Ethereum -Whale-induced sell-offs have THIS effect on its market trend

- Whales not too long ago moved important ETH to the exchanges.

- The optimistic tendencies have been worn out with current declines.

Ethereum [ETH] whales not too long ago made a big transfer, which notably affected the netflow available in the market. This coincided with a drop within the value of ETH, accompanied by a gradual enhance within the provide on exchanges.

Whales transfer over $100 million in Ethereum

Latest information from Lookonchain revealed that six Ethereum whales not too long ago transferred ETH to the Binance and Coinbase exchanges.

The most important deposit amounted to 10,431 ETH, valued at $32.66 million, whereas the smallest was 2,000 ETH, valued at $6.28 million, from FTX/Alameda.

In complete, 44,000 ETH, value $140 million, had been deposited to exchanges by these whales. Earlier than this, one other whale had deposited 11,892 ETH, roughly $38 million, to an change.

Ethereum netflow sees month-to-month excessive

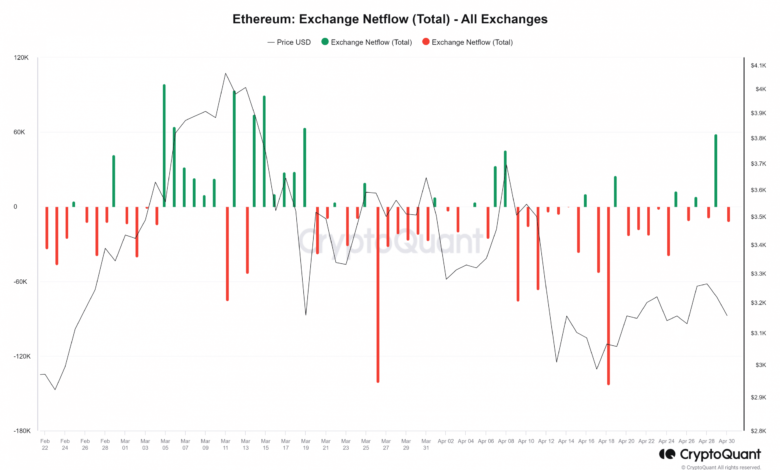

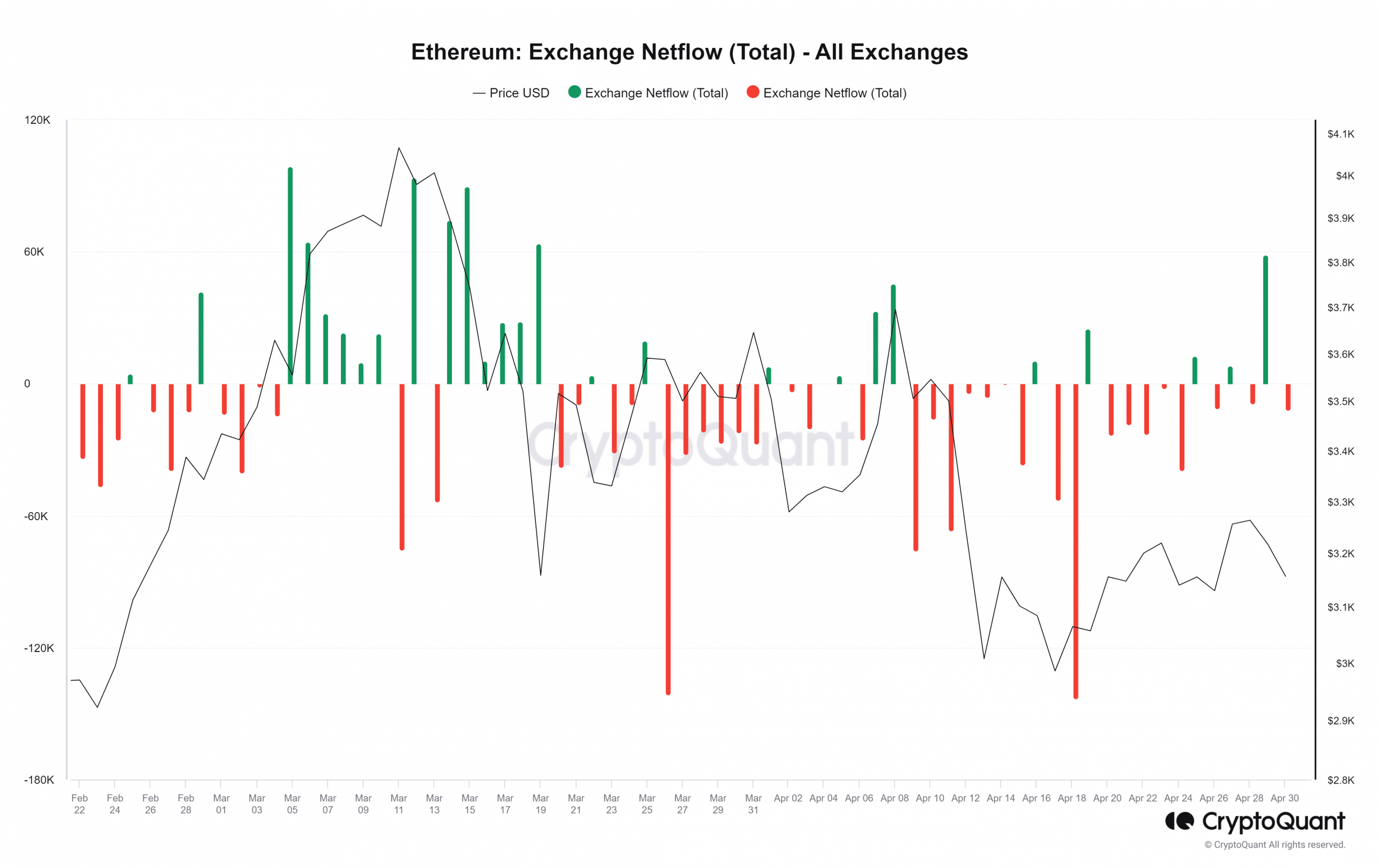

A current evaluation of Ethereum inflows on CryptoQuant indicated that on twenty ninth April, over 281,000 ETH had been deposited into exchanges. Whereas this was important, it wasn’t the best influx noticed within the month; that report was set on thirteenth April, with over 401,000 ETH deposited.

Nonetheless, inspecting the change netflow revealed an fascinating development. On twenty ninth April, the Netflow of ETH into exchanges was over 58,500, with inflows surpassing outflows. This marked the best influx of the month, with nineteenth March being the final occasion of such notable exercise.

These tendencies recommend elevated promoting stress as extra merchants are promoting ETH quite than shopping for. As of this writing, there was an influx of over 57,000 ETH, however outflows, totaling round -8,900 ETH, dominated the Netflow.

Supply: CryptoQuant

Extra Ethereum equipped to exchanges

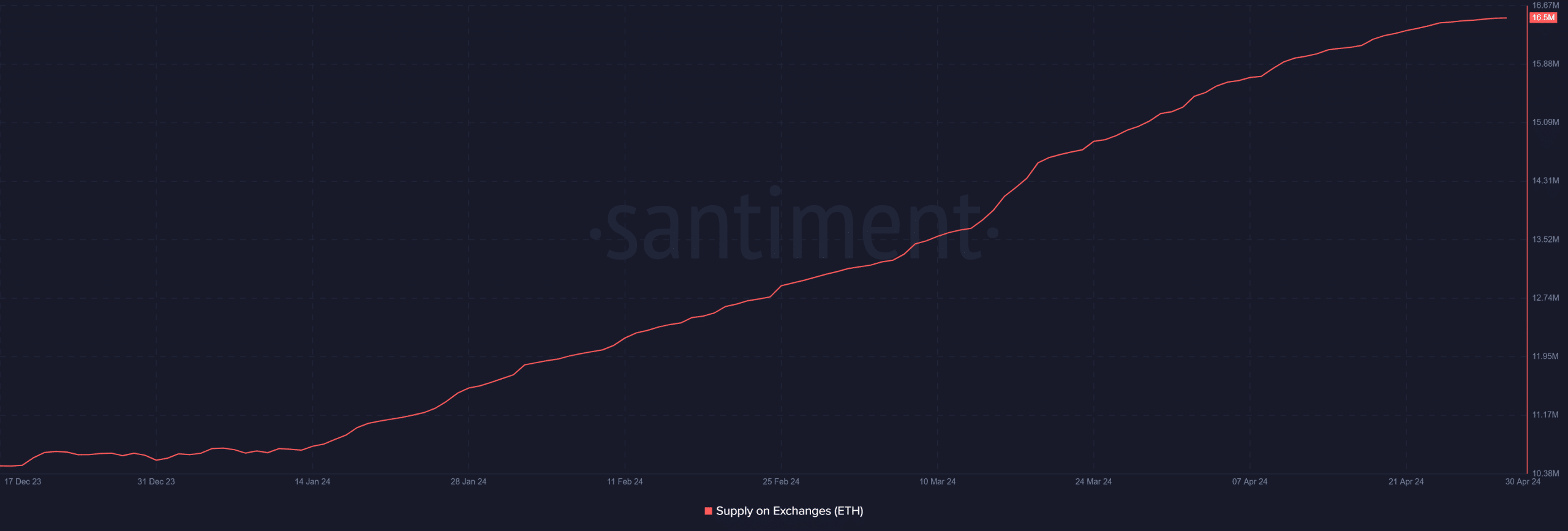

Evaluation of the provision on change metric revealed a gradual enhance within the quantity of Ethereum held on exchanges. At the start of the month, the provision of ETH on exchanges was round 15.31 million.

Nonetheless, as of this writing, this quantity has risen to roughly 16.5 million.

Supply: Santiment

ETH goes again to bear development

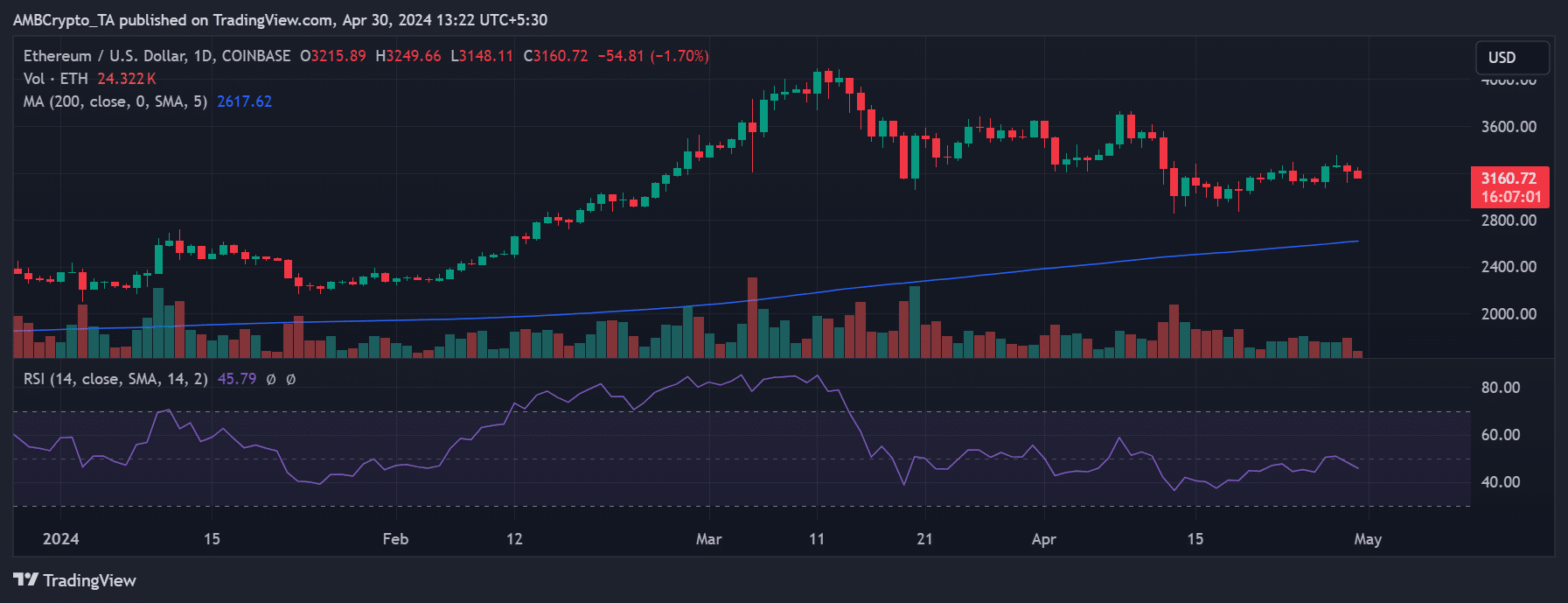

AMBCrypto’s evaluation of the every day timeframe chart revealed a dip in Ethereum’s value on twenty ninth April. Buying and selling at round $3,215, ETH skilled a 1.44% decline, reversing the minor uptrend noticed within the previous days.

Learn Ethereum (ETH) Value Prediction 2024-25

The chart indicated that this decline pushed Ethereum’s Relative Energy Index (RSI) again under the impartial line, signaling a return to a bear development. On the time of this writing, ETH was buying and selling at roughly $3,160, reflecting an extra decline of round 1.7%.

Moreover, its RSI had moved even additional under the impartial line.

Supply: TradingView