Ethereum: THIS can majorly impact ETH’s $5K price prediction

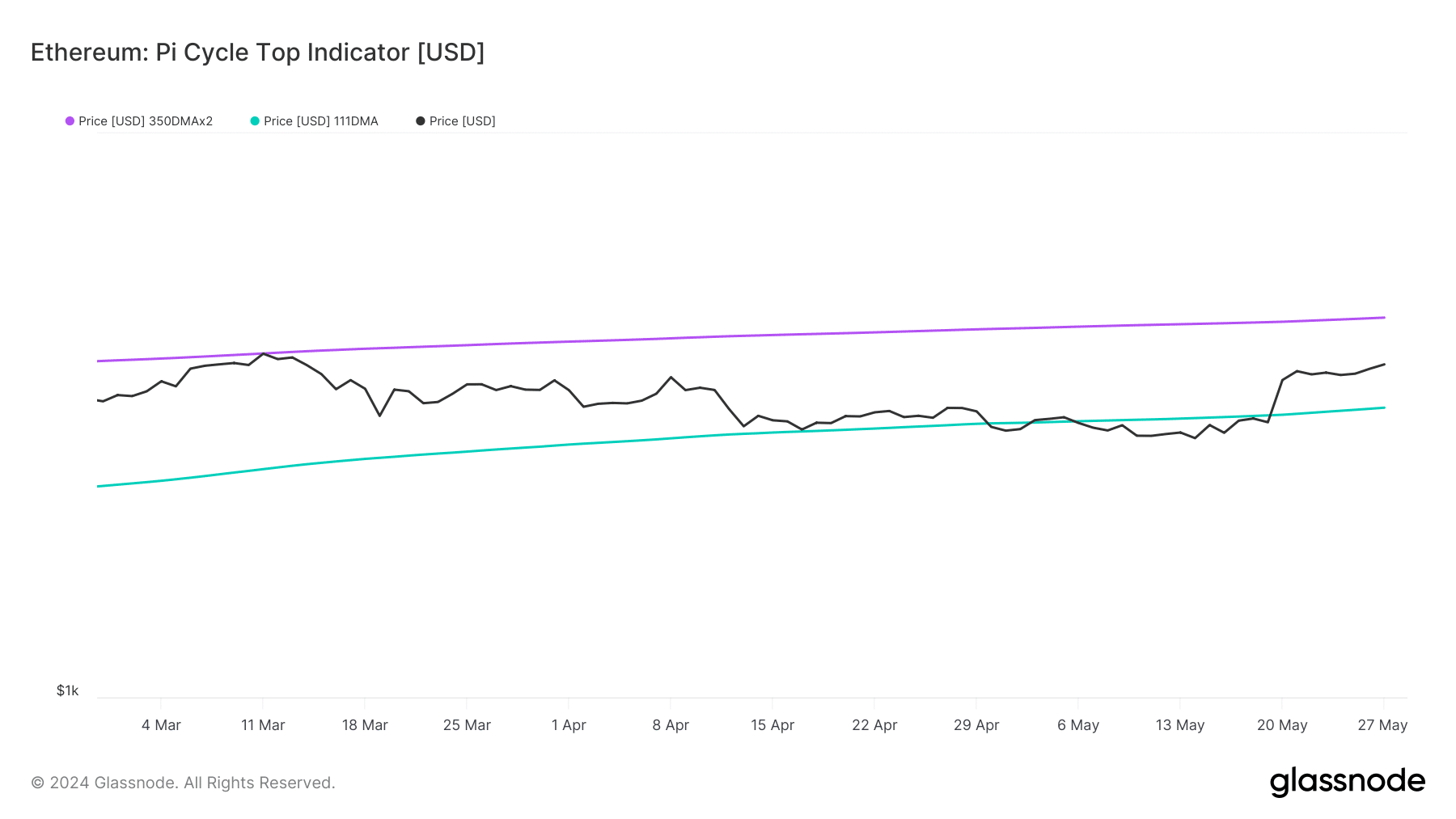

- Alternate influx reached January highs, placing the ETH’s worth in danger.

- Although the reward ratio dropped, a key indicator instructed that ETH may rally above $4,700.

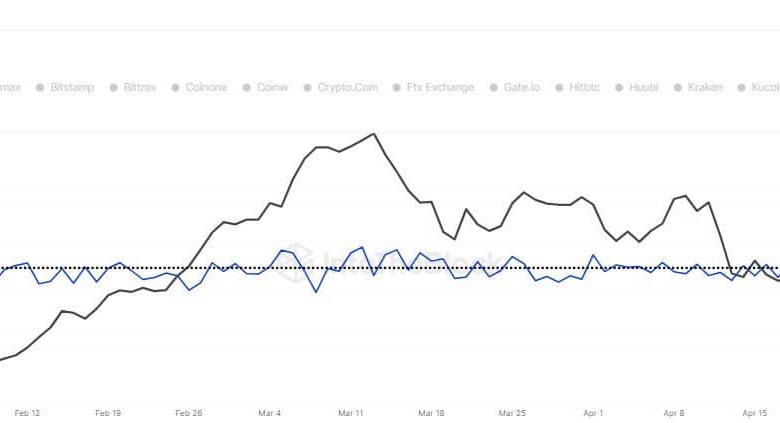

Nearly six months because it final hit the very best trade influx, Ethereum [ETH] is again in the identical scenario, sparking speculations that the value may swing decrease.

At press time, ETH’s worth was $3,874. Based on knowledge from IntoTheBlock, the trade influx was as excessive as 140,660 on the twenty fifth of Could.

Whereas the influx has not shed a lot, AMBCrypto’s deep-dive into the rabbit instructed that the bullish prediction may not come as quick as market contributors anticipated.

Supply: IntoTheBlock

Is a brand new low coming?

It is because the excessive circulate of cryptocurrencies into the trade is an indication of elevated promoting stress. As such, it may be difficult for Ethereum to hit a better worth except the stress slows down.

AMBCrypto’s investigation confirmed that the rise within the sale of the altcoin might be linked to its latest worth enhance. A couple of days in the past, ETH’s worth was over $3,900. This was a 16.82% rise within the final 30 days.

The approval of the Ethereum spot ETFs fueled this hike. However the asset was not buying and selling stay but. Nonetheless, many opinions instructed that ETH’s worth may rally previous $4,500 or hit $5,000 as soon as the ETFs go stay.

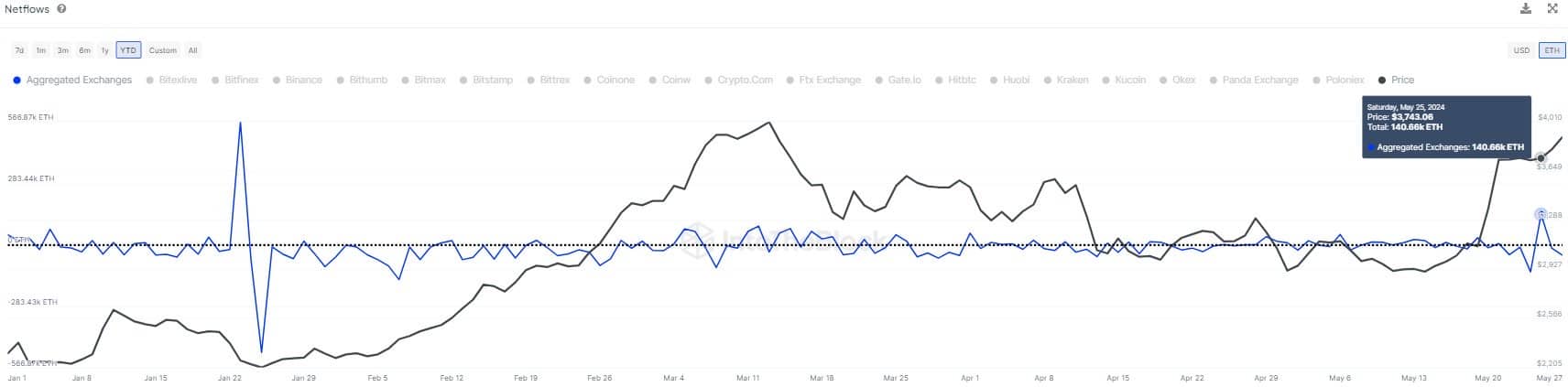

If promoting doesn’t cease by that point, this prediction may slip away from the heavyweight within the quick time period. To evaluate this, AMBCrypto checked out Ethereum’s Sharpe Ratio.

This ratio exhibits the risk-adjusted efficiency of an asset. If the studying of the Sharpe Ratio is damaging, it signifies that the asset concerned is producing unhealthy returns for holders.

Between 1 and 1.99 is taken into account an excellent risk-to-reward ratio. Ought to the studying rise above 3, it signifies that the cryptocurrency is providing good returns relative to the danger of funding.

Supply: Messari

Based on Messari, the metric hit a ceiling of three.62 on the twenty seventh of Could. However at press time, the ratio has declined to 2.98, indicating the returns have been no longer excellent however at a average tempo.

The bull section would possibly begin from $4,713

Ought to the studying proceed to fall, so will ETH’s worth. Nonetheless, the long-term potential of the cryptocurrency remained extraordinarily promising.

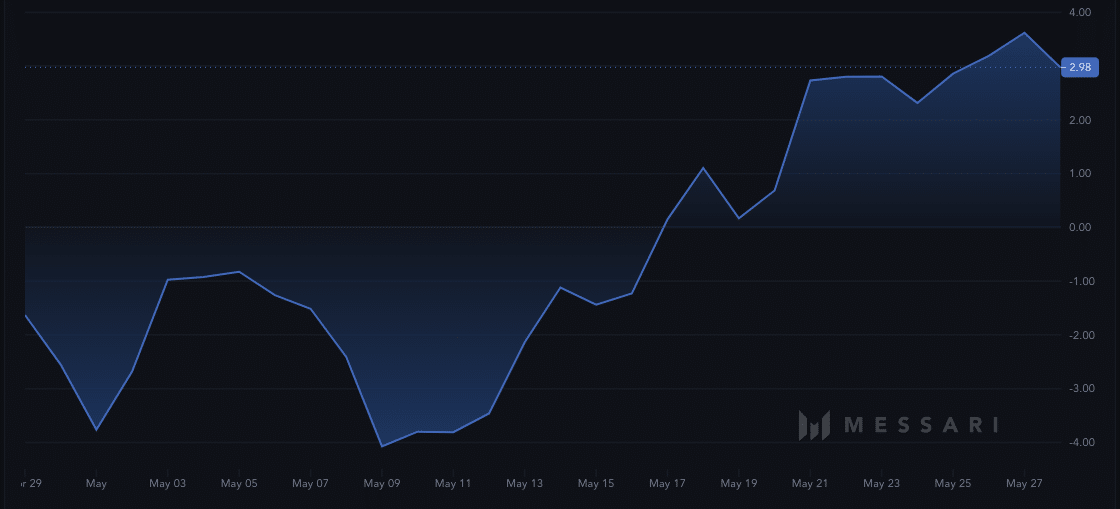

AMBCrypto gathered this after inspecting the Pi Cycle Prime indicator. This metric makes use of the 111-day Easy Transferring Common (SMA) and 350-day SMA to examine if costs have hit an overheated level.

For Ethereum, utilizing Glassnode’s knowledge, the 111 SMA (inexperienced) was beneath the 350 SMA (purple). This implies that the value has the potential to commerce increased.

Supply: Glassnode

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

Assuming a crossover of the shorter SMA over the longer one appeared, it could have spelled doom for ETH.

As well as, the indicator revealed that ETH’s worth may hit $4,713 as soon as the promoting stress fizzles out. Ought to this forecast come to cross, then the worth may try testing $5,000.