Ahead of 2024 halving, Bitcoin defies historical trends yet again – How?

- Bitcoin may start one other bull rally earlier than its upcoming halving.

- Metrics and indicators supported the opportunity of a bull run.

Bitcoin’s [BTC] value lastly confirmed indicators of a bull rally after days of being in a consolidation section. The king of cryptos’ value motion turned bullish at a time when it was anticipating its subsequent halving simply in a number of days.

Bitcoin turns risky

After a number of days of sluggish value motion, BTC bulls just lately made a transfer, permitting the king of cryptos to register beneficial properties.

In line with CoinMarketCap, Bitcoin was up by greater than 2% within the final 24 hours, serving to it inch in direction of $70k.

On the time of writing, BTC was buying and selling at $69,497.75 with a market capitalization of over $1.37 trillion.

The hike in value stirred up expectations from the coin, and for buyers, the opportunity of BTC touching its earlier ATH of $73k once more appeared more likely to occur.

In actual fact, Mags, a preferred crypto analyst, just lately posted a tweet mentioning that BTC’s first half of the bull rally was over, and it was about to start its second innings.

If that’s true, then the BTC may as properly attain a brand new ATH earlier than its upcoming halving. As per the tweet, BTC’s ATH is perhaps someplace close to $350k.

What the metrics recommend

For the reason that goal of $350k regarded fairly bold, AMBCrypto deliberate to try the king of crypto’s metrics to see what to anticipate within the close to time period.

Our evaluation of CryptoQuant’s data revealed that its alternate reserve was lowering, which means the shopping for strain on the coin was excessive.

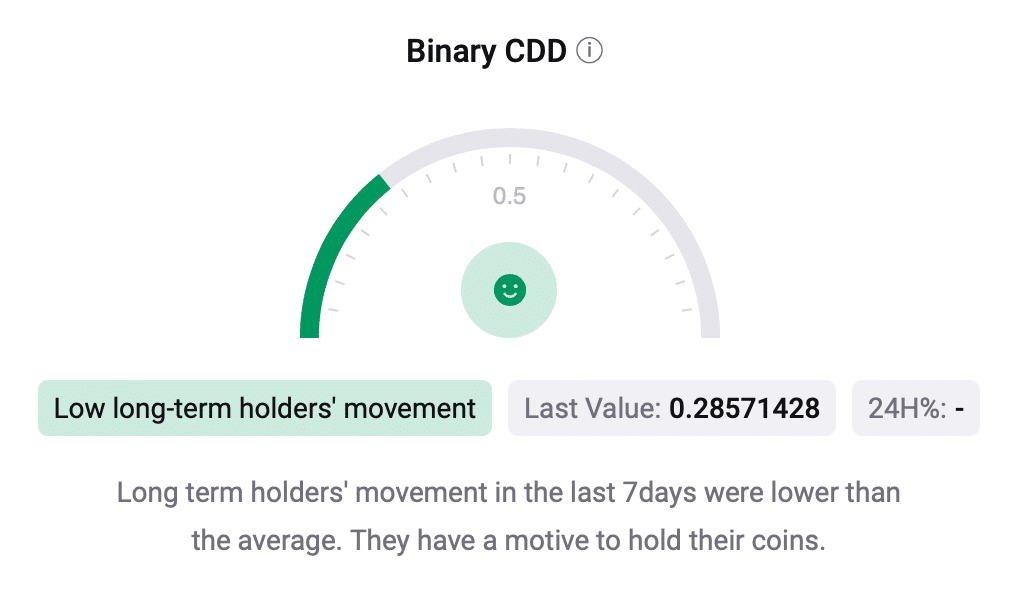

Its Binary CDD was inexperienced as properly, which means that long-term holders’ actions within the final seven days have been decrease than common.

Supply: CryptoQuant

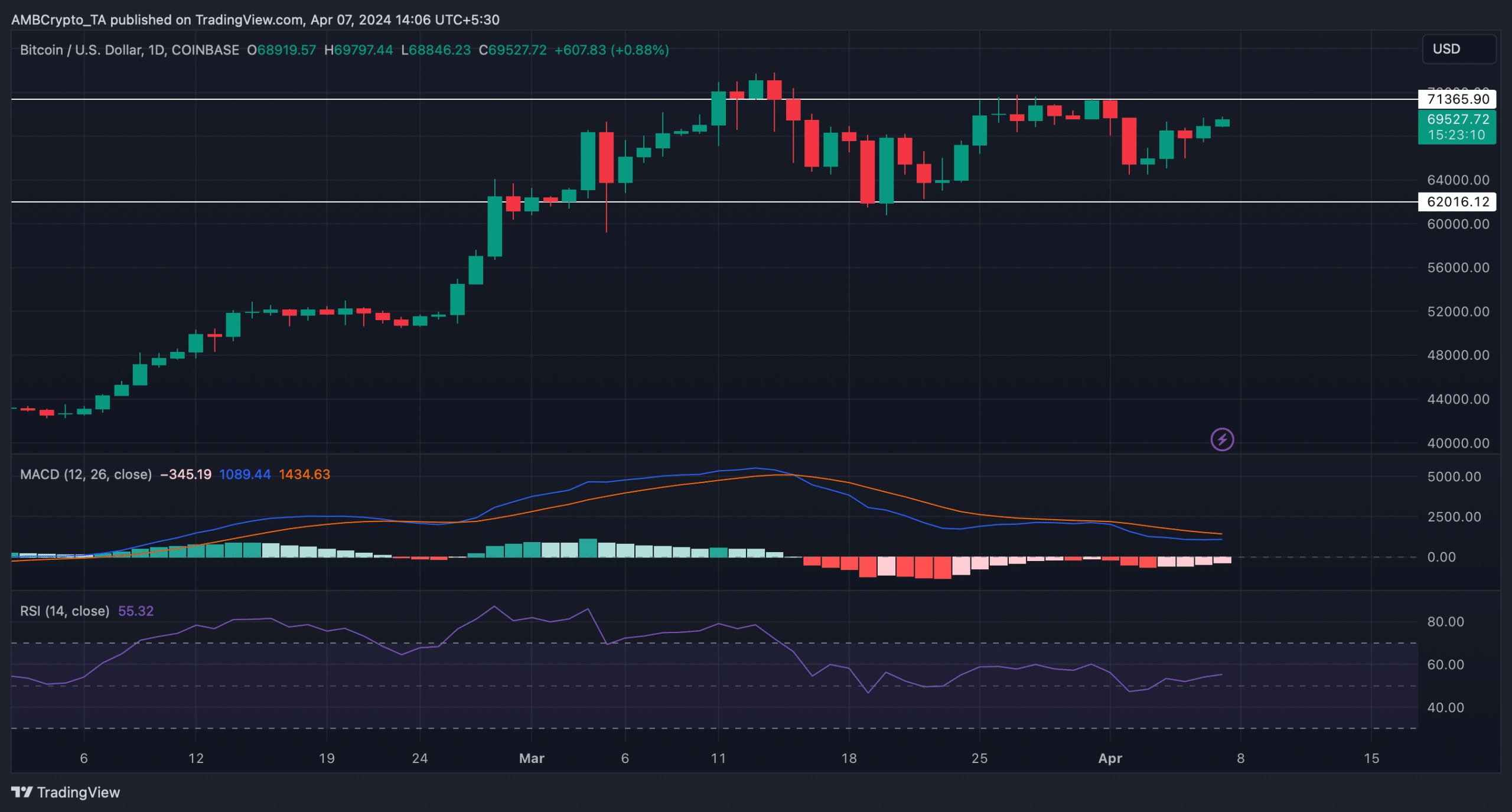

AMBCrypto then analyzed BTC’s each day chart to see whether or not an uptrend was inevitable. We discovered that BTC must go above the $71k resistance so as to provoke a bull rally.

The potential of this taking place was doubtless, because the Relative Energy Index (RSI) registered an uptick. Nevertheless, nothing might be mentioned with certainty, because the MACD displayed a bearish benefit out there.

Supply: TradingView

A fast take a look at the upcoming halving

All of this was taking place at a time when BTC was anticipating its subsequent halving, which is about to occur in round 12 days from press time.

The halving will step by step scale back the obtainable provide for commerce over the following 4 years, with an estimated influence of ~6%.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

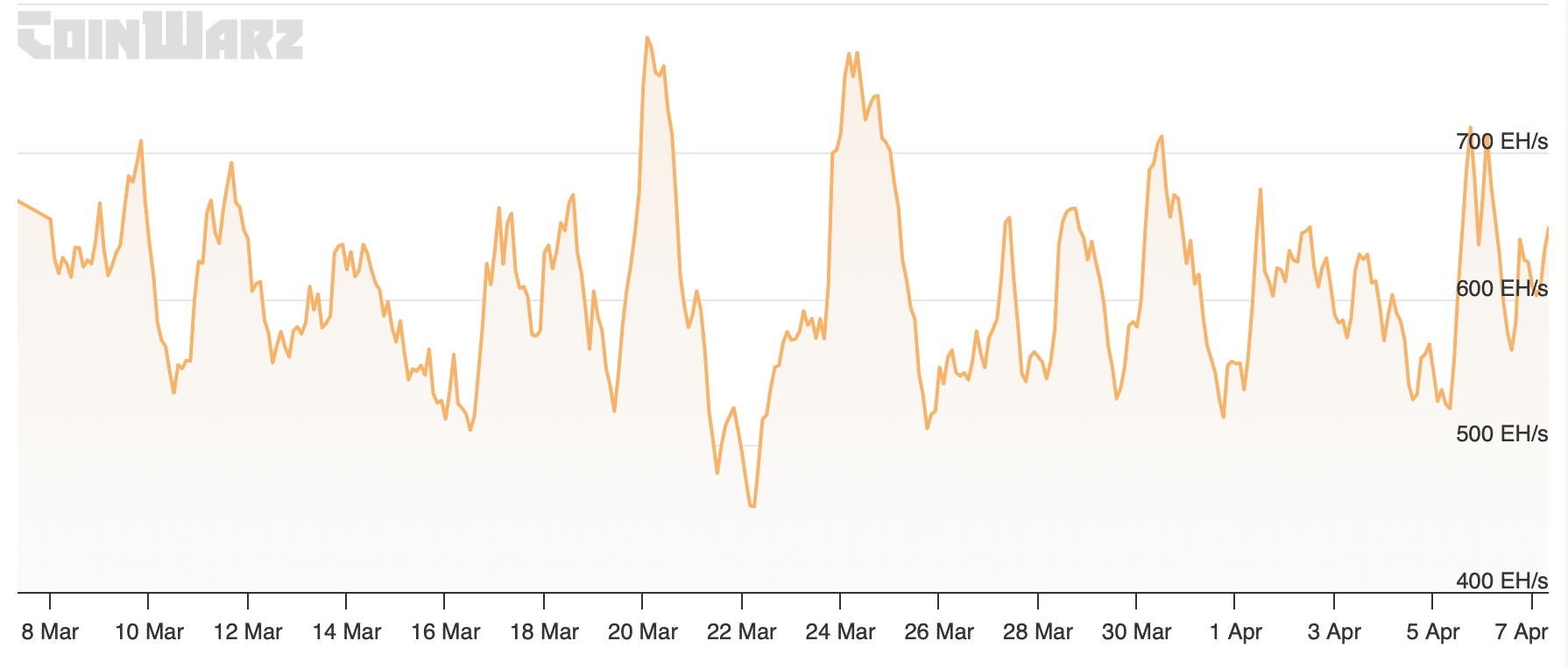

AMBCrypto then took a take a look at BTC’s mining sector to see how miners have been behaving earlier than the halving.

We discovered that BTC’s hashrate remained comparatively excessive final month, reflecting a steady variety of miners working within the ecosystem. At press time, BTC’s hashrate stood at 656.61 EH/s.

Supply: Coinwarz