Ethereum validators stay put – Where does that leave ETH’s price?

- Voluntary exit on Ethereum fell to a one-month low.

- Regardless of final week’s value rally, bearish sentiments stay important within the ETH market.

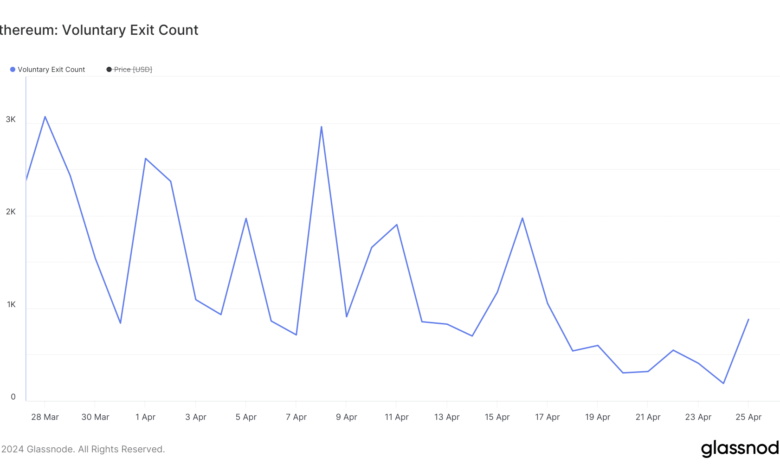

The each day rely of validators exiting the Ethereum [ETH] community lately cratered to a 30-day low, information from Glassnode confirmed.

Supply: Glassnode

This occurred as a result of latest decline in demand for the proof-of-stake (PoS) community. AMBCrypto beforehand reported that consumer exercise on Ethereum has declined during the last month.

This resulted in a low ETH burn price, which has elevated the coin’s provide and made it inflationary as soon as once more.

When ETH turns into inflationary, its value experiences important downward stress. In line with CoinMarketCap’s information, the coin’s worth has dropped by 13% within the final month.

On account of ETH’s low value motion, validators on the Ethereum community haven’t been incentivized to unstake their cash for onward gross sales.

The community sometimes witnesses a surge in validator exit when ETH value climbs, inflicting validators to try to seize positive aspects on their beforehand staked cash.

With fewer validators leaving the community, the participation price amongst validators has additionally risen to its highest within the final month.

Validators should take part within the community to make sure that Ethereum runs optimally. A excessive participation price signifies dependable validator node uptime, fewer missed blocks, and superior blockspace effectivity.

As of this writing, the validators’ participation price on the community was 99.6%.

ETH positive aspects, however at what price?

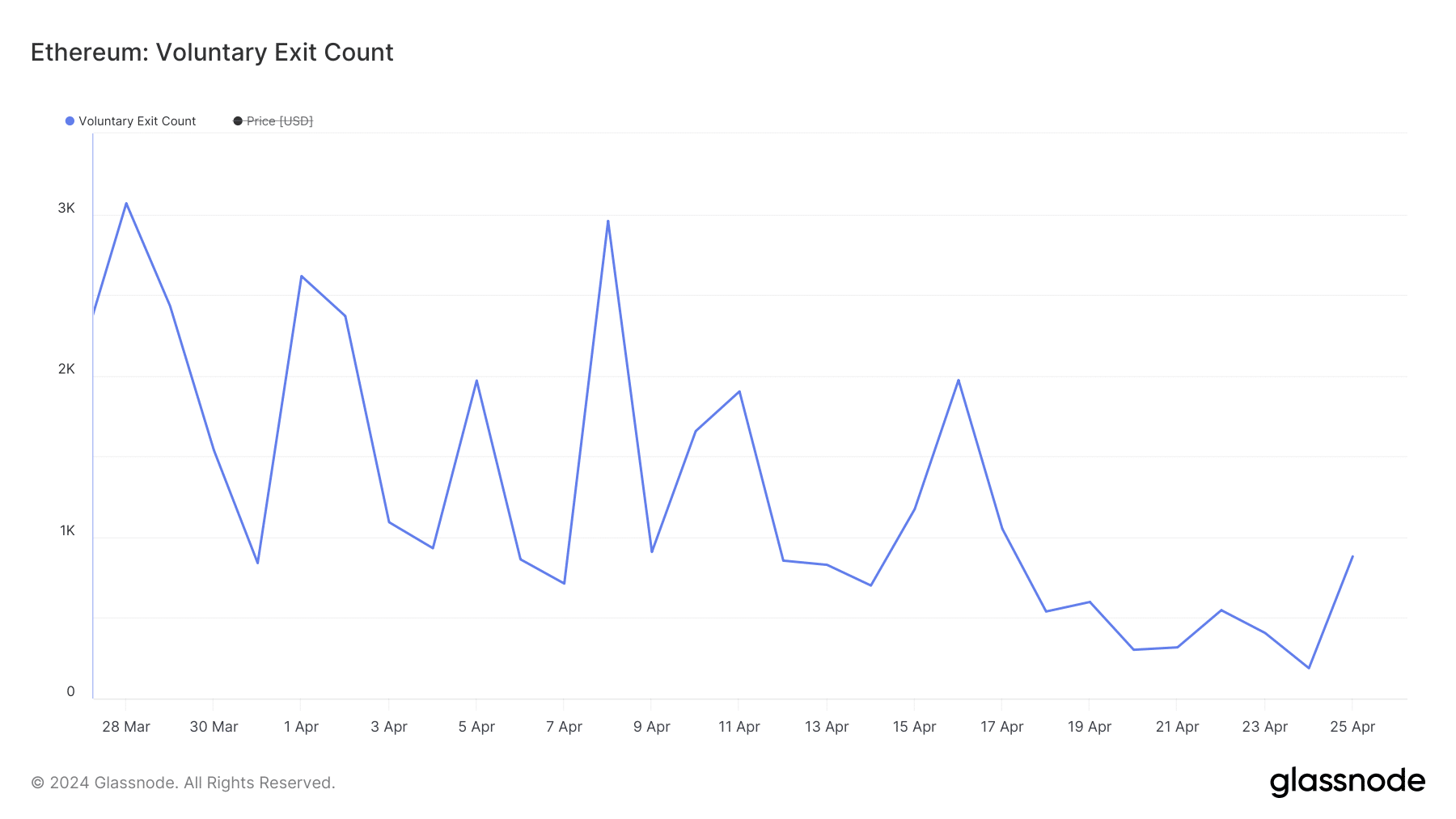

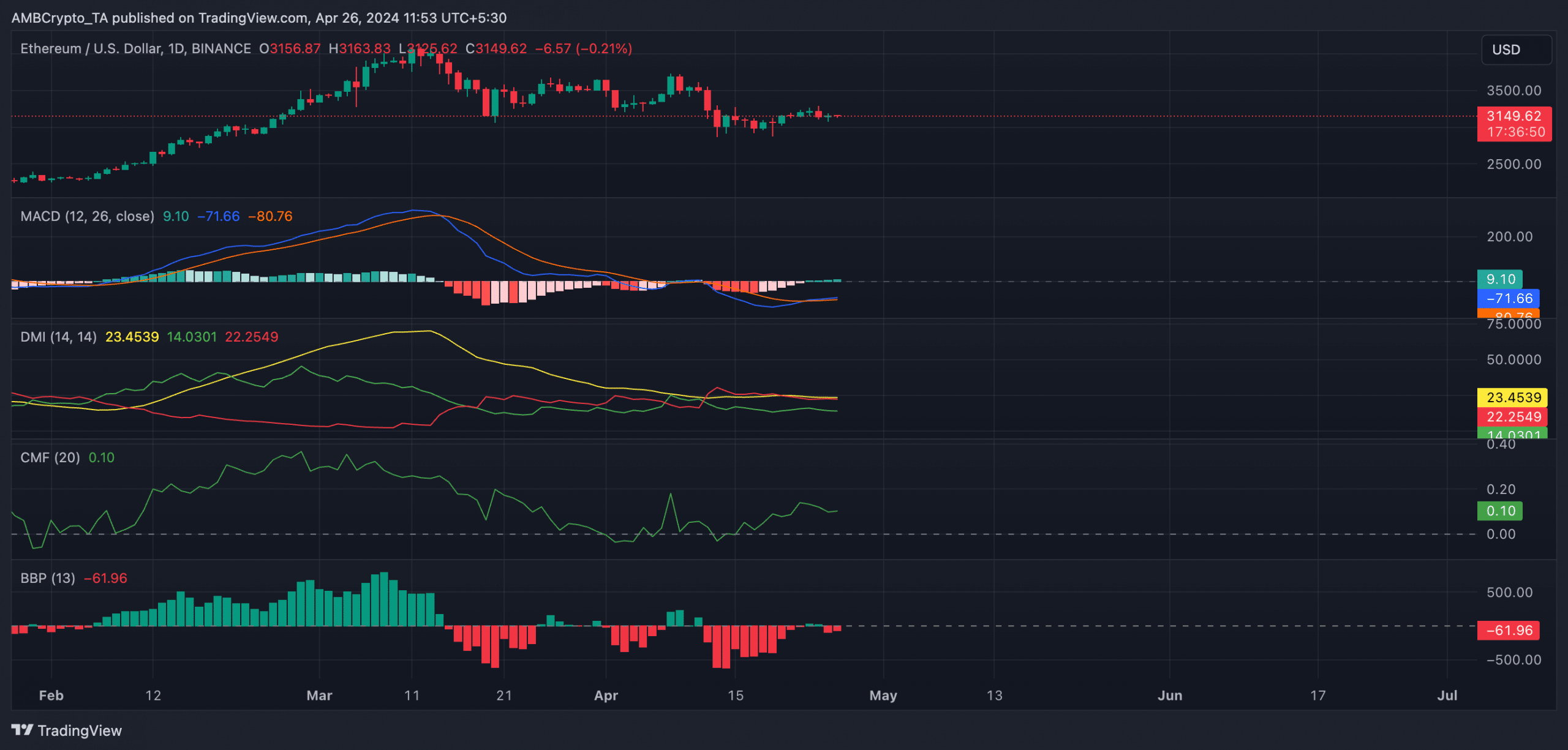

At press time, ETH traded at $3,150, recording a 5% worth uptick within the final week. This value progress has been attributable to a minor resurgence in bullish sentiments amongst market individuals, which AMBCrypto gleaned from its readings of the coin’s key technical indicators on a one-day chart.

For instance, the coin’s MACD line rested above its sign line at press time. This signaled that ETH’s short-term shifting common is above its long-term shifting common. It’s considered as a bullish sign and interpreted as a sign to take lengthy and exit brief positions.

Likewise, the coin’s Chaikin Cash Move (CMF), which measures the circulate of cash into and out of the market, returned a constructive worth at press time. This confirmed that the ETH market had a gradual liquidity provide.

Nonetheless, bearish sentiments lingered out there. The worth of the coin’s Elder-Ray Index was -61.96 on the time of press. This indicator measures the connection between the power of consumers and sellers out there.

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

When its worth is unfavourable, bear energy is dominant out there.

Confirming the power of ETH bears, its unfavourable directional index (purple) was positioned above its constructive index. This confirmed that coin sellers had extra presence out there than consumers.

Supply: ETH/USDT on TradingView