Ethereum EigenLayer’s 14x growth in a year: Redefining DeFi?

- EigenLayer’s deposits equated to about 4% of ETH’s complete circulating provide.

- Attributable to EigenLayer, staked ETH provide has risen 1o% YTD.

EigenLayer has attracted greater than $15 billion in deposits in simply over a yr since its launch, rising as probably the most profitable decentralized finance (DeFi) tasks in current instances.

The restaking protocol’s complete worth locked (TVL) has exploded 14x for the reason that begin of the yr, a feat that made it the second main DeFi mission by TVL, in accordance with AMBCrypto’s evaluation of DeFiLlama’s knowledge.

The deposits equated to about 4% of Ethereum’s [ETH] complete circulating provide, the asset round which its major use case revolves.

Supply: DeFiLlama

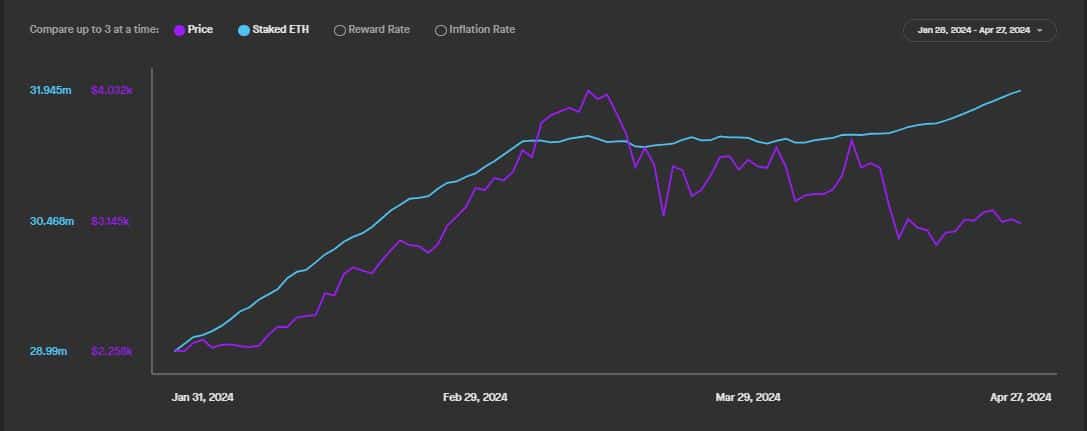

ETH staking will get energized

Restaking, probably the most talked-about subjects within the Web3 sector proper now, provides worth to staked ETH by repurposing it to supply safety to purposes aside from the Ethereum mainnet.

The setup helps stakers earn further yields on their deposits.

Arguably, EigenLayer, the largest restaking protocol, has had a trigger and impact relationship with ETH staking.

Based on AMBCrypto’s evaluation of Staking Rewards’ knowledge, staked ETH provide has risen 10% year-to-date (YTD), mimicking the surge in EigenLayer’s deposits.

Supply :DeFiLlama

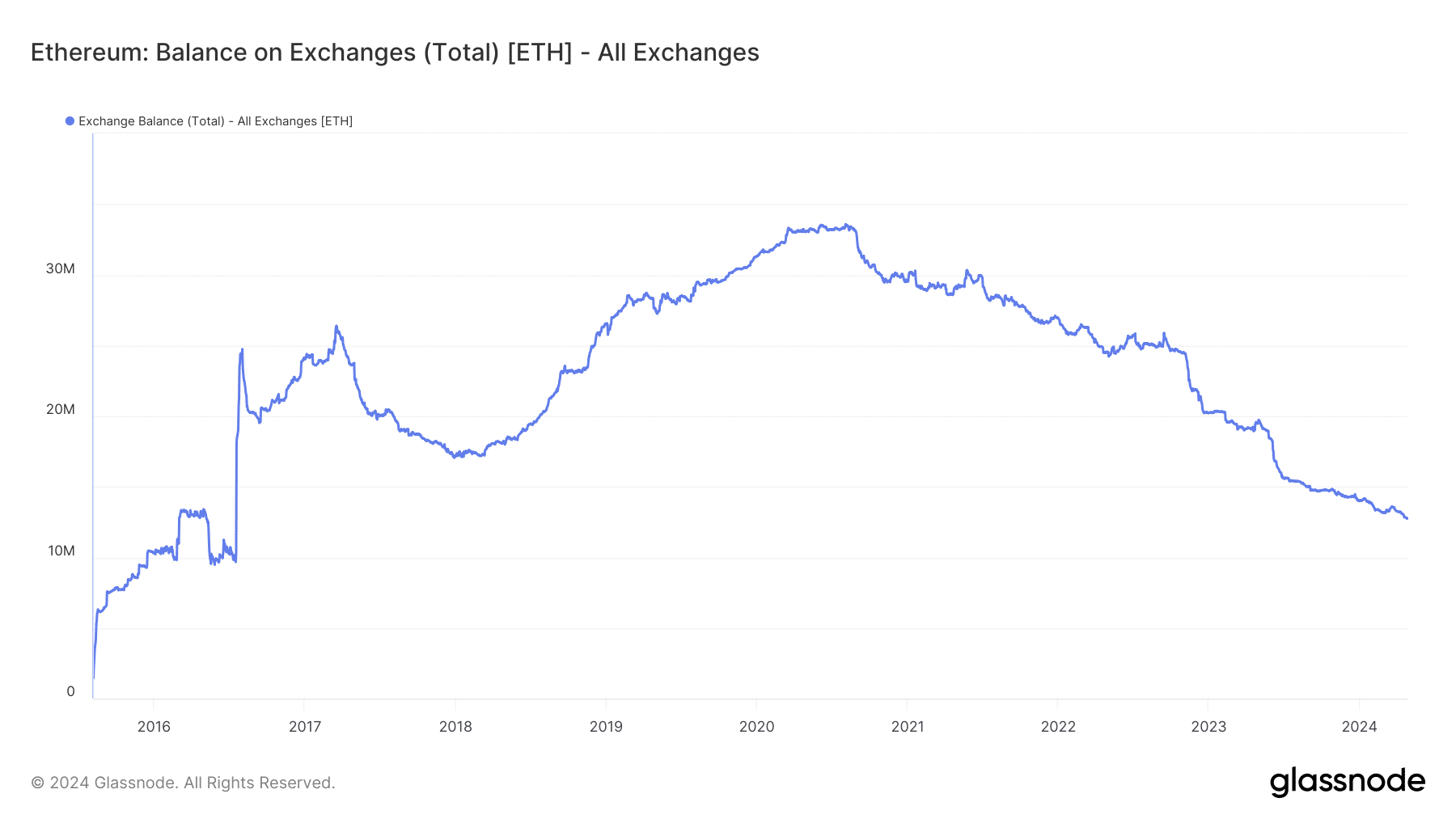

On the contrary, liquid ETH obtainable on exchanges has continued to fall, as AMBCrypto seen utilizing Glassnode’s knowledge.

EigenLayer’s ascent.

A shift in market construction?

This noticeable divergence underscored ETH’s rising standing as a yield-bearing, long-term funding asset, away from its roots in speculative buying and selling.

Moreover, with increasingly ETH getting locked up in staking providers, the asset was certain to turn into much less unstable, opening itself to a broader cohort of traders.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

As of this writing, the second-largest asset was buying and selling at $3,141, following a 2.38% rise over the week, knowledge from CoinMarketCap revealed.

The market sentiment was one among greed, in accordance with the most recent readings of the Ethereum Fear and Greed Index, implying that demand for the asset was nonetheless sturdy.