Is Solana witnessing a slow start to 2024?

- Solana fund outflows have been price $5.3 million final week.

- Bitcoin took a big share of the inflows amid an imminent spot ETF approval.

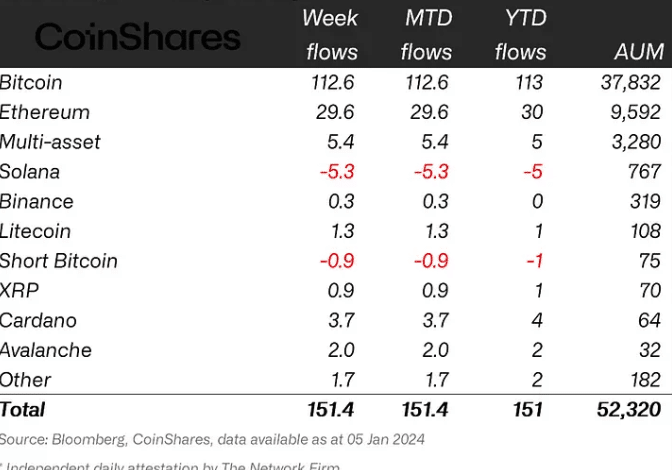

The yr 2024 began on a superb observe as digital asset funding inflows recorded $151 million within the first week. Nevertheless, Solana [SOL] didn’t contribute a lot to the funds regardless of having a formidable yr in 2023.

As a substitute, it recorded extra outflows, the CoinShares report revealed.

In accordance with AMBCrypto’s evaluation of the weekly report, Solana outflows have been price $5.3 million. There have been many causes for the change in sentiment towards the altcoin. However the notable of them was Bitcoin [BTC] and the value of SOL.

Although the value of SOL has recovered above $100, the earlier week was not a superb one for it. Based mostly on CoinMarketCap’s data, the SOL value went under $90 within the first week of January. This was one of many the explanation why its seven-day efficiency remained a ten.12% decline.

In Bitcoin’s case, there was quite a lot of optimism across the coin. Consequently, inflows associated to it have been price $113 million out of the whole $151 million.

Supply: CoinShares

Moreover, AMBCrypto found that the anticipation across the spot ETF approval within the U.S. was the main driver of the circulation. So, it was not stunning that CoinShares’ Head of Analysis famous that:

“Regardless of the spot-based ETF not being launched but within the US, 55% of the inflows have been from US exchanges, with Germany and Switzerland seeing 21% and 17% respectively.”

Additionally, studies from a number of sources confirmed that the approval was nearly completed. This was additionally corroborated by Gary Gensler’s publish on X on the eighth of January.

Within the publish, the SEC chair encouraged traders to watch out of crypto property. Feedback from underneath the publish indicated hypothesis that the crypto-averse regulator had agreed to offer the candidates the inexperienced gentle.

Prior to now, there was hypothesis that the occasion could be a “promote the information” one. Nevertheless, particulars from the CoinShares report revealed that many contributors didn’t share that sentiment. The report famous:

“If many really believed that the launch of the ETF within the US could be a “purchase the rumor, promote the information” occasion, we certainly would count on to see inflows into short-bitcoin ETPs, as an alternative, outflows over the past 9 weeks have amounted to US$7m.”

In the meantime, the sentiment round Solana has been altering from what it was final week. To reach at this conclusion, AMBCrypto checked out the Weighted Sentiment, utilizing Santiment’s on-chain knowledge.

In accordance with Santiment, SOL’s Weighted Sentiment was -0.334 on the sixth of January. Nevertheless, at press time, the metric has climbed to the constructive area.

Supply: Santiment

This resurgence was affirmation that the constructive commentary concerning the undertaking has outweighed the unfavorable ones over the past two days.

Lifelike or not, right here’s SOL’s market cap in ETH phrases

Ought to the sentiment stay the identical until the tip of the week, then fund flows linked to Solana might improve.

Nevertheless, the altcoin may have to battle it out with Ethereum [ETH]. In contrast to Solana, Ethereum funding merchandise noticed inflows totaling $29 million.