MicroStrategy Stock’s price prediction reveals what’s next after Bitcoin halving

- MSTR prolonged its weekly losses to about 20%.

- Bitcoin’s halving and ‘over-valuation’ issues might supply sellers extra edge

MicroStrategy’s (MSTR) inventory prolonged its weekly losses to over 19%, simply hours earlier than Bitcoin’s [BTC] fourth halving. After hitting a recorded excessive of $1999.99 on 27 March, the inventory retraced, reversing a part of its month-to-month positive factors. MSTR’s weekly losses marked a three-week-long prolonged pullback on the charts.

On a quarterly foundation, the inventory was down 30% in Q2. Quite the opposite, its Yr-to-Date efficiency had a studying of +73.4%, on the time of writing.

On 17 April, MSTR closed at $1188.05, a large low cost for anybody who missed leaping on the inventory beforehand. Even so, macro situations and worth charts revealed that extra juicy reductions should still be possible for anybody selecting to dive in.

Will MSTR lengthen losses amidst Bitcoin halving?

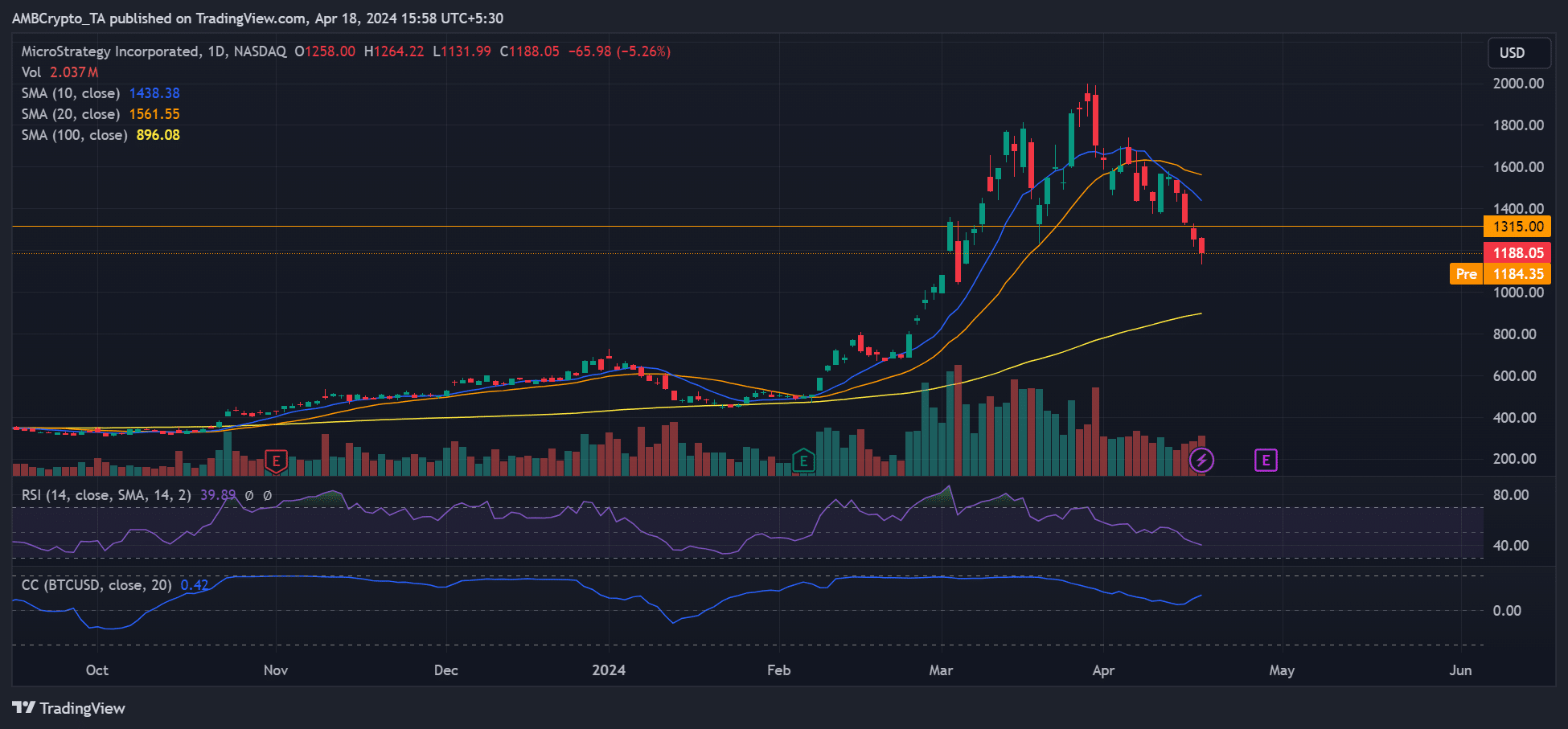

Supply: MSTR inventory, day by day chart

As one of many firms with a Bitcoin technique, MSTR’s inventory strongly correlates with BTC. This was evidenced by its constructive correlation coefficient since mid-February.

What this implies is that BTC’s prolonged worth dump has been dragging MSTR inventory too.

Between 27 March and 18 April, BTC dropped by 13%, from $71.7K to $62.4K on Bitstamp. Over the identical interval, MSTR slumped by 40%—Greater than 3x BTC’s drop.

Proper now, bears have extra leverage after dropping MSTR under the 10- and 20-day SMA (Easy Transferring Common), marked blue and orange, respectively.

Ought to bears push additional, the following goal is the 100-day SMA ($896), which is able to mark an effort to tug MSTR’s worth under $1000. If this occurs, it could possibly be a greater low cost for bulls who missed the earlier motion.

The below-average studying on the RSI (Relative Energy Index) is an indication of heightened promote strain – Supporting the prolonged drop projection.

Bitcoin halving and MSTR being “overvalued”

Moreover, Bitcoin’s halving might embolden MSTR bears if BTC promoting strain spikes across the occasion.

MicroStrategy’s present BTC holdings stand at 214,246 cash, price over $13B based mostly on present market costs. Most of them have been acquired by means of company-issued convertible notes.

Nevertheless, the continuing dump additionally resonates with some market watchers who really feel MSTR inventory is overvalued. Final month, non-public funding supervisor Kerrisdale Capital said the identical,

“We’re lengthy Bitcoin and quick shares of MicroStrategy, a proxy for Bitcoin which trades at an unjustifiable premium to the digital asset that drives its worth.”

Kerrisdale Capital argued that new spot BTC ETFs supply alternate options to realize publicity to BTC, which denies MicroStrategy any distinctive benefit for the premiums it prices.

For perspective, some buyers had beforehand most popular shopping for MSTR to realize an oblique publicity to BTC.

Merely put, the non-public funding supervisor sees MSTR’s truthful worth as $700 – $800. The higher estimate is nearer to the bearish goal marked by the 100-day SMA (yellow).

Nevertheless, the projection could possibly be invalidated, particularly within the unlikely occasion of a large Bitcoin rally across the halving.