Bitcoin: Why now is the best time to stockpile BTC

- BTC was up by practically 10% over the past seven days.

- Shopping for strain was excessive, and indicators additionally appeared bullish.

Bitcoin [BTC] has lastly gained upward momentum as its worth went above the $47,000 mark. This sparked pleasure in the neighborhood as buyers anticipated the king coin to succeed in new highs. Amidst that, a key BTC indicator flagged a shopping for sign, suggesting that buyers ought to take into account accumulating.

A have a look at Bitcoin’s weekly journey

Bitcoin managed to as soon as once more flip bullish because it painted its weekly and each day charts inexperienced. In response to CoinMarketCap, BTC was up by greater than 9.5% within the final seven days.

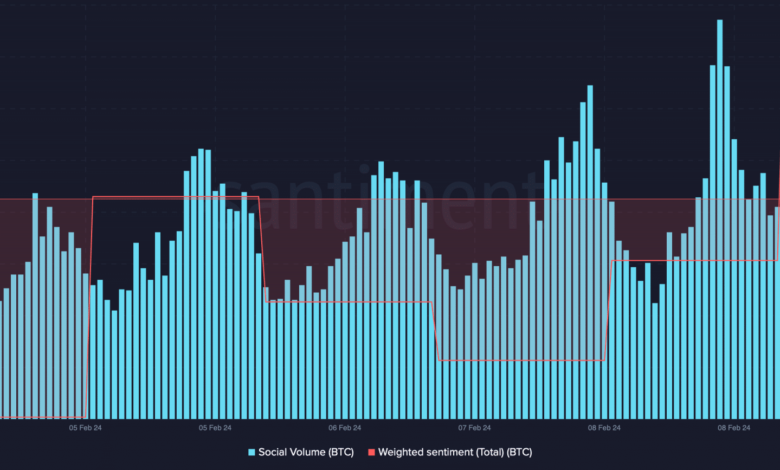

Actually, within the final 24 hours alone, its worth surged by over 3%. On the time of writing, BTC was buying and selling at $47,454.25 with a market capitalization of over $931 billion. Due to the value uptick, the coin’s social quantity spiked, which means that its reputation has elevated within the current previous.

Moreover, bullish sentiment across the coin additionally went up these days, which was evident from the rise in its weighted sentiment.

Supply: Santiment

In the meantime, Ali, a well-liked crypto analyst, lately posted a tweet highlighting a key BTC metric. As per the tweet, the Tremendous Development simply flashed a purchase sign on the Bitcoin month-to-month chart, a device recognized for its precision in predicting BTC bull markets.

The Tremendous Development simply flashed a purchase sign on the #Bitcoin month-to-month chart, a device recognized for its precision in predicting $BTC bull markets.

The 4 purchase alerts it has issued since #BTC inception have all been validated, resulting in good points of 169,172%, 9,900%, 3,680%, and 828%,… pic.twitter.com/83GtqJNryW

— Ali (@ali_charts) February 8, 2024

Traditionally, for the reason that begin of BTC, the indicator has offered 4 validated purchase alerts, which have resulted in good points of 169,172%, 9,900%, 3,680%, and 828%, respectively.

Due to this fact, AMBCrypo took a more in-depth have a look at BTC’s state to grasp whether or not buyers have began to build up extra BTC.

Bitcoin accumulation is rising once more

Our evaluation of Santiment’s information clearly confirmed that buyers have been really shopping for BTC. The king of cryptos’ provide on exchanges sank final week whereas its provide outdoors of exchanges elevated, indicating excessive shopping for strain.

Its trade outflow additionally spiked, additional establishing the truth that shopping for strain was excessive.

Supply Santiment

Since shopping for strain was excessive and Bitcoin’s worth motion was bullish, we then checked its each day cart to see whether or not the uptrend would final. An evaluation of BTC’s each day chart revealed that BTC’s Chaikin Cash Movement (CMF) went up sharply.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Its MACD additionally displayed a transparent bullish benefit available in the market. These indicators instructed that the opportunity of a continued worth uptrend was excessive.

Nevertheless, the Relative Power Index (RSI) was about to enter the overbought zone. This could improve promoting strain on Bitcoin, which can lead to an finish to the bullish worth motion.

Supply: TradingView