Ethereum: Are traders betting big on ETH? Data suggests…

- ETH’s funding charges have risen to a two-year excessive.

- Demand for the altcoin persists within the spot market.

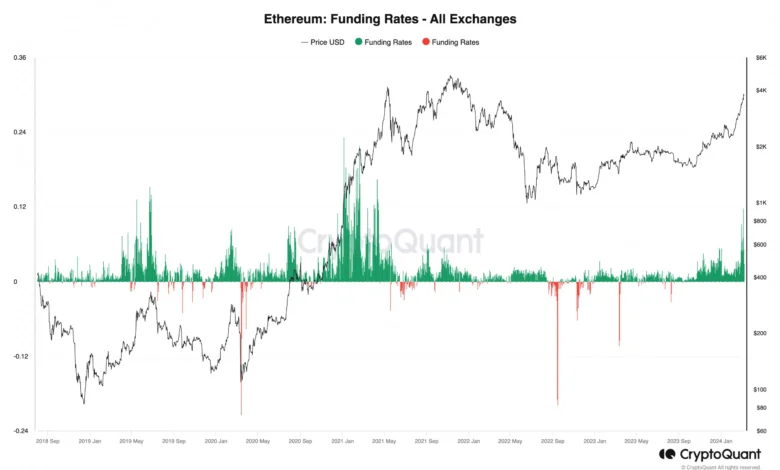

Ethereum’s [ETH] current rally above the $3700 worth mark has been accompanied by an increase within the coin’s funding charges throughout cryptocurrency exchanges. In response to a pseudonymous CryptoQuant analyst this mirrors the occasions main as much as the 2021 worth growth.

When an asset’s futures funding charges witness a surge and are considerably constructive, it suggests that there’s a sturdy demand for lengthy positions. It’s thought of a bullish sign and a precursor to an asset’s continued worth development.

Supply: CryptoQuant

ETH’s worth has elevated by 59% within the final month. At press time, the altcoin exchanged palms at $3753, its highest worth level since December 2021, in response to CoinMarketCap’s knowledge.

Information from Coinglass confirmed that the current uptick within the altcoin’s worth has brought on its futures open curiosity to climb to a 27-month excessive. As of this writing, ETH’s open curiosity was $12.2 billion, rising by 71% within the final month.

When a coin’s open curiosity witnesses this sort of development, merchants are both opening new positions or sustaining current ones, and the market is seeing an inflow of liquidity.

A rising open curiosity paired with constructive funding charges suggests important bullish exercise. It signifies that market individuals proceed to position bets in favor of a worth rally.

Nevertheless, this has its dangers. In response to the CryptoQuant analyst:

“Nevertheless, whereas rising funding charges sometimes accompany a bullish market sentiment, excessively excessive values will be harmful. Elevated charges improve the chance of lengthy liquidation cascades, which can end in heightened market volatility and sudden corrective actions.”

This performed out on fifth March, after ETH climbed above $3800 earlier than plummeting to $3400. In response to Coinglass knowledge, lengthy liquidations on that day totaled $135 million.

Supply: Coinglass

ETH on the spot market

On the spot market, ETH accumulation steadied above sell-offs. The coin’s key momentum indicators had been noticed above their respective impartial strains at press time. For instance, ETH’s Relative Energy Index (RSI) was 76.50, whereas its Cash Move Index (MFI) was 80.16.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Additional, its Superior Oscillator, which helps to measure market traits posted principally inexperienced upward-facing bars at press time.

When an asset’s Superior Oscillator returns inexperienced, upward-facing bars on this method, it suggests strengthening bullish momentum out there.

Supply: TradingView