Bitcoin: History suggests BTC will be up and running again after…

- BTC’s value moved marginally within the final 24 hours.

- Market indicators hinted at just a few extra slow-moving days.

Buyers might need been fearful about the previous couple of days, as Bitcoin’s [BTC] value witnessed a number of corrections.

Nonetheless, they need to not lose hope, as this may simply be yet one more re-testing section, which may finish with one other bull rally.

What historical past suggests

The final week didn’t witness excessive volatility when it comes to BTC’s value motion, because the king of cryptos’ worth moved marginally. An identical pattern was additionally famous within the final 24 hours.

Based on CoinMarketCap, on the time of writing, BTC was buying and selling at $64,796.66 with a market capitalization of over $1.27 trillion.

Nonetheless, there have been possibilities for the coin’s value to show risky over the times to observe. Moustache, a preferred crypto analyst, just lately posted a tweet mentioning how BTC was in a “re-testing” section.

If historical past is to be thought-about, BTC may quickly start a bull rally, because the coin turned bullish when its value entered an analogous sample again in 2017 and 2020.

Due to this fact, AMBCrypto checked Bitcoin’s metrics to see the probabilities of the coin really kick-starting a bull rally.

Metrics look bearish although

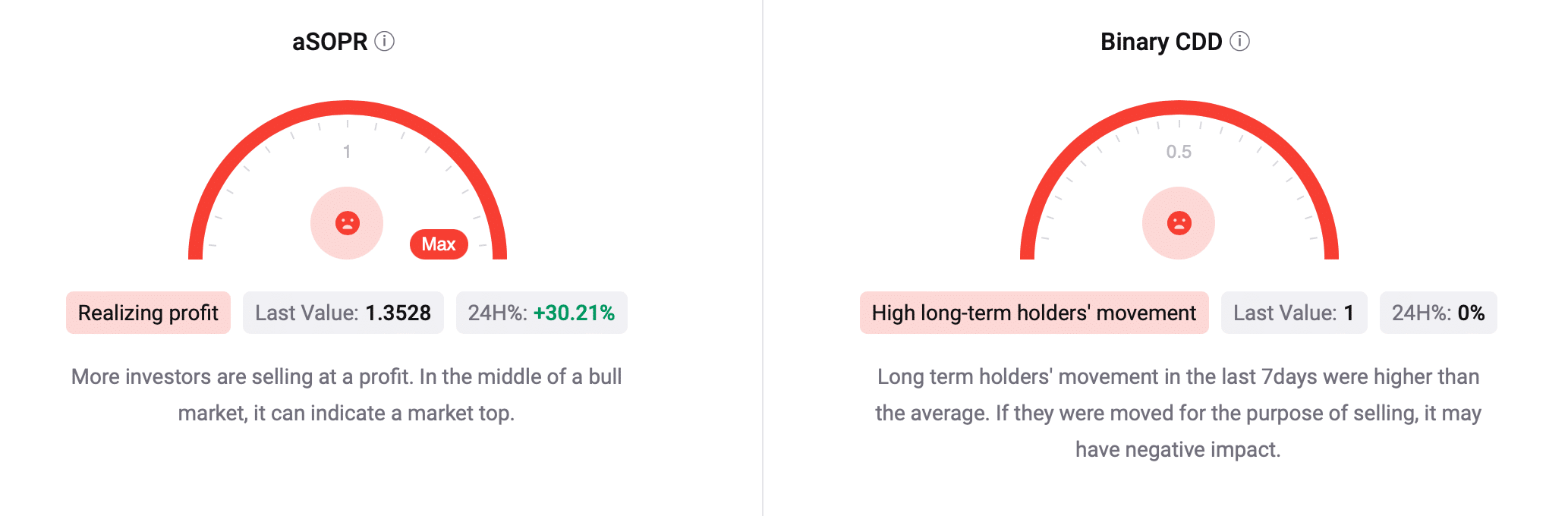

Regardless of a historic bull sample, Bitcoin’s on-chain metrics continued to look bearish. For instance, it’s aSOPR was purple, as per our evaluation of CryptoQuant’s data.

This meant that extra buyers had been promoting at a revenue. In the midst of a bull market, it may point out a market prime.

Its Binary CDD adopted an analogous pattern, that means that long-term holders’ actions within the final seven days had been increased than common. In the event that they had been moved for the aim of promoting, it might have a damaging impression.

Supply: CryptoQuant

Nonetheless, different metrics instructed a special story. Bitcoin’s change reserve was dropping at press time, indicating that promoting stress on the coin was low.

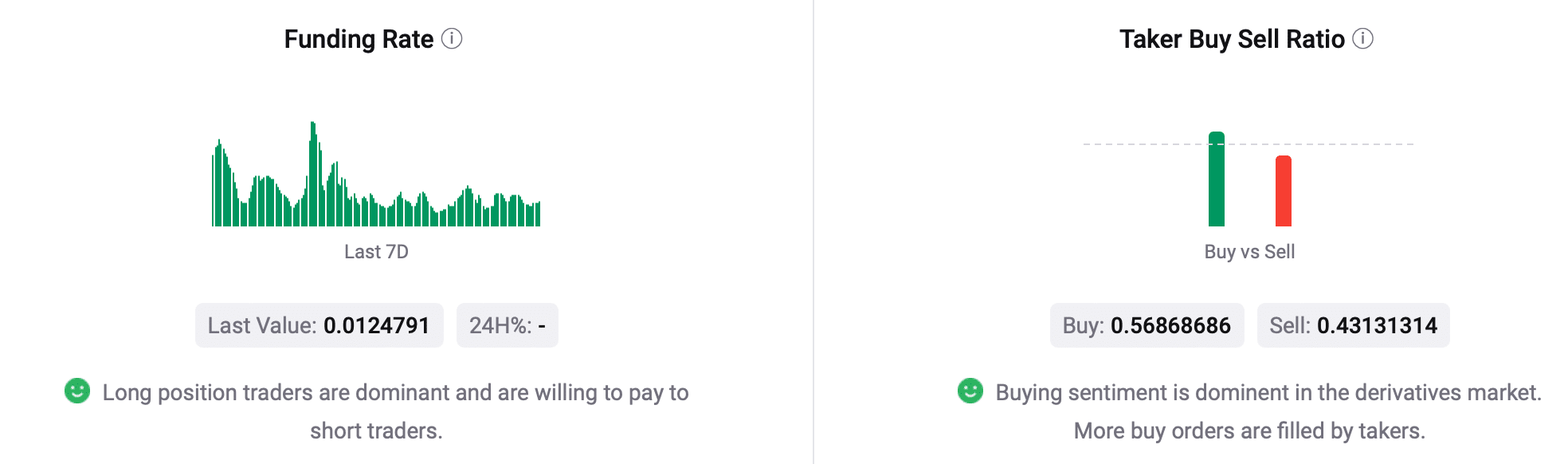

Moreover, its Funding Charge and Taker Purchase Promote Ratio was within the inexperienced, suggesting that purchasing sentiment was dominant within the derivatives market.

Supply: CryptoQuant

AMBCrypto then checked BTC’s day by day chart to seek out out which course the coin was headed.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Our evaluation of TradingView’s chart urged that buyers may as nicely witness just a few extra slow-moving days, because the Relative Power Index (RSI) moved sideways close to the impartial zone.

The Cash Stream Index (MFI) additionally adopted an analogous pattern, indicating that probabilities of much less risky value motion had been excessive.

Supply: TradingView