Bitcoin Hash Rate Prices and the Future of the Mining Industry

TL;DR

Full Story

Let’s cap issues off with a fast explainer on Bitcoin hash charges.

Why? Trigger whereas it’d seem to be a small and easy factor, BTC hash charges can inform us rather a lot in regards to the state of mining operations.

So what are BTC hash charges?

The hash charge is the quantity of computational energy used to mine a block.

(I.e. resolve a bunch of sophisticated equations, course of a bunch of BTC transactions, and get rewarded in BTC for doing so).

Every guess submitted by computer systems on the community is measured, and the hash charge is the variety of guesses which can be occurring per second.

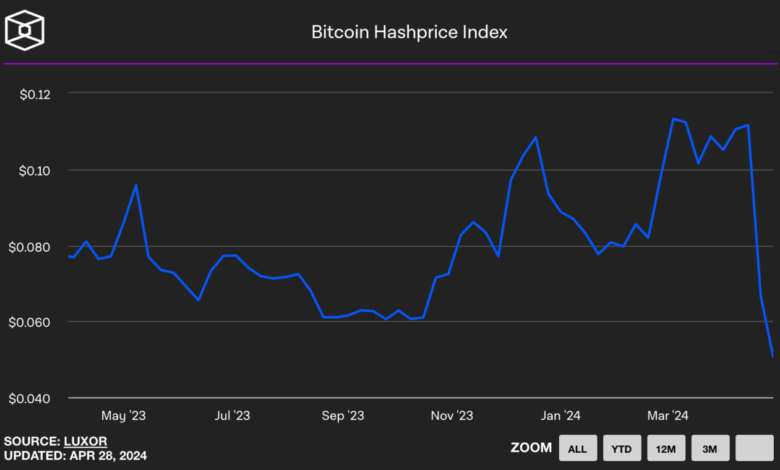

Proper now, BTC’s hash charge worth has dropped to all-time lows.

Which means that fewer miners are competing to mine every block; and relative to earlier than the BTC halving, whereas the rewards have been reduce in half, the prices are method down too.

What’s this inform us in regards to the state of mining operations?

The necessary factor right here is that it appears ‘The Nice Consolidation’ of mining operations has begun.

There are 4 main public miners within the US: CleanSpark, Marathon, Riot Platforms and Cipher Mining. These corporations are absolute beasts.

Because the above 4 have the {hardware} and infrastructure arrange, the much less it prices to mine BTC (the decrease the hash charge worth), the extra income they’ll probably make.

With these income, likelihood is they’ll snap up the entire smaller mining corporations who battle to be as environment friendly.

It’s a canine eat canine world on the market!