Ethereum Dencun upgrade nears: Did anything change for ETH?

- The Dencun improve is aimed toward decreasing charges to assist L2s develop additional.

- ETH’s value motion remained bullish, as did market sentiment.

The watch for Ethereum’s [ETH] much-talked-about Dencun improve is coming to an finish, as it’s scheduled to happen on the thirteenth of March.

The improve will carry a number of modifications to the blockchain, which can be particularly useful for the L2s.

Because the replace is across the nook, AMBCrypto deliberate to test how ETH was doing forward of the launch.

All about Ethereum’s Dencun improve

The Dencun improve would be the subsequent main replace for Ethereum after the Shapella improve that was pushed again in 2023.

For the uninitiated, the Dencun improve will execute two upgrades concurrently on Ethereum’s consensus and execution layers. The first focus of the improve is to drastically cut back charges to assist Layer-2s development.

This can be made potential because the builders will activate a brand new Ethereum Enchancment Proposal (EIP), which is called proto-danksharding.

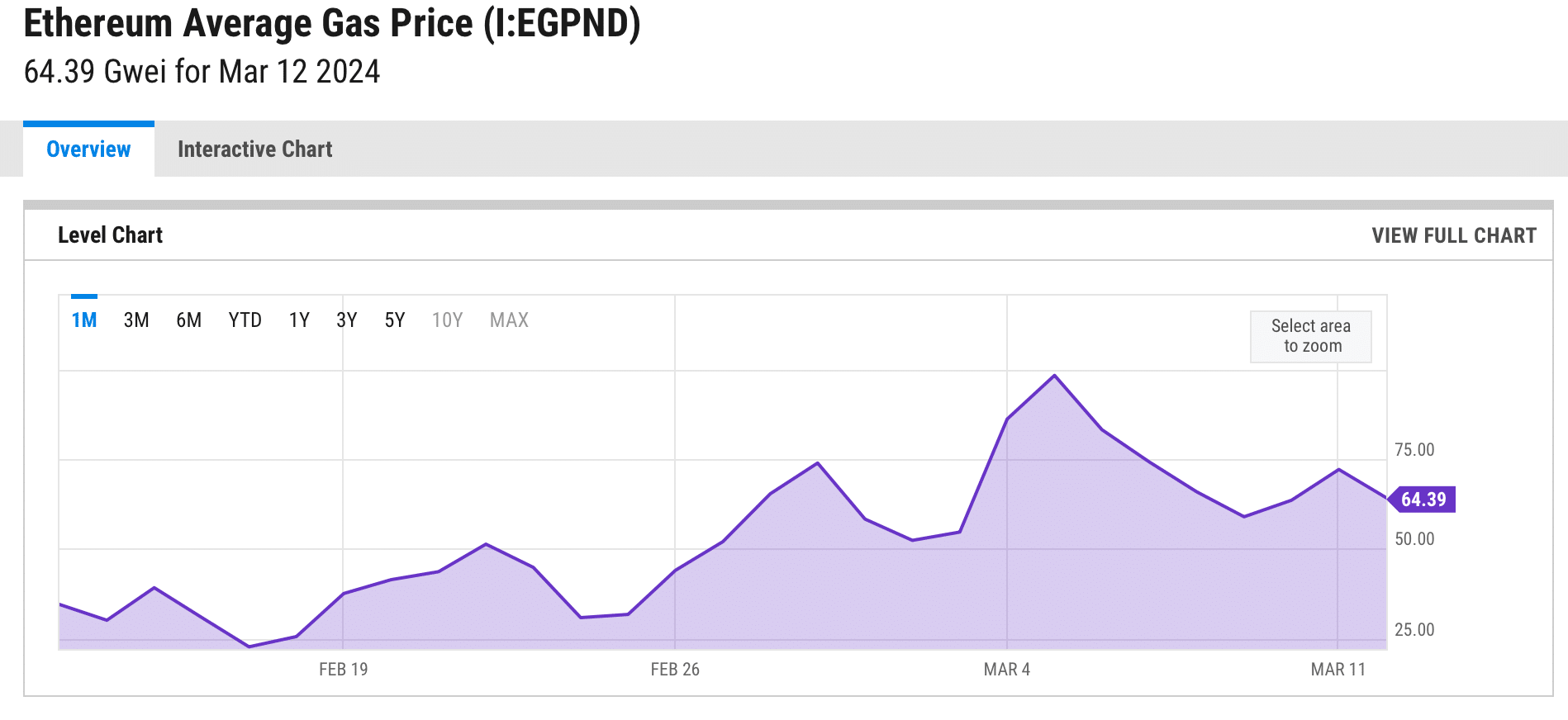

Ethereum’s charges spike

Whereas builders ready to push the brand new improve, Ethereum’s community charges elevated.

AMBCrypto’s evaluation of Artemis’ data revealed that ETH’s charges gained upward momentum and spiked on the fifth of March. Consequently, ETH’s income additionally rose on the identical day.

A potential motive behind this surge could possibly be the hike in ETH’s fuel value, which stood at 64.39 Gwei per Ycharts.

Supply: YCharts

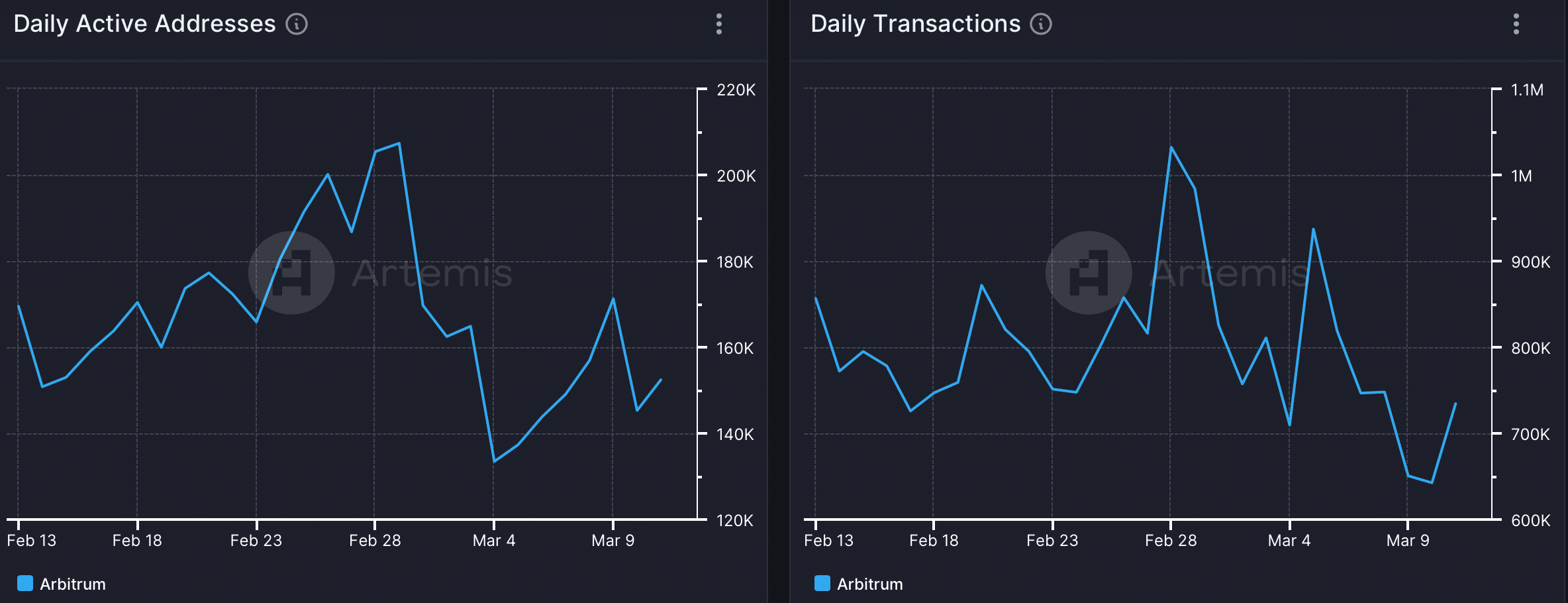

Although issues appeared optimistic when it comes to captured worth, Ethereum’s community exercise had dropped. This was evident from the decline in its Day by day Energetic Addresses chart because the twenty ninth of February.

Due to the drop in addresses, ETH’s Day by day Transactions fell as properly.

Supply: Artemis

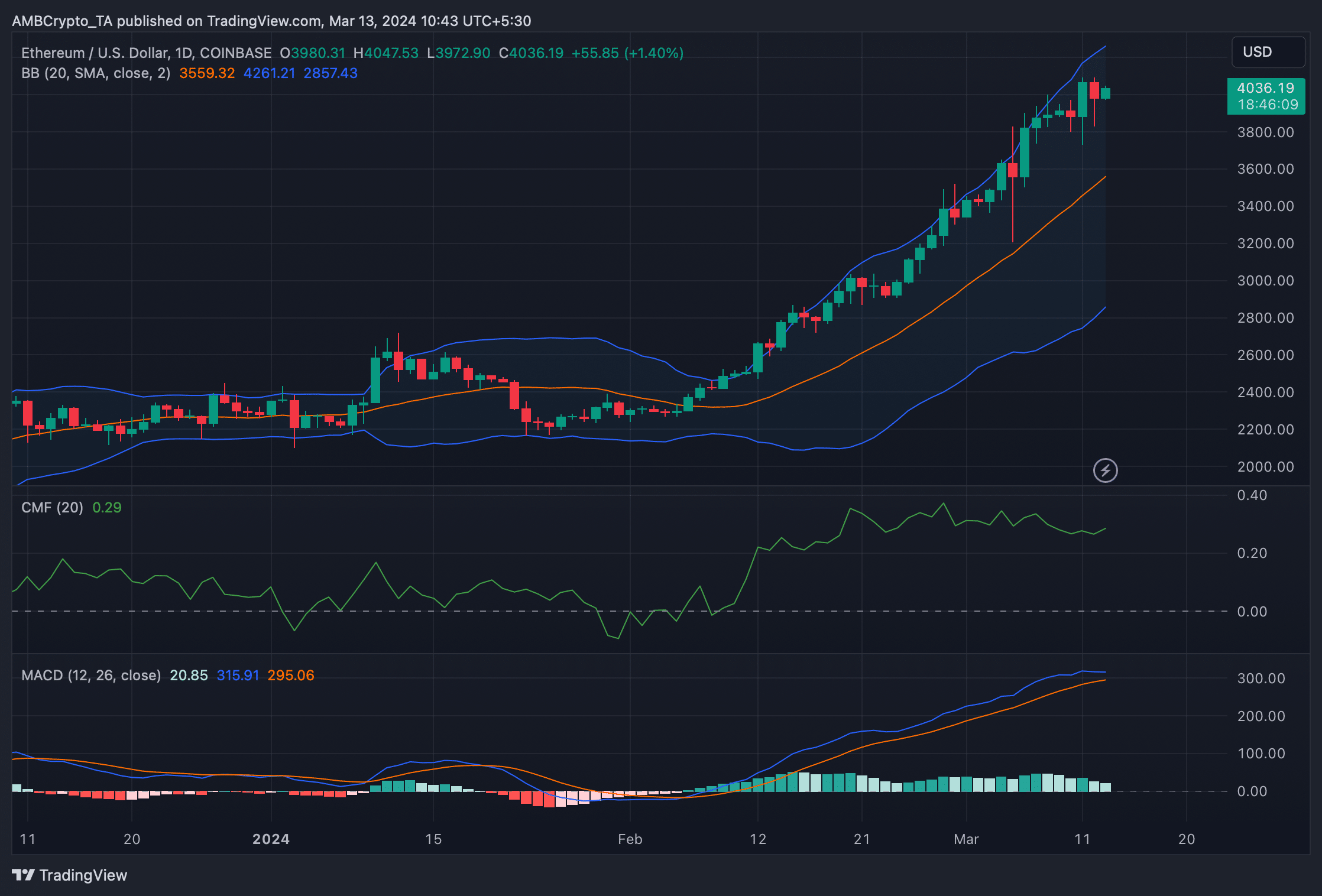

Nonetheless, Ethereum’s value motion favored the bulls, because it was up by greater than 9% within the final seven days. On the time of writing, ETH was buying and selling at $4,034.42 with a market capitalization of over $484 billion.

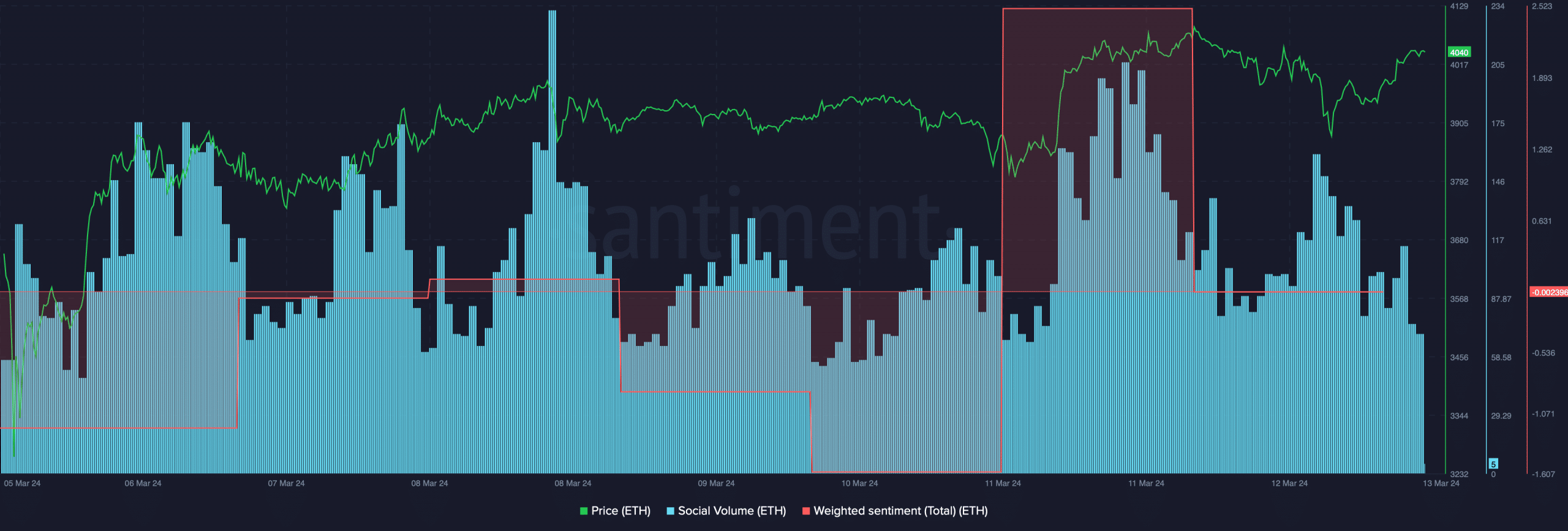

The king of altcoins additionally remained a buzzing matter of debate out there as its Social Quantity remained excessive.

Moreover, its Weighted Sentiment spiked, suggesting that bullish sentiment across the token was dominant at press time.

Supply: Santiment

Learn Ethereum’s [ETH] Value Prediction 2024-25

Other than that, the technical indicator MACD displayed a bullish higher hand out there. The Chaikin Cash Move (CMF) additionally registered an uptick, hinting at an additional rally.

Nevertheless, ETH’s value had touched the higher restrict of the Bollinger Bands at press time, which indicated a value correction.

Supply: TradingView