Ethereum: U.S. investors look for other altcoins as ETH’s price falls

- ETH’s Coinbase Premium Index was unfavourable.

- This confirmed a decline within the coin’s shopping for exercise amongst U.S.-based buyers on Coinbase.

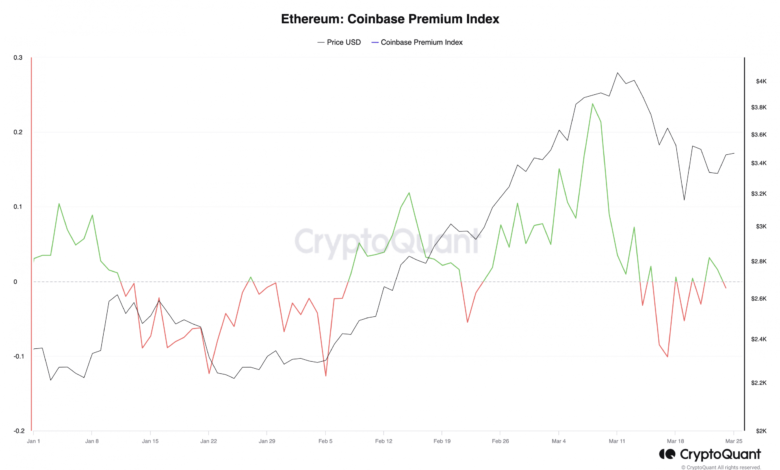

Ethereum’s [ETH] worth decline since briefly buying and selling above $4000 on the eleventh of March has resulted in a drop in its Coinbase Premium Index (CPI), in response to CryptoQuant’s information.

This metric measures the distinction between an asset’s costs on Coinbase and Binance. When its worth grows, it suggests important shopping for exercise by US-based buyers on Coinbase.

Conversely, when it declines and dips into the unfavourable territory, it indicators much less buying and selling exercise on the US-based change.

At press time, ETH’s CPI was -0.008. CryptoQuant’s information confirmed that when the altcoin’s worth fell under $3200 on the 18th of March, its CPI cratered to a 30-day low of -0.1.

Supply: CryptoQuant

The coin’s CPI has declined in the previous few weeks after rallying to a 12-month excessive originally of March.

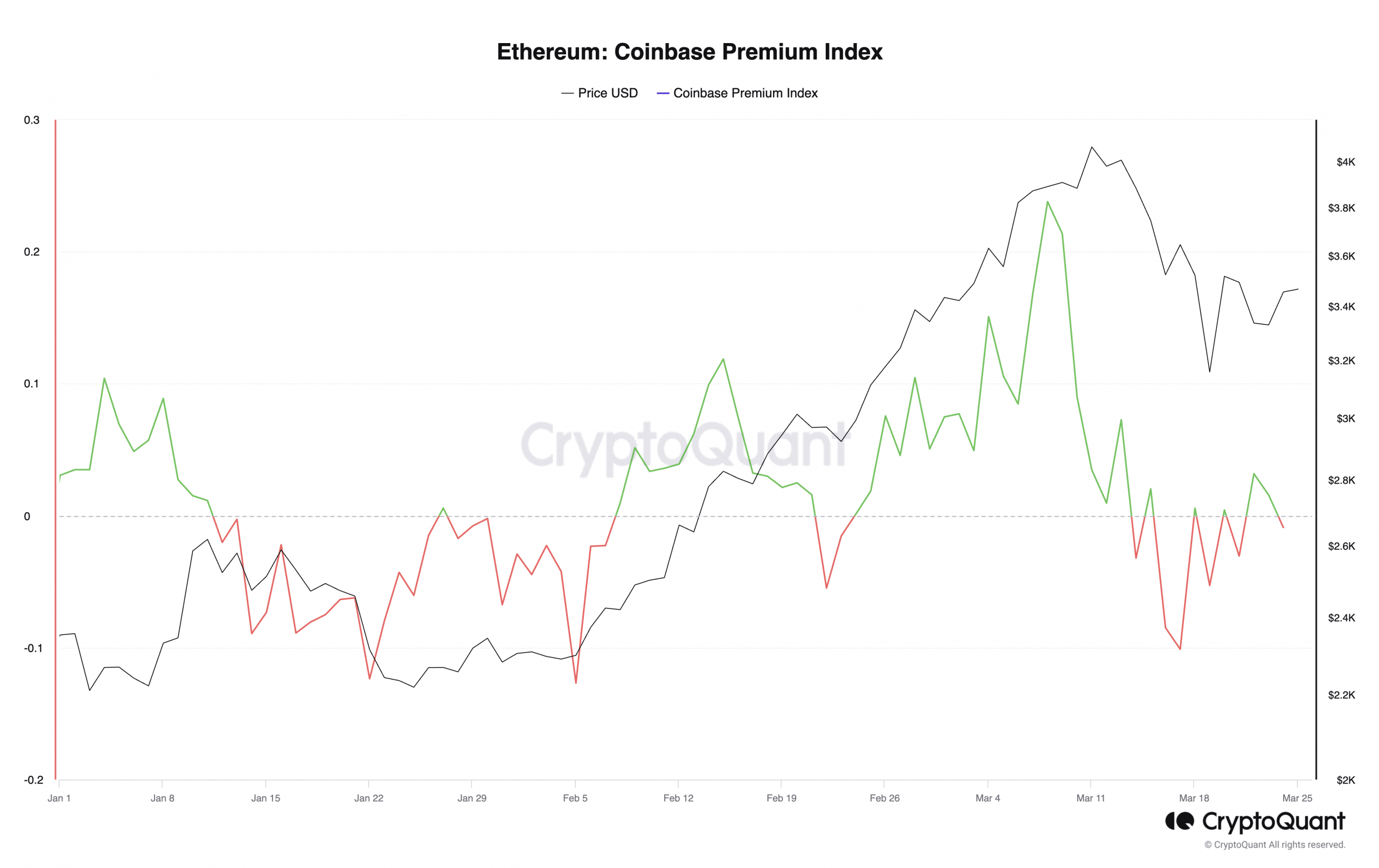

Though the Asian markets comply with an analogous development, an evaluation of ETH’s Korean Premium Index (KPI) confirmed that it stays constructive regardless of the value pullback prior to now few weeks.

At press time, ETH’s KPI was 6.83.

Supply: CryptoQuant

The bears intention to increase ETH’s losses

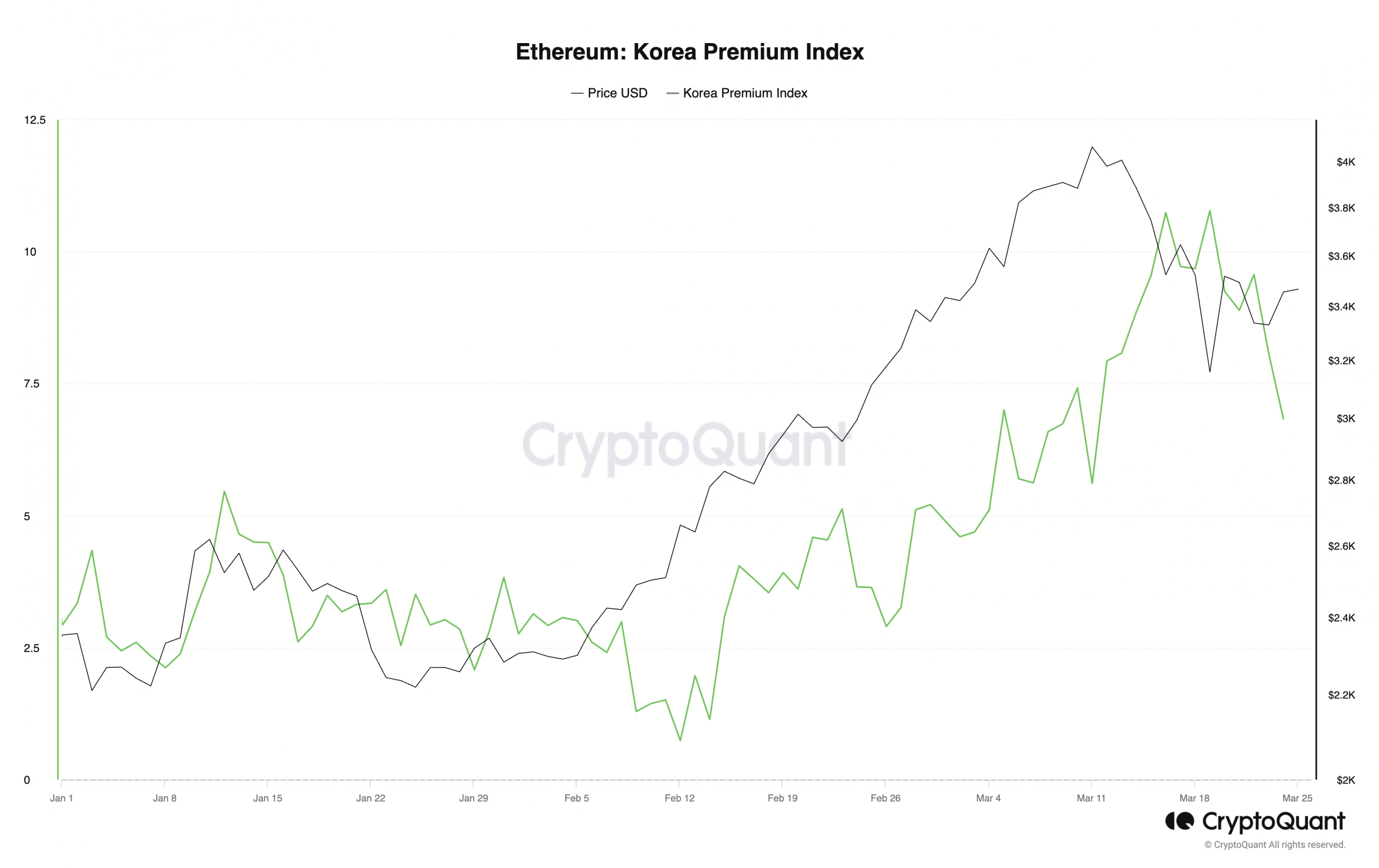

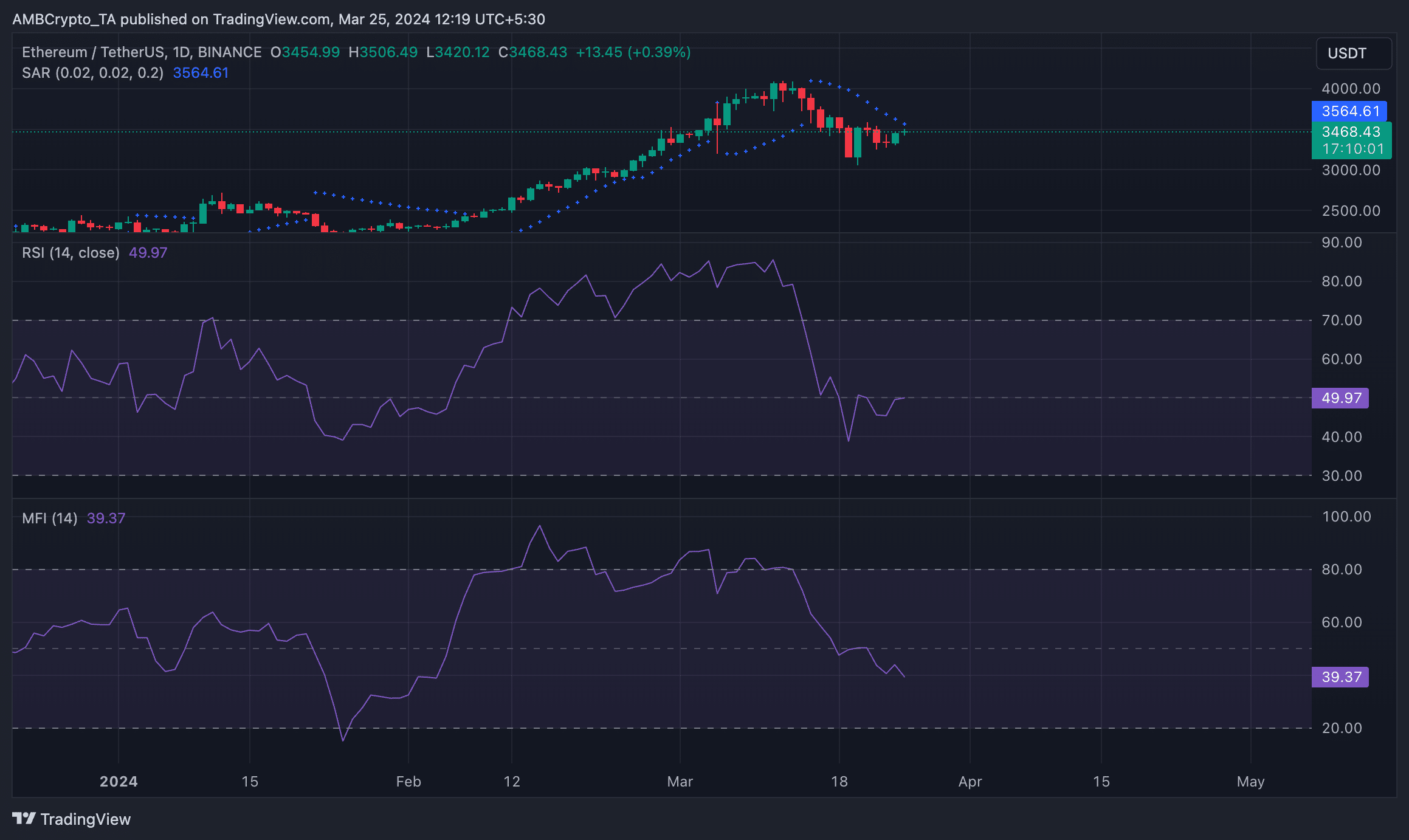

AMBCrypto’s evaluation of ETH’s worth efficiency on a day by day chart hinted at the potential for a decline within the coin’s worth this week.

As of this writing, the altcoin exchanged palms at $3,474, witnessing a 4% worth decline within the final week.

The coin’s Cash Circulation Index (MFI) was noticed at a low of 39.34. This indicator measures the power of cash flowing out and in of an asset.

At a worth of 39.34, ETH’s MFI steered that the coin was witnessing a decline in shopping for strain.

Confirming the lower in demand for the coin, its Relative Power Index (RSI) trended downward to return a worth of 49.

This additionally confirmed that promoting exercise outpaced coin accumulation amongst spot market individuals.

Additional, ETH’s Parabolic SAR revealed that the bearish sentiment has been important because the fifteenth of March.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

It has been positioned above ETH’s worth prior to now 10 days, throughout which the coin’s worth has dropped by 6%.

Supply: ETH/USDT on TradingView

The Parabolic SAR indicator tracks potential development path and reversals. When its dotted traces relaxation above an asset’s worth, the market is deemed to be in a downtrend.