Will Ethereum’s low network utilization eclipse ETH’s rise? Gauging…

- The expansion within the variety of customers was not essentially driving community utilization for Ethereum.

- ETH’s alternate influx hit its highest worth because the Merge on 2 Could.

Customers within the crypto area confirmed vital curiosity in Ethereum [ETH] over the previous few months, as evidenced by a progress in each its consumer base and the demand for its blockspace.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Nonetheless, the expansion within the variety of customers was not essentially driving community utilization. Analyst ali_charts highlighted that the month-to-month common of each day energetic addresses on the biggest proof-of-stake (PoS) community was beneath the yearly common for many elements of 2023.

#Ethereum | Elevated energetic customers, transaction quantity, and blockspace demand point out wholesome $ETH community adoption.

Nonetheless, the month-to-month common of energetic #ETH addresses has been rejected by the yearly common, suggesting weak community fundamentals and diminished utilization. pic.twitter.com/c5Lsl7hhmf

— Ali (@ali_charts) May 1, 2023

All quiet on ETH’s entrance?

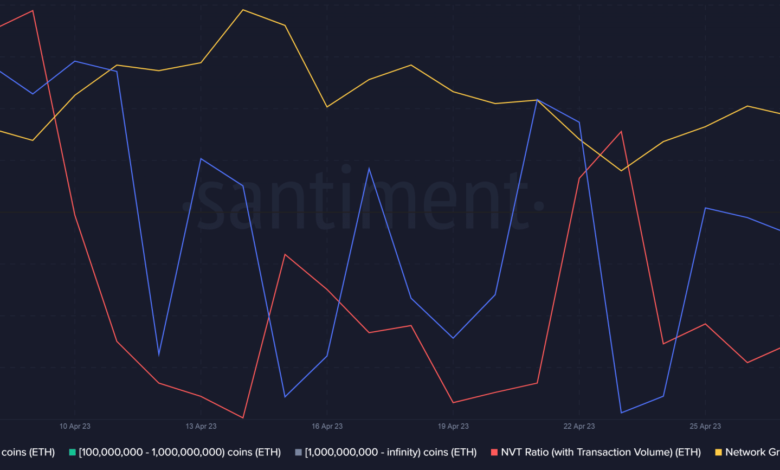

One of the crucial highly effective measures of a blockchain’s utilization is the Community Worth-to-Transaction (NVT) ratio. In response to Santiment, Ethereum’s NVT Ratio spiked in the previous few days. This implied that the community’s market cap had outpaced on-chain community exercise.

Furthermore, the variety of new energetic addresses getting created on the chain tumbled, considerably impeding community progress. The speed indicator, which reveals how ceaselessly ETH tokens change addresses each day, confirmed a decline after an uptick was seen earlier. This strengthened that transaction exercise was muted on Ethereum.

Supply: Santiment

Ominous indicators or…

Whereas issues round community utilization rose, one other intriguing growth caught the attention of crypto watchers. Santiment took to Twitter to focus on that 2 Could noticed one of many largest self-custody to alternate transfers within the final 5 years, with a $505 million switch of ETH tokens into Binance. Consequently, ETH’s alternate influx hit its highest worth because the Merge, which occurred on September 2022.

Nonetheless, the most recent development might additionally sign their rising belief in centralized exchanges, which hit all-time low following FTX‘s collapse in November final yr.

🐳 With a $505M switch of #Ethereum tokens on to #Binance in the present day, this is likely one of the largest self custody to alternate transfers in 5 years. It additionally spiked the $ETH community to its largest each day alternate provide improve because the day earlier than the #merge. https://t.co/FTFNugMg16 https://t.co/FMfHl3V3zB pic.twitter.com/HAmtunceln

— Santiment (@santimentfeed) May 1, 2023

Life like or not, right here’s ETH’s market cap in BTC’s phrases

So far as demand for ETH futures was involved, the nominal worth of Open Interest (OI) stayed flat over the previous few days, signifying sluggish speculative curiosity for the second-largest altcoin by marketcap.

Nonetheless, the funding charges throughout most exchanges have been constructive, which mirrored the dominance of long-term merchants. At press time, ETH was valued at $1,830, down practically 1% within the final 24 hours.

Supply: Coinglass