777,000 Ethereum moved post-ETF approval: Impact on ETH?

- Ethereum’s worth had dropped by over 2% within the final seven days

- A metric indicated that ETH was overvalued

Ethereum [ETH] created a lot buzz within the crypto house when the US Securities and Alternate Fee gave approval to ETH ETFs. Although ETH’s worth didn’t flip bullish after the approval, issues may change within the coming days.

Is shopping for stress excessive?

Earlier than ETFs obtained approval, there was a lot anticipation and hype round it. Throughout that point, ETH’s worth motion additionally turned risky in a northward course.

Nonetheless, after the proposal was handed, issues cooled down. The truth is, Ethereum has struggled over the previous couple of days.

Based on CoinMarketCap, ETH was down by greater than 2% within the final seven days. On the time of writing, the king of altcoins was buying and selling at $3,814.82 with a market capitalization of over $458 billion.

Within the meantime, Ali, a well-liked crypto analyst, not too long ago posted a tweet highlighting an fascinating improvement.

As per the tweet, roughly 777,000 ETH, which was valued at about $3 billion, have been withdrawn from crypto exchanges because the ETF approval. This indicated excessive shopping for stress, which could even have a optimistic impression on the token’s worth.

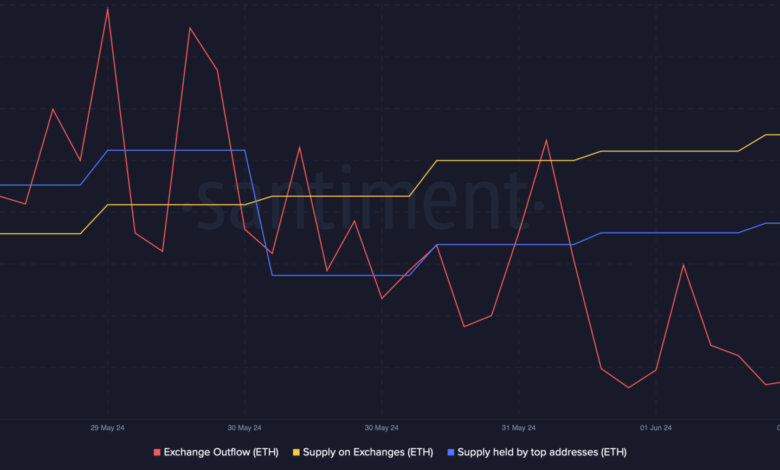

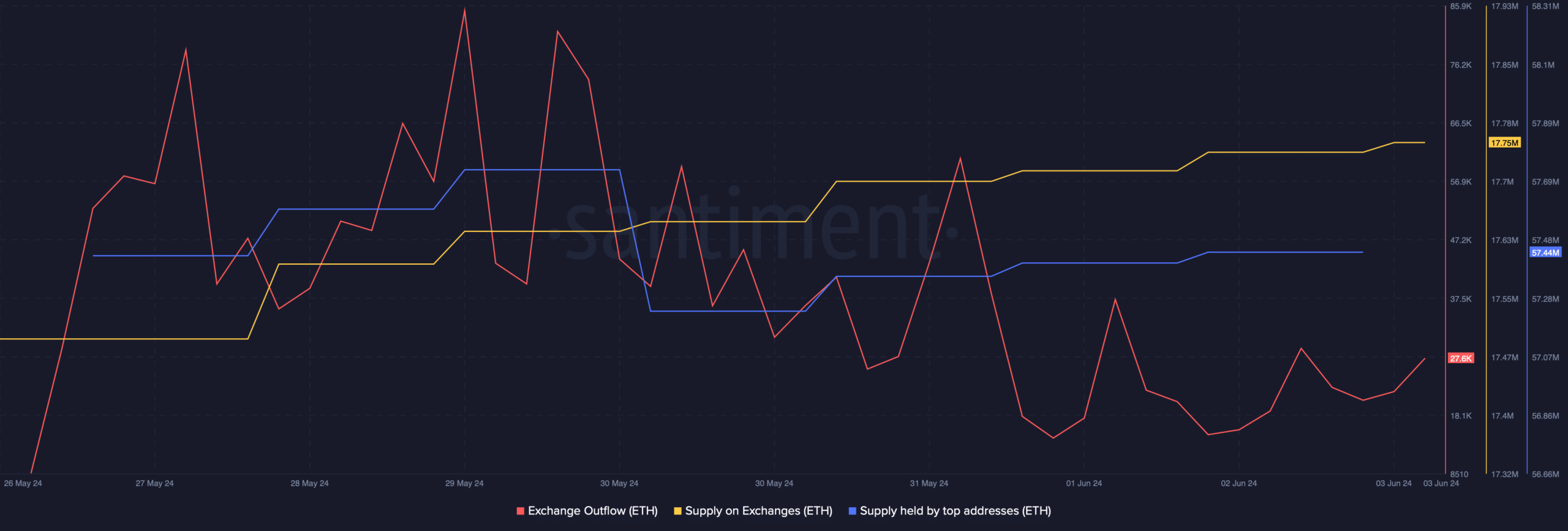

Due to this fact, AMBCrypto analyzed its on-chain metrics to see whether or not shopping for stress was really excessive. AMBCrypto’s evaluation of Santiment’s knowledge revealed that Ethereum’s alternate outflow dropped final week.

Its provide on exchanges elevated, which means that traders had been slightly promoting ETH.

On high of that, the token’s provide held by high addresses additionally dropped barely final week. This meant that whales had been additionally promoting ETH because it struggled to the touch $4k.

Supply: Santiment

Wanting ahead

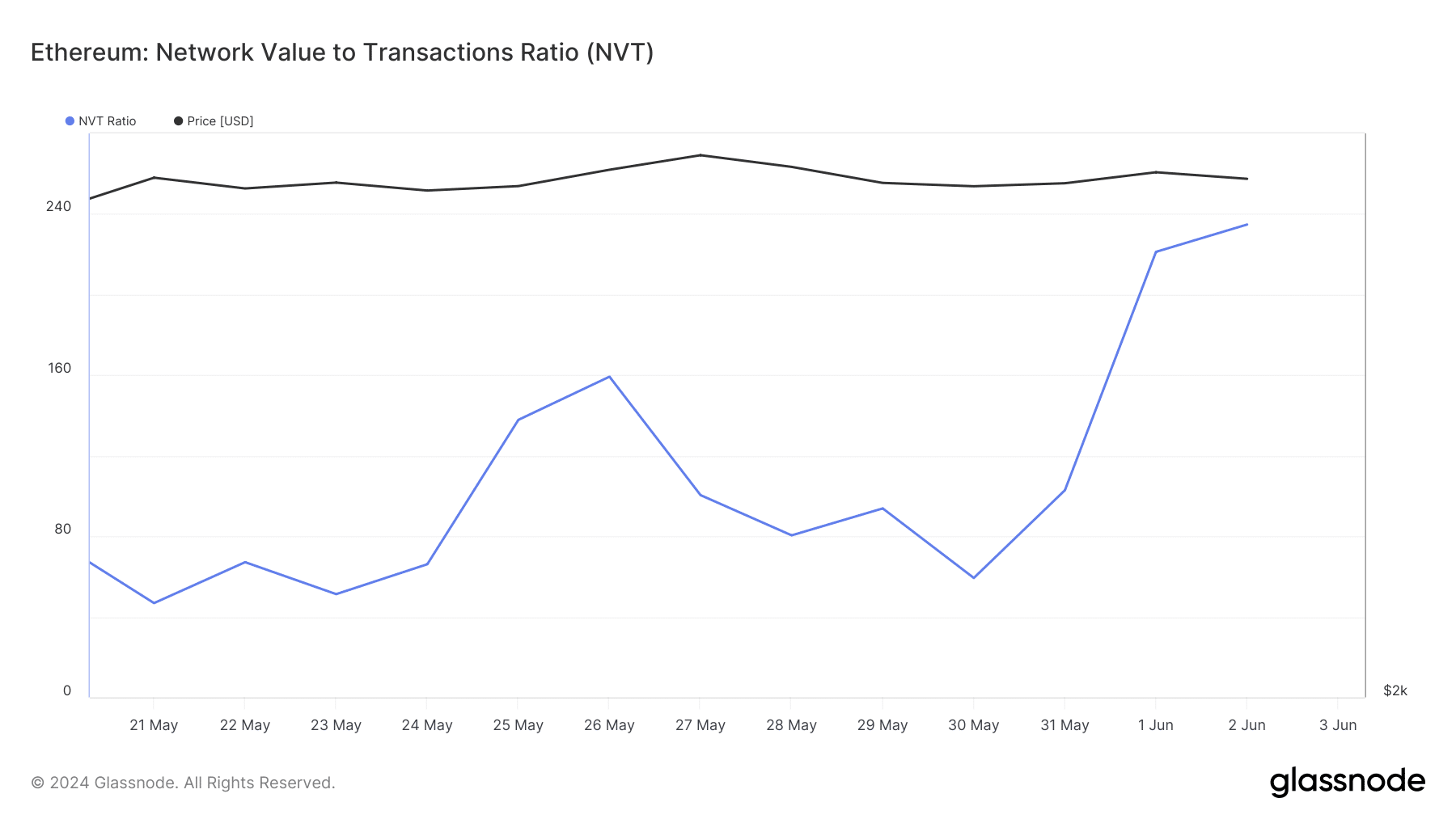

Whereas promoting stress elevated, a key metric turned bearish on the token. Our evaluation of Glassnode’s knowledge revealed that Ethereum’s NVT ratio registered a pointy uptick on the first of June.

For starters, the metric is computed by dividing the market cap by the transferred on-chain quantity measured in USD.

At any time when the metric rises, it signifies that an asset is overvalued. This recommended that the possibilities of a worth correction had been excessive.

Supply: Glassnode

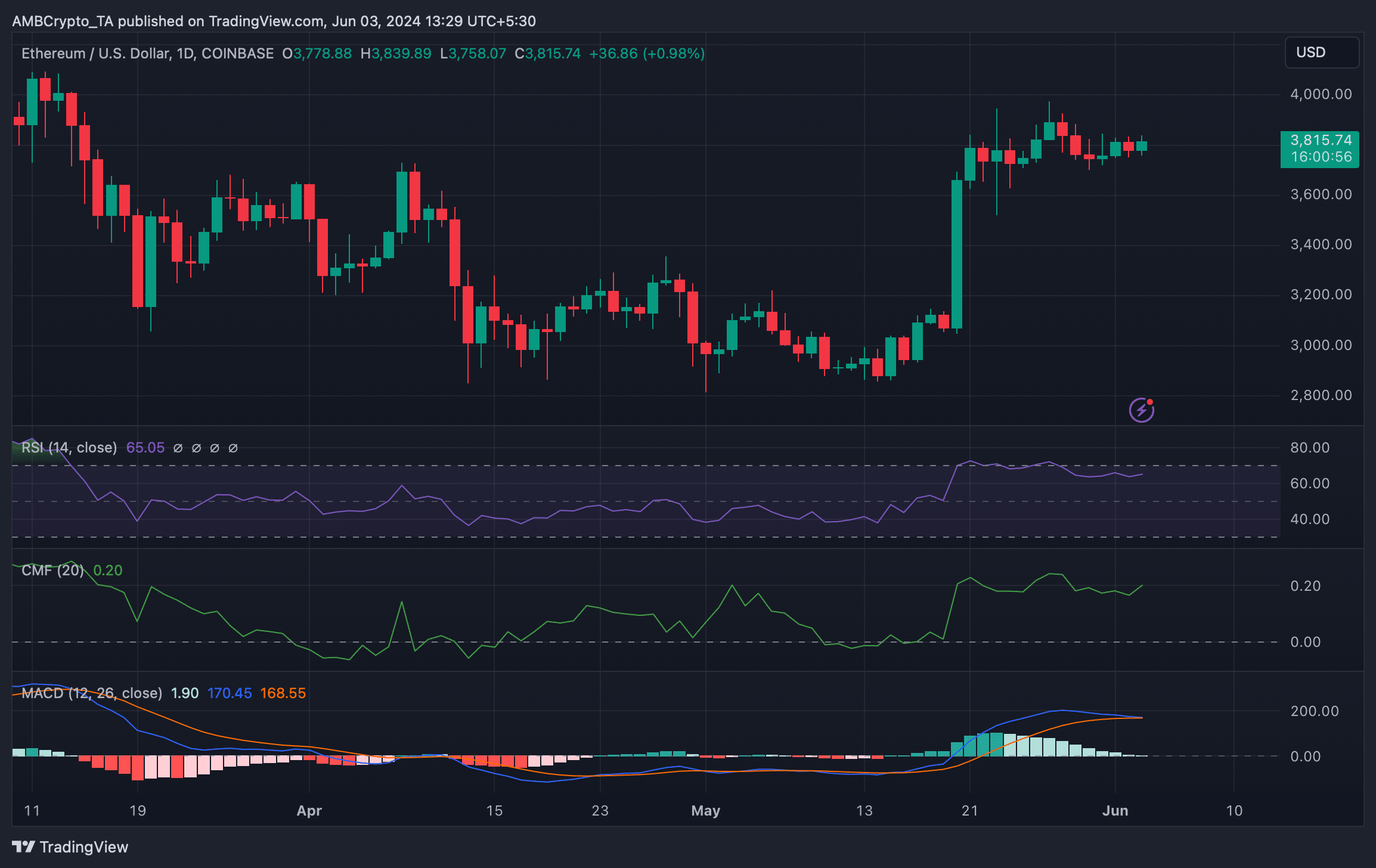

We then analyzed Ethereum’s every day chart to raised perceive which approach it was headed. The technical indicator MACD displayed a bearish crossover, hinting at a worth correction.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Nonetheless, the Chaikin Cash Circulation (CMF) had registered an uptick.

Furthermore, the Relative Power Index (RSI) additionally regarded bullish, because it was effectively above the impartial mark. If these two indicators’ knowledge is to be thought of, then there are possibilities of a worth enhance.

Supply: TradingView