4 weeks of Bitcoin ETF growth explained – A closer look at $70K

- ETF volumes for Bitcoin continued to develop regardless of market volatility.

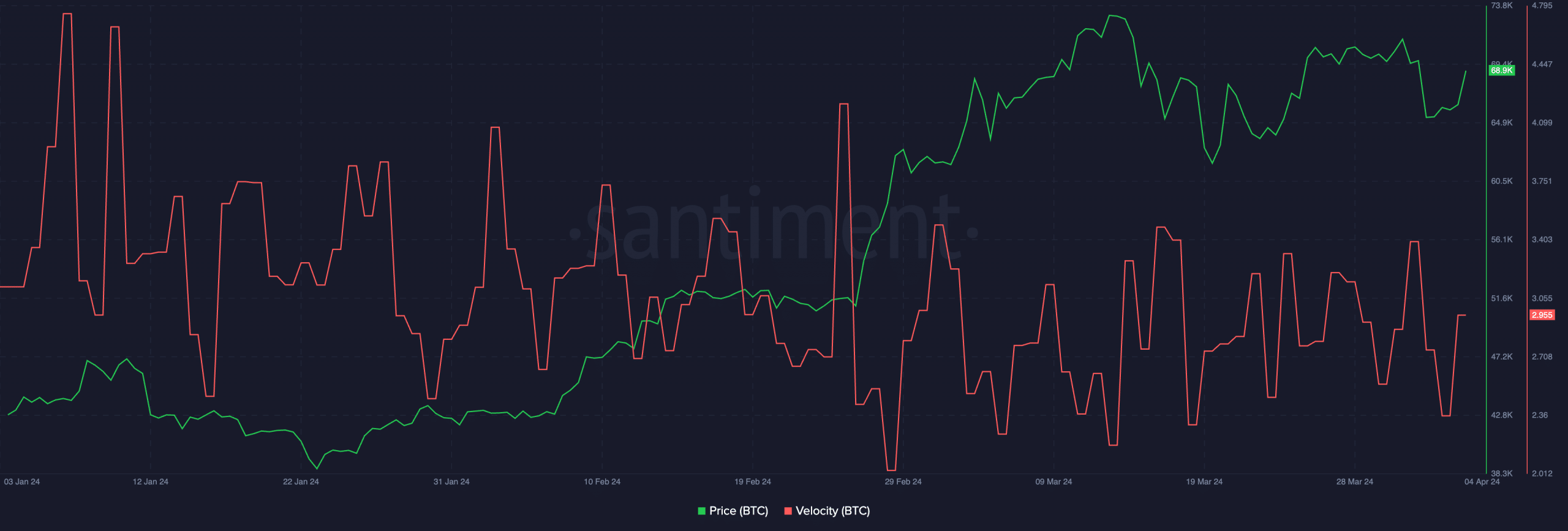

- BTC’s worth surged, together with its velocity.

Following Bitcoin’s [BTC] surge to the $70,000 mark, hypothesis concerning an imminent correction intensified.

Regardless of the continuing battle between Bitcoin bulls and bears within the cryptocurrency sphere, the sentiment in conventional monetary markets remained evident.

ETF volumes on the rise

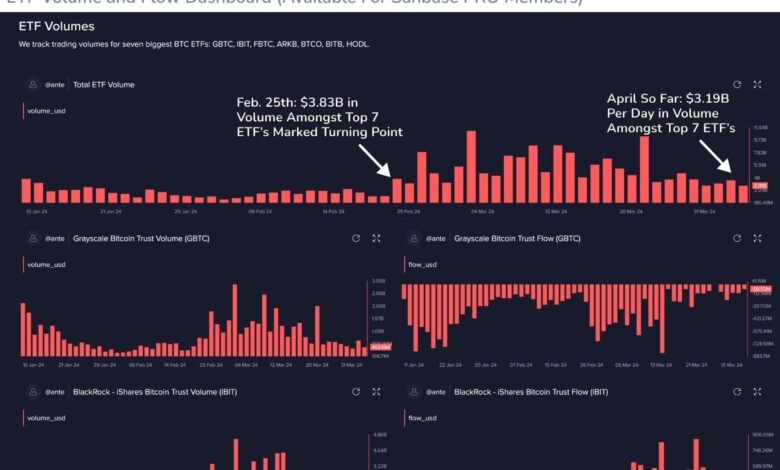

Based mostly on Santiment’s knowledge, Bitcoin ETF volumes have proven no indicators of slowing down, even 4 weeks after BTC reached its All-Time Excessive.

Throughout property like GBTC, IBIT, FBTC, ARKB, BTCO, BITB, and HODL, dealer exercise remained elevated in comparison with the turning level noticed in late February, following a surge in particular person buying and selling exercise that has continued since then.

It’s extremely possible that this heightened exercise will persist main as much as the April halving. This sustained curiosity, even after Bitcoin’s all-time excessive, suggests robust investor urge for food.

This translated to elevated demand for Bitcoin, as ETFs maintain precise Bitcoin to again their shares. However whereas this might probably drive the value of Bitcoin up, it’s not with out its dangers.

Excessive quantity may also result in important worth swings if there are sudden modifications in investor sentiment inside the ETF market.

On the optimistic facet, the recognition of Bitcoin ETFs might convey Bitcoin to a wider viewers and additional legitimize it inside the conventional monetary world.

Supply: Santiment

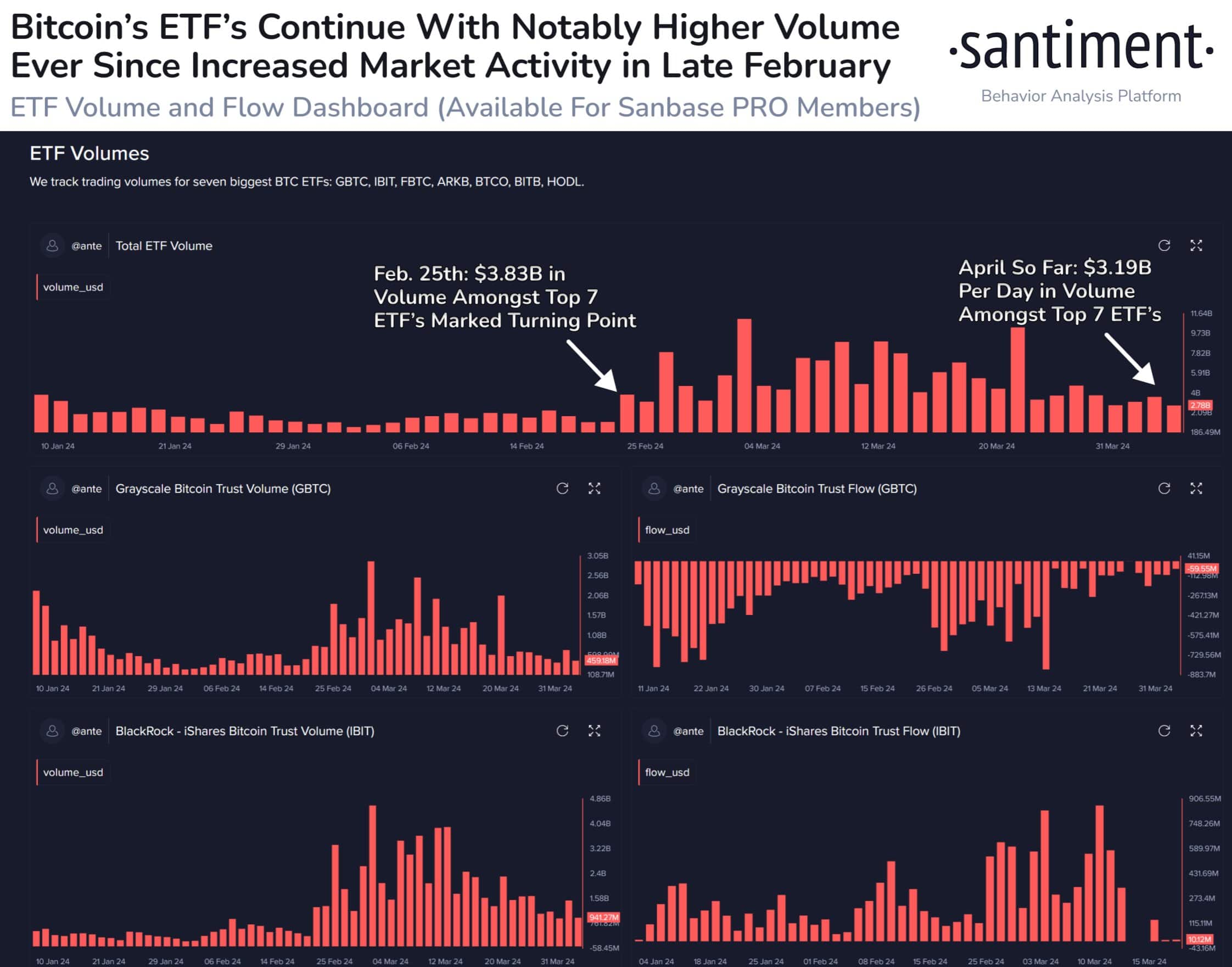

Nevertheless, it wasn’t all bullish information for BTC. Defiance not too long ago filed for an ETF that’s brief 2x of MicroStrategy.

MicroStrategy, the corporate run by Michael Saylor, has been infamous for being extraordinarily bullish on BTC. The agency has accrued Bitcoin at numerous worth factors at completely different market cycles.

The creation of this ETF means that not everybody on Wall Road shares the identical optimistic outlook on BTC.

Supply: SEC

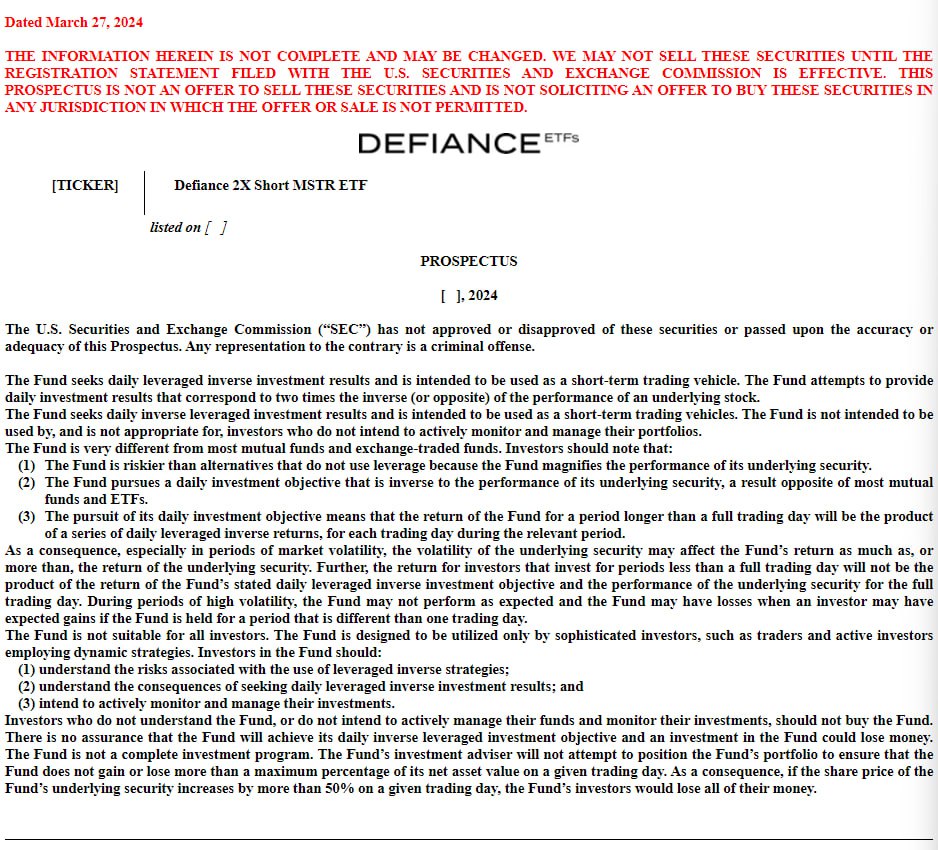

Although MSTR hasn’t seen comparable progress as BTC, each these property have proven some stage of correlation over the past six months.

Supply: Portfolios Lab

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

State of Bitcoin

At press time, BTC was buying and selling at $72,029.22 and its worth had grown by 3.98% within the final 24 hours. The speed at which BTC was buying and selling at had additionally grown throughout this era.

The rising velocity of BTC indicated that the frequency with which BTC was buying and selling had additionally grown alongside its worth in the previous couple of days.

Supply: Santiment