium began to enter the detrimental zone within the current previous. Traditionally, every time such incidents occurred, BTC skilled worth corrections.

Subsequently, AMBCrypto deliberate to take a better take a look at BTC’s press time state to know whether or not a worth correction is inevitable.

As per our evaluation of CryptoQuant’s data, promoting strain on BTC was excessive as its change reserve was rising.

Its aSORP was crimson, that means that extra buyers have been promoting BTC at income. This usually signifies a market high.

Moreover, derivatives buyers continued to purchase BTC whereas its worth motion remained gradual, rising the probabilities of a development continuation.

Supply: CryptoQuant

What to anticipate from Bitcoin in 2024

Since most metrics appeared bearish, AMBCrypto checked BTC’s liquidation ranges. We discovered that after a worth pump, BTC witnessed excessive sell-offs close to the $43,800 mark.

The liquidation triggered a worth correction, which brought on BTC to plummet below $43,000 and made it transfer sideways during the last seven days.

Supply: Hyblock Capital

Learn Bitcoin’s [BTC] Value Prediction 2023-24

BTC’s MACD displayed that the bears have been main the market. Its Bollinger Bands revealed that BTC’s worth entered a squeeze zone at press time, suggesting elevated risk of an unprecedented worth hike within the close to future.

Nonetheless, BTC’s Relative Energy Index (RSI) remained bullish because it registered a slight uptick from the impartial mark.

Supply: TradingView