Ethereum – IF listed on the NYSE or Nasdaq, here’s how it might do…

- Ethereum revenues grew considerably in Q1 regardless of worth volatility

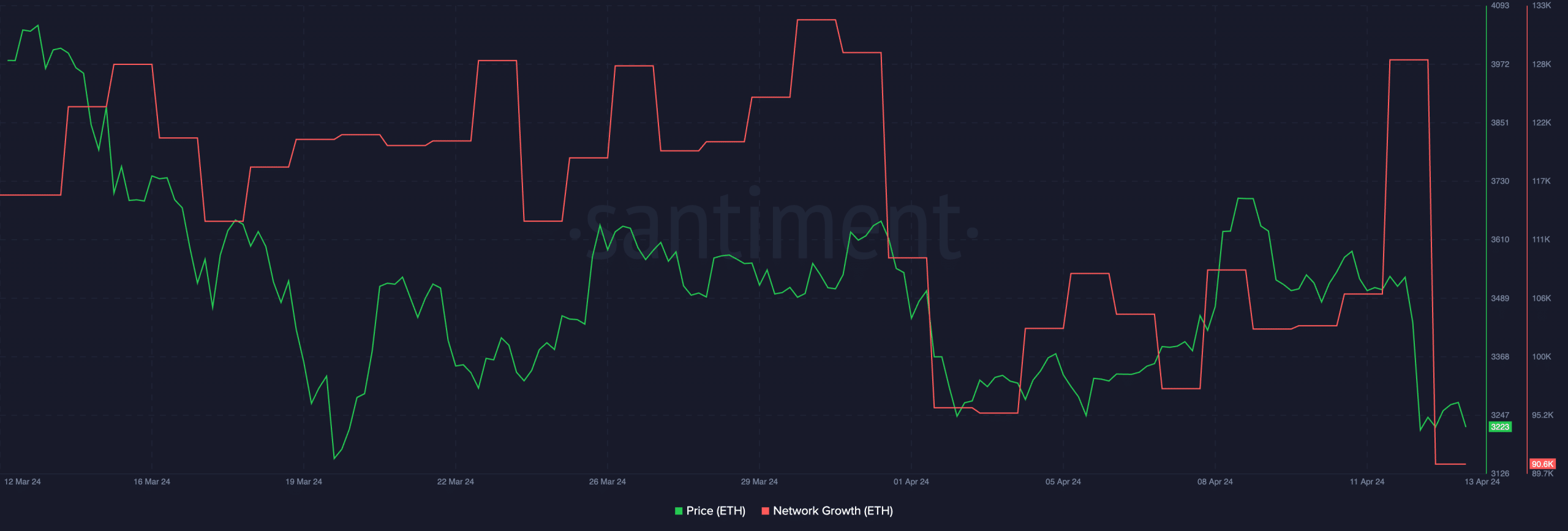

- ETH’s worth began to see inexperienced once more as community development fell

Ethereum [ETH] took a large hit by way of worth over the previous couple of days. Nevertheless, it’s value trying on the greater image too, with the identical revealing that Ethereum’s community has been doing rather well, regardless of the current worth fluctuations.

Ethereum had a really optimistic Q1. Actually, Ethereum achieved a revenue of $370 million from $825 million in income, equating to a internet revenue margin of roughly 45%.

Ethereum income on the rise

If Ethereum was listed on the New York Inventory Alternate or the NASDAQ, it could lead the online revenue margin (%) rankings, with Microsoft, Adobe, and Veeva following carefully. When it comes to complete earnings throughout all publicly traded software program firms, Ethereum would rank sixth.

On the time of writing, Ethereum’s market capitalization stood at roughly $350 billion, putting it on par with tech giants corresponding to Salesforce.

Nevertheless, there are important caveats to think about right here.

Ethereum’s historic efficiency might not be as stellar, and its construction deviates from conventional companies. Not like a typical firm, Ethereum’s token features as each a utility and a type of “fairness.” Moreover, Ethereum’s valuation is significantly larger than conventional software program firms, compared by income multiples.

Supply: X

How is ETH doing?

The expansion of Ethereum in Q1 and its potential for development within the subsequent quarter will help help the bullish narrative across the community. Furthermore, the income generated via L2s after the Dencun improve may assist the Ethereum community by way of profitability.

Regardless of all these favorable issues occurring for Ethereum, the worth of ETH fell materially over the previous week. It depreciated by over 11% and slipped previous the $3,000-mark, earlier than recovering once more. Nevertheless, the curiosity in ETH grew after this drastic decline.

Is your portfolio inexperienced? Test the Ethereum Revenue Calculator

Right here, it’s value noting that AMBCrypto’s analysis of Santiment’s information revealed that regardless that the worth of ETH recovered, its community development flatlined.

This indicated that the variety of new addresses interacting with ETH fell. An absence of curiosity from new addresses in ETH might have an effect on the worth motion of the altcoin considerably going ahead.

Supply: Santiment