After Hong Kong Bitcoin ETF, Australia joins the party: Will BTC rise again?

- Hong Kong Bitcoin ETFs will begin buying and selling this week.

- Australia joins the BTC ETF mania; will APAC demand increase BTC costs?

The much-awaited and distinctive “in-kind” Hong Kong Bitcoin [BTC] ETFs are right here. Slated to start out buying and selling on Tuesday, the thirtieth of April, market watchers view the debut as a sport changer for Asia.

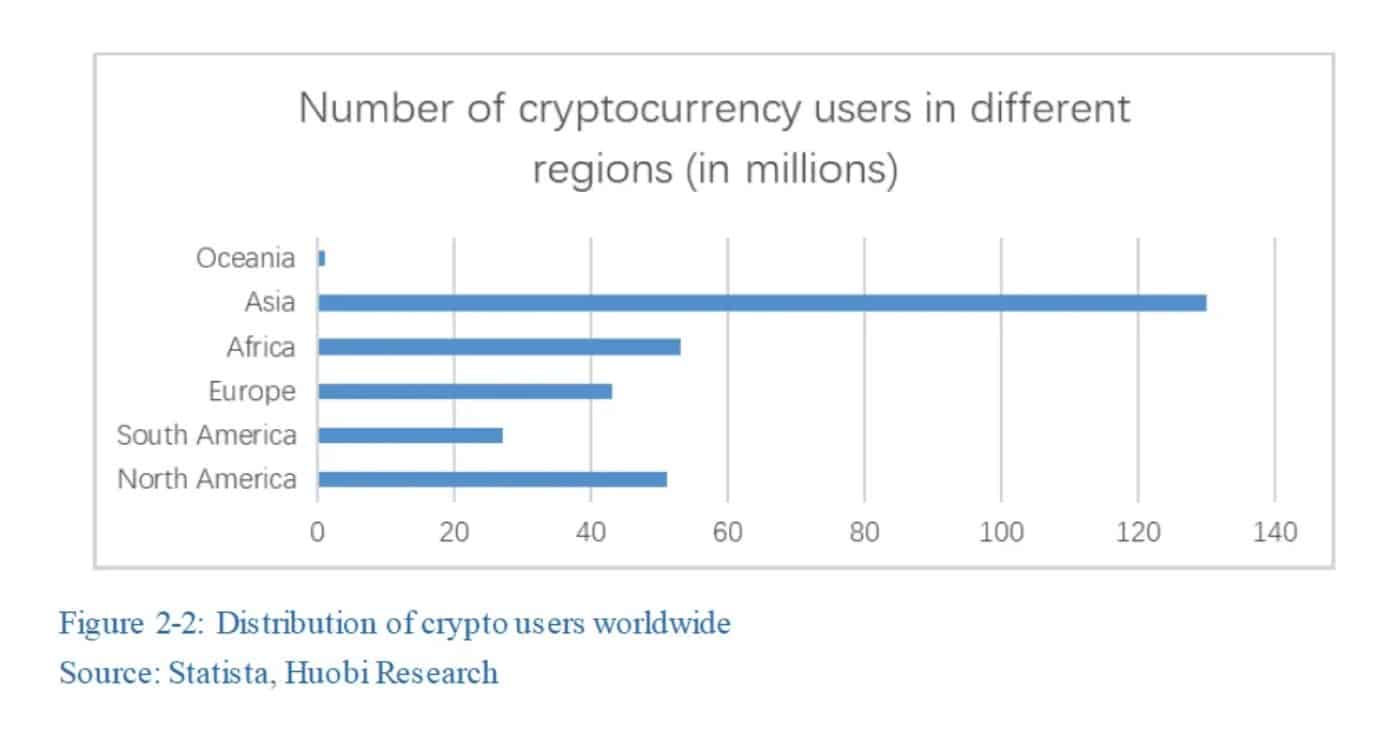

One market watcher, Willy Woo, underscored the Hong Kong ETF’s significance within the area by citing Asia’s highest crypto person statistics.

“The Asian market in person rely is BIGGER than the US and European markets mixed.”

Supply: X/Willy Woo

Hong Kong Bitcoin ETFs charge wars and market dimension

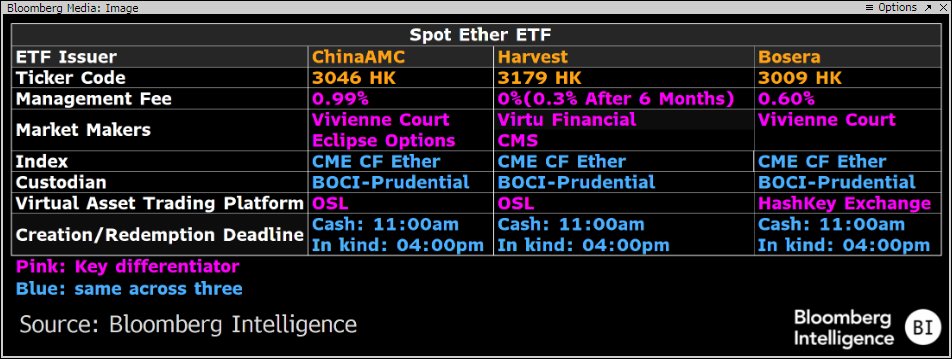

The primary batch of accredited merchandise from Bosera, ChinaAMC (Hong Kong), and Harvest Fund will go stay on the Hong Kong inventory trade on the thirtieth of April.

On common, Bloomberg analyst James Seyffart noted that Hong Kong issuers have set very low prices that might appeal to charge wars.

“A possible charge conflict may escape in Hong Kong over these #Bitcoin & #Ethereum ETFs. Harvest coming in scorching with a full charge waiver and the bottom charge at 0.3% after waiver.”

Supply: X/James Seyffart

There was preliminary pleasure concerning the potential influence on BTC costs if Hong Kong spot BTC ETFs begin buying and selling.

In mid-April, Singapore-based crypto analysis agency, Matrixport, projected that Hong Kong’s spot BTC ETFs may appeal to $25 billion in inflows.

Nonetheless, a Bloomberg analyst, Eric Balchunas, downplayed the estimates because it grew to become obvious that Mainland China would face restrictions.

The analyst up to date his earlier $200 million estimate to $1 billion in AUM (belongings below administration), noting that,

“Our asset estimate is now $1b in first two years (which is wholesome IMO however nonetheless nowhere close to the $25b that some have stated), however rather a lot depends upon infrastructure enchancment.”

Moreover, the report famous that the APAC area had solely round $250M in present BTC ETFs shared between Hong Kong and Australia-based funds.

“The Asia-Pacific area’s BTC ETFs presently handle $251 million in belongings, cut up between three funds in Kong Kong and two in Australia.”

Australia follows U.S., Hong Bitcoin ETF frenzy

Nonetheless, Australia is reportedly within the superior levels of enlisting extra spot BTC ETFs on its bigger Australian Inventory Alternate (ASX).

A latest Bloomberg report, dated the twenty ninth of April, highlighted that potential issuers like Van Eck, BetaShares, and DigitalX have lodged functions for spot Bitcoin ETFs in Australia.

ASX didn’t present an official timeline. Nonetheless, an eventful approval may gas institutional adoption and strengthen Hong Kong Bitcoin ETFs and the general APAC area.

Within the meantime, BTC’s worth hovered barely above its range-low of $60.8K.

Given the US Fed fee resolution scheduled on Wednesday and lots of liquidity on the chart positioned on the upside, wild volatility is probably going this week.