Bitcoin market decline pauses, weekly trading volume of listed investment products hits record high of $17.5 billion

Macroeconomics and monetary markets

The US inventory market was closed on the fifteenth. Within the Tokyo inventory market at present, the Nikkei Inventory Common was down 109.7 yen (0.31%) from yesterday.

The value has continued to development upwards, hovering to the 36,000 yen stage, the best stage in 34 years, and the worth has fallen for the primary time in seven enterprise days amid considerations that the market is at present overheated.

connection:10 main digital foreign money shares within the Japanese and US inventory markets

Digital foreign money market situations

Within the crypto asset (digital foreign money) market, the Bitcoin worth rose 0.43% from yesterday to 1 BTC = $42,803.

BTC/USD every day

Along with the promoting strain surrounding Grayscale’s conversion to GBTC, with lower than 100 days remaining till the halving, it has been identified that promoting by miners in preparation for diminished mining charges after the halving has come to an finish.

NEW: #Bitcoin miners’ outflow hits a six-year excessive as greater than 💵 $1B price of #Bitcoin is shipped to exchanges 👀 pic.twitter.com/Jr4VFdoCPo

— (@BitcoinNewsCom) January 12, 2024

By the thirteenth, $1 billion price of Bitcoin (BTC) had been transferred to exchanges, pushing a measure of miner outflows to a six-year excessive.

connection:Cryptocurrency market has fallen sharply after approval of Bitcoin ETF, promoting strain as a result of Grayscale’s GBTC and so on.

In line with the newest report from CoinShares, the growing issue of mining as a result of current speedy improve within the variety of energetic miners and the numerous lower in mining rewards after the halving threaten the profitability of many miners, inflicting weaker miners to withdraw. There’s a excessive chance that you’ll be pressured to take action.

In line with information from previous halvings, the common hash charge within the six months following the halving dropped by 9% as inefficient miners grew to become unprofitable and had been faraway from the community. The hash charge, which signifies mining pace, will improve by 104% in 2023, demonstrating the intensifying competitors between main mining firms which might be making upfront investments in gear.

CoinShares estimates the common manufacturing price after the halving to be $37,856 per BTC, and the breakeven level for miners after the following halving is anticipated to be round $40,000 per BTC.

connection:The break-even level for miners after the following Bitcoin halving is 1 BTC = $40,000 | CoinShares Report

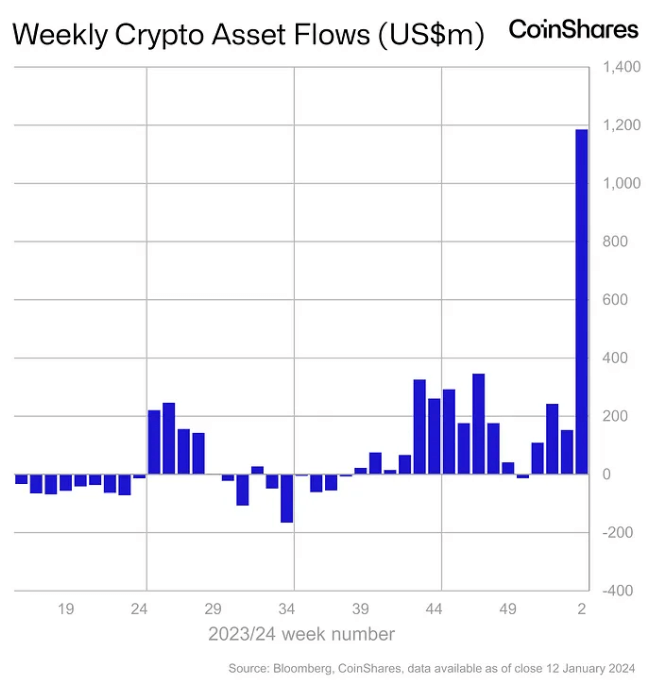

Flows into trade traded merchandise (ETPs) elevated by $1.18 billion final week, based on asset administration agency CoinShares’ weekly report.

Though this measurement was lower than the $1.5 billion weekly inflows following the approval of futures ETFs in October 2021, when 1 BTC = $69,000 and on the peak of the bull market, final week’s buying and selling quantity was the best ever. It recorded $17.5 billion. That is roughly 9 occasions the common weekly buying and selling quantity of $2 billion in 2022.

The approval of Bitcoin ETFs (Trade Traded Funds) has led to an unprecedented surge in capital inflows into digital foreign money funding merchandise from main asset administration firms equivalent to Bitwise, Grayscale, and 21Shares.

The buying and selling quantity of the Bitcoin ETF (trade traded fund), which was launched in partnership between Ark Funding and 21Shares, reached 6 million shares ($275 million) on the primary day.

The 11 authorized Bitcoin ETFs have attracted a complete of $625.8 million in web flows, indicating robust curiosity from institutional buyers, based on information compiled by BitMEX Analysis.

Concerning this level, the CEO of 21Shares stated in an interview with Blockworks on the fifteenth, “Because the entry of U.S. monetary establishments into the Bitcoin market is justified and Bitcoin ETFs grow to be mainstream, the There will probably be two waves,” he stated, stressing the necessity to take a look at the market from a medium- to long-term perspective somewhat than from a short-term perspective.

connection:Study Bitcoin ETFs from the start: Explaining the benefits and drawbacks of investing and learn how to purchase US shares

altcoin market

As of yesterday, the worth of Solana (SOL) had fallen greater than 8%, with over $7 million in lengthy positions being liquidated.

The Block stories that Aave’s governance discussion board is contemplating a proposal to deploy Aave v3 on Neon EVM, a sensible contract platform that permits Ethereum dApps (decentralized purposes) on the Solana community.

If authorized, Aave will be capable to use Solana’s liquidity for lending companies.

Bitcoin ETF particular characteristic

Now we have launched the “Warmth Map” perform to the CoinPost app for buyers!

Along with vital information about digital currencies, you too can see at a look trade info such because the greenback yen and worth actions of crypto asset-related shares within the inventory market equivalent to Coinbase.■Click on right here to obtain the iOS and Android variations

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (digital foreign money media) (@coin_post) December 21, 2023

Click on right here for a listing of previous market stories