Ethereum: Why ETH’s drop below $4K shouldn’t worry you

- Ethereum has dropped under the $4,000 worth vary.

- Provide outdoors exchanges nonetheless exceeds provide in exchanges.

Ethereum [ETH] skilled a surge past the $4,000 worth threshold, suggesting the opportunity of surpassing its earlier all-time excessive (ATH).

Though the worth has since dipped under $4,000, sure metrics counsel a possible resurgence, with the possibility of reaching a brand new ATH nonetheless on the horizon.

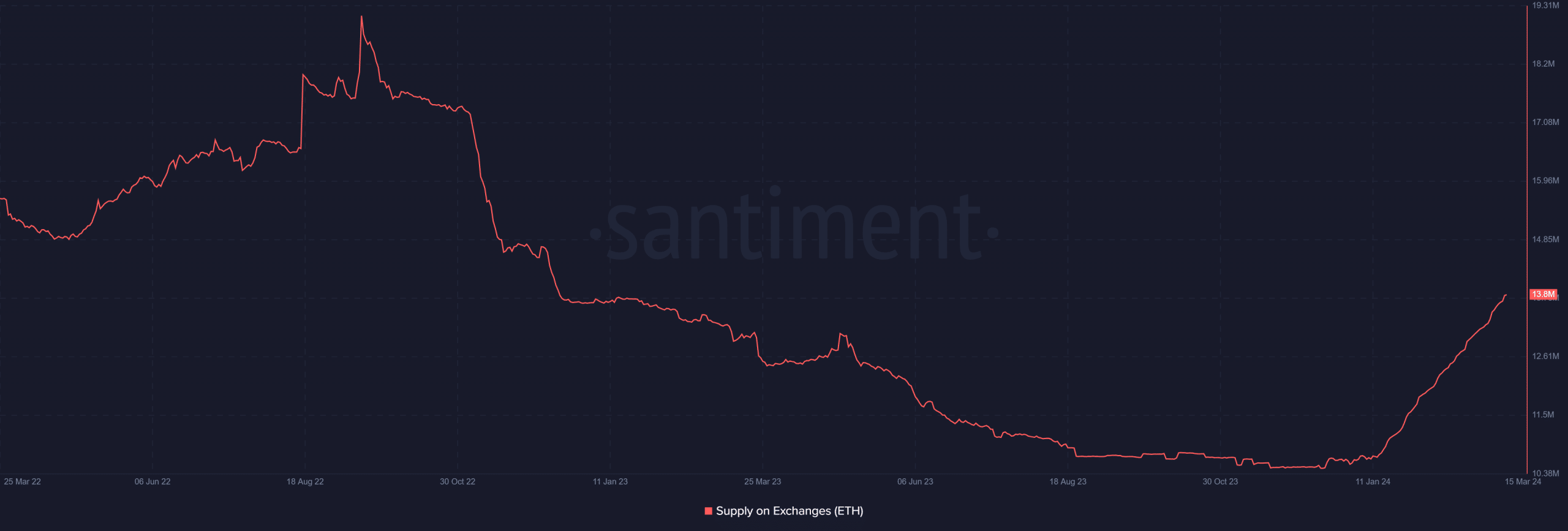

How Ethereum provide on exchanges has trended

New knowledge from CryptoQuant means that Ethereum reveals indicators of power based mostly on its trade reserve metric.

The chart illustrates a constant trade spot reserve metric decline over the previous few months. This decline confirmed that holders withdrew their property from exchanges, signaling a reluctance to promote.

Nonetheless, a more in-depth examination of the metric on Santiment confirmed a contrasting development.

Since January, there was an uptick within the provide of Ethereum on exchanges. The chart confirmed an increase from about 10 million to over 13 million on the time of this writing.

This improve means that extra merchants have deposited their property onto exchanges, doubtless capitalizing on the current surge in ETH worth.

Supply: Santiment

A comparability of the provision outdoors of exchanges to the provision on exchanges helped to realize a clearer understanding. Evaluation of the provision off exchanges signifies a comparatively steady development not too long ago.

On the time of this writing, the amount was over 121 million, indicating a major quantity of ETH being held outdoors of exchanges.

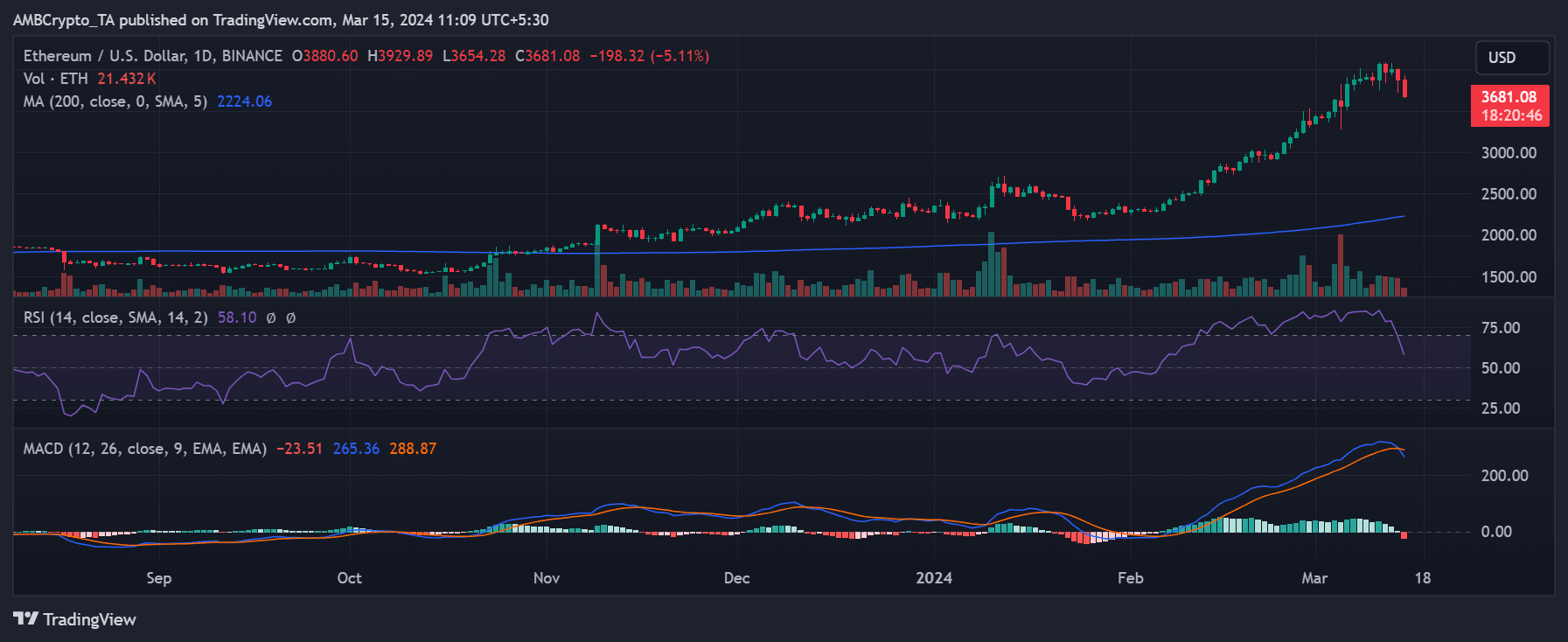

Ethereum drops under new excessive

Evaluation of Ethereum’s efficiency on a day by day time-frame revealed a notable decline of over 3% by the top of 14t March, with costs settling round $3,870. This marked a retreat from the $4,000 worth stage earlier within the week.

Nonetheless, on the time of writing, the decline had deepened additional, with costs plummeting by over 5% to roughly $3,680. These declines symbolize essentially the most important and consecutive drops since round twenty fourth February.

Regardless of this downturn, knowledge on the provision of Ethereum on exchanges means that this can be a brief setback.

The provision off exchanges nonetheless considerably exceeds the provision on exchanges, indicating a considerable quantity of Ethereum being held outdoors buying and selling platforms.

Supply: Buying and selling View

How a lot are 1,10,100 ETHs value at this time

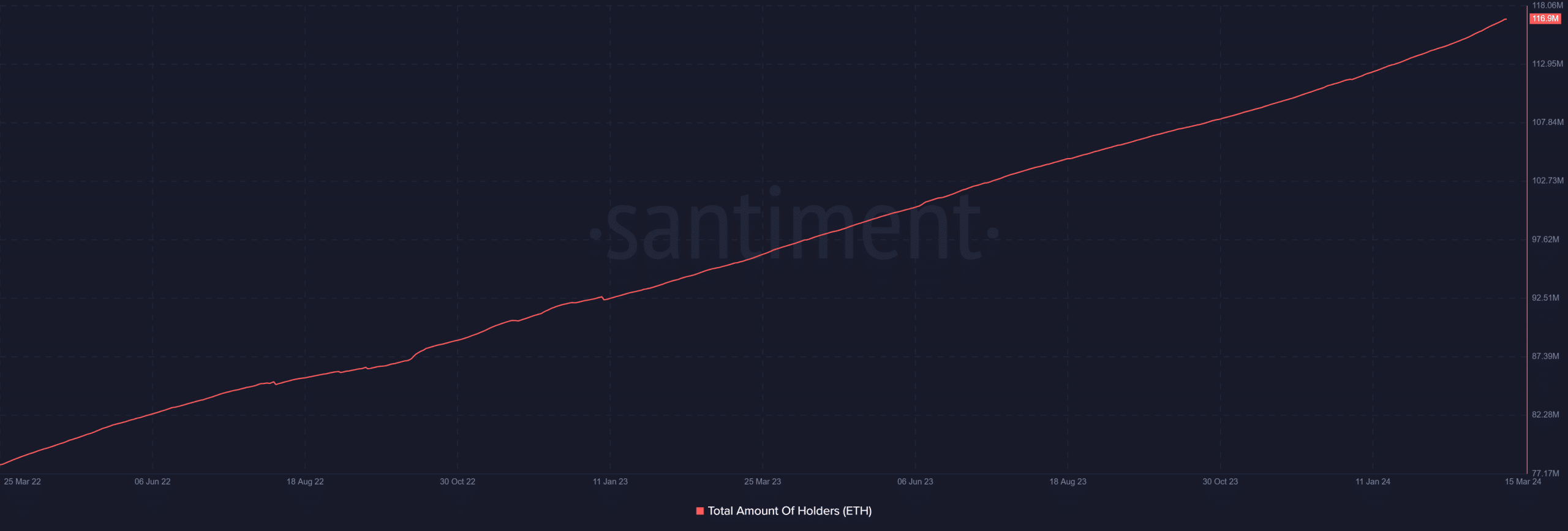

Quantity of holders continues to rise, nonetheless

Evaluation of the overall variety of Ethereum holders on Santiment revealed continued development over the months. On the time of this writing, the quantity was approaching 117 million. This ongoing improve suggests sustained curiosity from holders who proceed to build up Ethereum.

The buildup development stays a bullish signal for Ethereum, regardless of its current worth decline when thought-about alongside the numerous quantity of Ethereum held outdoors of exchanges.

Supply: Santiment