Ethereum ETFs to be launched in July? Expert weighs in!

- The ultimate approval of ETH ETFs’ S-1s might occur in 2-3 months per analyst.

- If that’s the case, will Grayscale ETH Belief bleed like GBTC?

After the inexperienced mild of spot Ethereum [ETH] ETFs’ 19b-4s filings, market observers have been vaguely estimating the timeline for the SEC’s last approval of S-1s (registration statements).

Proper now, one coverage and market watcher, Nate Geracci of ETF Retailer, predicts that the S-1s approval might occur in 2-3 months.

‘When will SEC approve spot eth ETF registration statements? *No person* is aware of for positive, however my expectation can be the following few weeks. 2-3 months max.”

Geraci precisely projected that the SEC would approve the 19b-4s (change functions) after which slow-play the S-1s when many of the market was anticipating an SEC rejection on twenty third Could.

So, his projection can’t be merely overruled or missed.

The analyst added that ‘heavy lifting already performed following spot BTC ETFs & eth futures ETFs.’

Bloomberg ETF analyst Eric Balchunas echoed Geraci’s projection and singled out July as a possible date for approval.

“July 4th seems like over/beneath’

Ethereum ETG: Will Grayscale bleed out once more?

If confirmed, market observers will give attention to Grayscale’s Ethereum Belief (ETHE) and whether or not it’s going to observe GBTC’s development in outflows after spot Bitcoin [BTC] ETF approval in January.

In January alone, GBTC recorded $6.5 billion in outflows, per a current Kaiko insights report.

If the development continues into Grayscale’s ETHE as extra pissed off traders redeem their shares, extra outflows are doubtless.

Kaiko estimates that the ETHE, with at present $11 billion in AUM (belongings beneath administration), might see outflows hit $110 million on a each day common if the development mirrors GBTC. A part of the report read,

“Ought to we see an identical magnitude of outflows from ETHE, this could quantity to $110 million of common each day outflows or 30% of ETH’s common each day quantity on Coinbase.”

Nevertheless, crypto analyst James Van Straten beforehand downplayed the potential of large outflows from ETHE and stated that Grayscale’s low-fee Mini Belief ($ETH) might stop the bleeding.

“I’m on the fence by way of outflows if $ETHE sees comparable outflows to $GBTC. The mini belief $ETH could launch on the identical time with smaller charges, and traders don’t must do something, which wasn’t out there for $GBTC.”

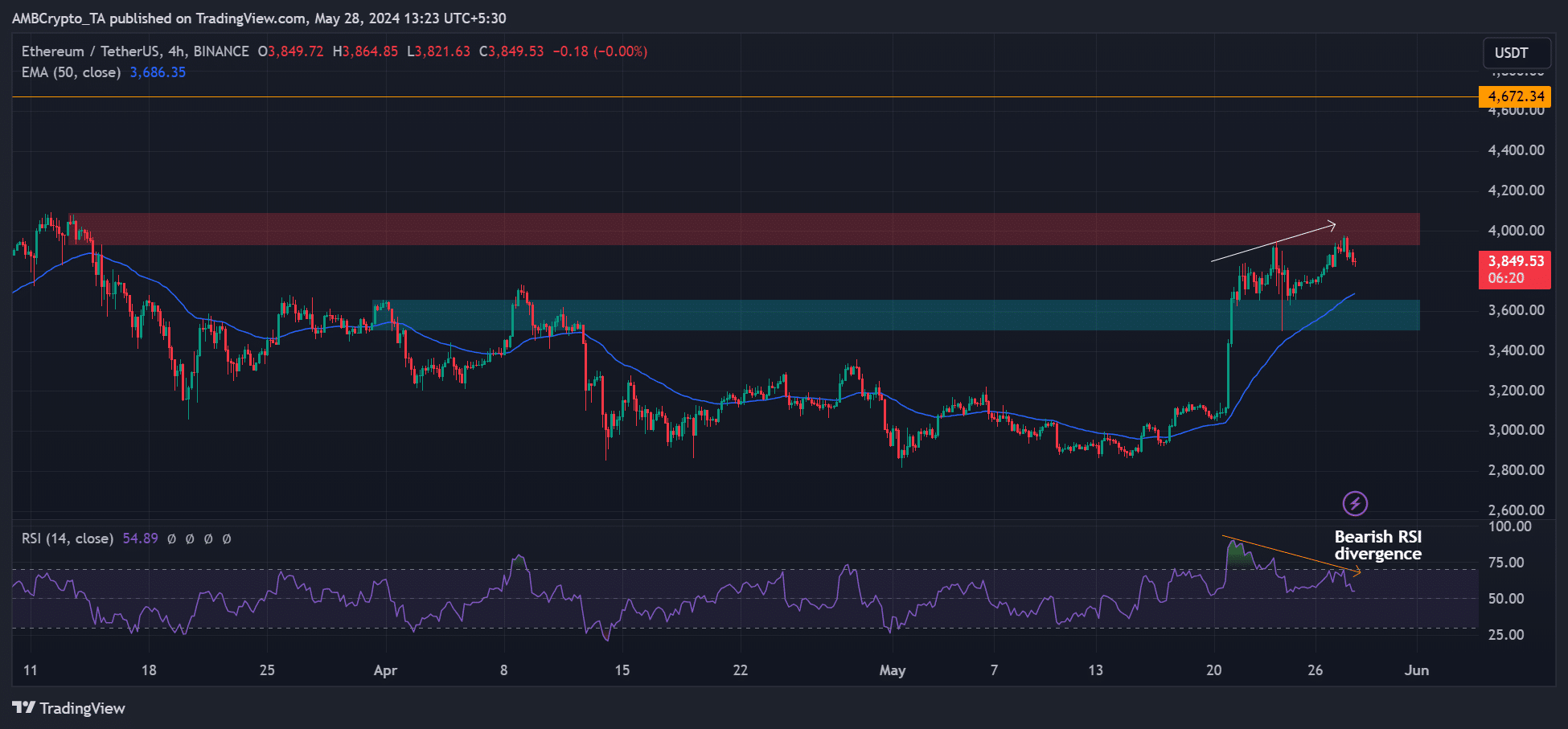

Within the meantime, ETH chalked a bearish RSI divergence on the 4-hour chart. It meant that the RSI (Relative Power Index) was making decrease highs whereas the worth printed greater highs.

Sometimes, such a divergence results in worth pullback.

Supply: ETH/USDT, TradingView

ETH might ease again to the transferring common(50-day EMA, blue), round $3.68K, or the earlier residence-cum-support close to $3.6K (marked cyan) earlier than rebounding to the resistance zone and each day bearish order block at $4K (marked crimson).