AVAX preps for a ‘flip’ – Here’s what you should know

- AVAX has not but damaged its bearish construction on the one-day chart

- Coming days may see a dip, and the demand zone highlighted is a key space of curiosity

Avalanche [AVAX] witnessed a powerful bounce from the $31-support zone. It fell to $31.12 on 8 January, however has gained 24% since then. The community additionally hit a record-breaking variety of month-to-month energetic customers.

Avalanche’s community additionally noticed a surge in NFT exercise. It’s anticipated that new NFT mints contribute vital quantity and exercise to a community. This might appeal to creators to the community and gasoline higher demand for AVAX.

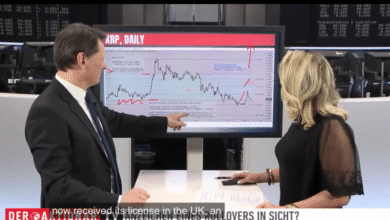

Market construction hasn’t flipped bullishly but

Supply: AVAX/USDT on TradingView

The one-day value chart has been bearish since 27 December, when AVAX fell beneath the low at $43.34. At press time, the latest decrease excessive of the downward transfer since then was at $39.45, marked in inexperienced.

A every day session shut above this stage has not occurred but. If it does, it could make the $33.08-$35.87 (cyan field) a bullish order block. Whereas the construction was technically bearish, the descending trendline resistance (yellow) has been damaged.

A transfer above $39.45 and a dip to the bullish order block or the descending trendline to retest it as assist would supply a super shopping for alternative. The Fibonacci ranges (pale yellow) marked the $42.76 and $45.93-levels as agency resistances.

Probabilities of one other dip in quest of liquidity appear good

Supply: Hyblock

AMBCrypto analyzed the information from the liquidation ranges chart from Hyblock. The Cumulative Liq Ranges Delta has been constructive over the previous 24 hours. This advised that the lengthy liquidation ranges have been extra in quantity. It introduced a lovely alternative for costs to hunt liquidity by dropping south and forcing longs to shut.

How a lot are 1, 10, or 100 AVAX price immediately?

To the south, the $38.2 and $37.7-levels had a number of liquidation ranges of $2 million or extra. Additional down, the $35.7-$36.3 vary additionally has a substantial variety of liquidation ranges. Therefore, within the short-term, merchants should beware a drop in costs. From a 1-day value motion perspective, a transfer to $35 can be splendid as it could be a very good place to lengthy AVAX.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.