Bitcoin Bears Risk Losing $7.2 Billion If BTC Price Reaches This Level

The Bitcoin value continues to fluctuate wildly after crashing from its all-time excessive value above $73,000. This has triggered a wave of bearish sentiment out there, inflicting numerous crypto merchants to go brief on the pioneer cryptocurrency. Because of this, these bears lose, risking a big quantity if the Bitcoin value resumes its bullish rally.

Bears Will Lose $7.2 Billion If Bitcoin Reclaims All-Time Excessive

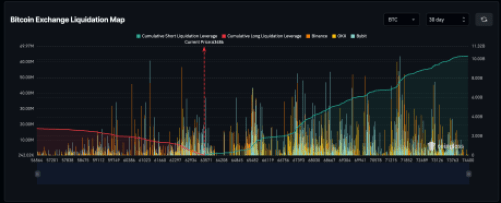

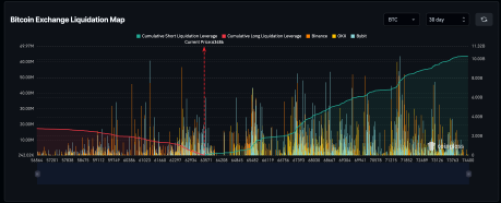

In a submit shared on X (previously Twitter), crypto analyst Ash Crypto revealed an fascinating pattern regarding Bitcoin that has been growing. The screenshot shared exhibits that numerous brief trades have been positioned on BTC, with the expectation that the worth may proceed to fall.

Now, up to now, these bulls look to be proper as Bitcoin has did not efficiently clear $67,000. Nonetheless, they stand to lose some huge cash if BTC is ready to clear this resistance and resume upward. In line with Ash Crypto, there may be over $7.2 billion price of BTC shorts which threat liquidation if Bitcoin had been to achieve a brand new all-time excessive value above $74,000.

On the time, the Bitcoin value had recovered above $66,000, spurring a flurry of bearish exercise out there. Nonetheless, these bears appear to have succeeded, because the BTC value has fallen under $64,000 on the time of writing.

Because of this, bears have been emboldened, with the expectation that the Bitcoin value will nonetheless from right here. Thus far, the liquidation developments dangers have continued to rise because the BTC value falls. Knowledge from Coinglass exhibits that if Bitcoin had been to get well above $44,000 and attain a brand new all-time excessive, bears stand to lose over $10 billion.

Supply: Coinglass

BTC Bulls Are Not Giving Up

Though Bitcoin bears appear to be making financial institution with the worth of Bitcoin falling, the bulls are removed from performed. Somewhat, they’ve been utilizing this value decline as a chance to refill their luggage. This accumulation has been much more outstanding amongst Bitcoin whales, who’ve picked up 1.4% of the full provide within the final month.

On-chain knowledge tracker Santiment reported that within the final 4 weeks, Bitcoin whales have added 266,000 BTC to their stability. The cohort liable for this are these holding between 1,000 and 10,000 BTC, making them the mega whales. In whole, they spent $17.8 billion on shopping for BTC in only one month.

On account of this accumulation, these 1,000-10,000 BTC whales now maintain 25.16% of all BTC in existence. Their numbers are additionally on the rise, with Santiment figuring out this because the “Highest crowd bullish bias since all-time excessive week in early March.”

For now, Bitcoin continues to battle with the bears to carry the $63,000 assist. Its value is down 4.05% within the final day to commerce at $63,600, on the time of writing.

BTC bears pull value down | Supply: BTCUSD on Tradingview.com

Featured picture from Coinpedia, chart from Tradingview.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal threat.