Uniswap decouples from Ethereum: Will UNI hold onto $9?

- Trade provide for UNI enhance whereas it dropped on Ethereum’s community.

- A declining sentiment, set off by reducing demand, indicated that ETH might slide to $9.20 within the quick time period.

For the final seven days, Uniswap’s [UNI] value and Ethereum [ETH] have failed to maneuver in the identical path. At press time, UNI modified fingers at $9.98, representing a 2.22% enhance within the final seven days.

ETH’s value, then again, was $3,687. This was a 2.56% lower inside the similar interval. Nonetheless, that isn’t the main problem at hand.

One thing AMBCrypto noticed utilizing on-chain information from Glassnode was that the tides might quickly change.

The correlation goes off

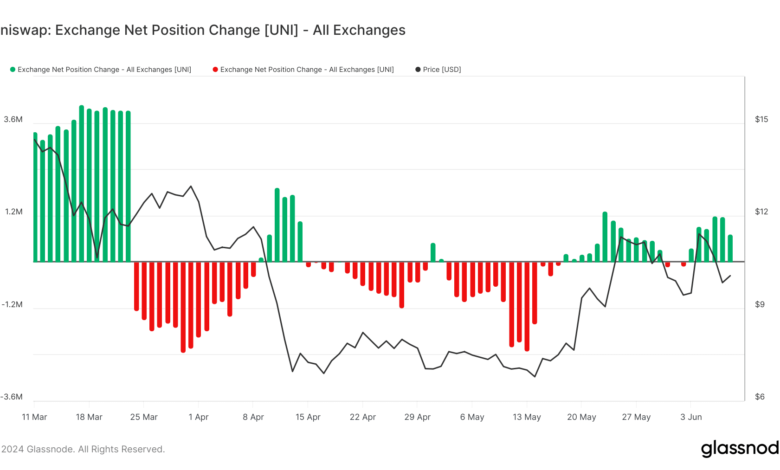

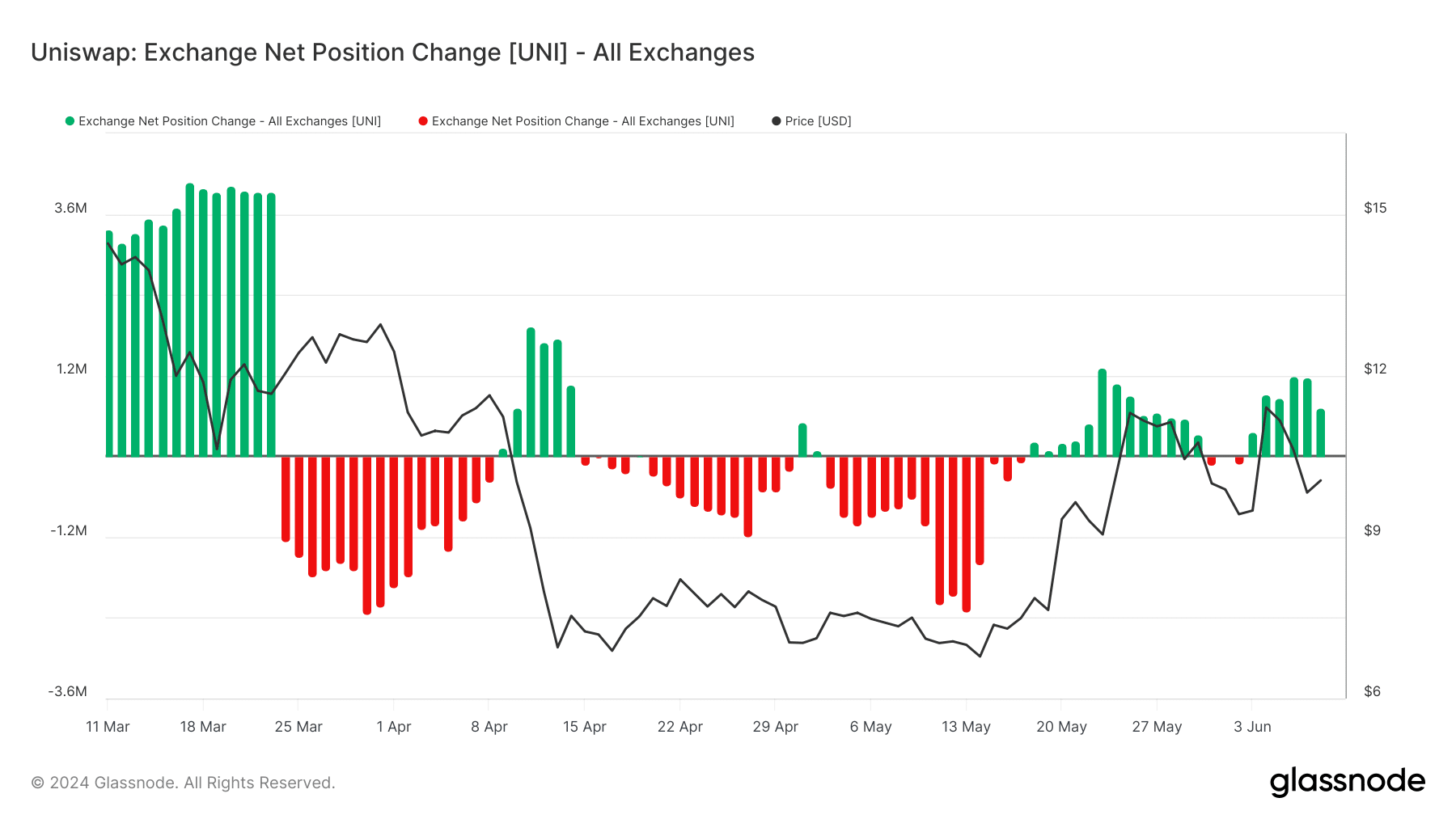

Proof of this was mirrored within the Trade Internet Place Change. In keeping with our evaluation, Uniswap’s Trade Internet Place Change was 733,683 on the eighth of June.

This metric is the full provide of tokens held in trade wallets. Whether it is constructive, it implies that extra tokens are going into exchanges, and this might result in a value lower.

Nonetheless, a adverse studying suggests a surge in withdrawals, which might decrease promoting stress. For UNI, the variety of tokens held on exchanges has been growing for the reason that third of June.

Supply: Glassnode

Due to this fact, there’s a excessive probability that the value of the token might lose maintain on the $9 area if the provision stays constructive. Nonetheless, it was a special ball sport for Ethereum.

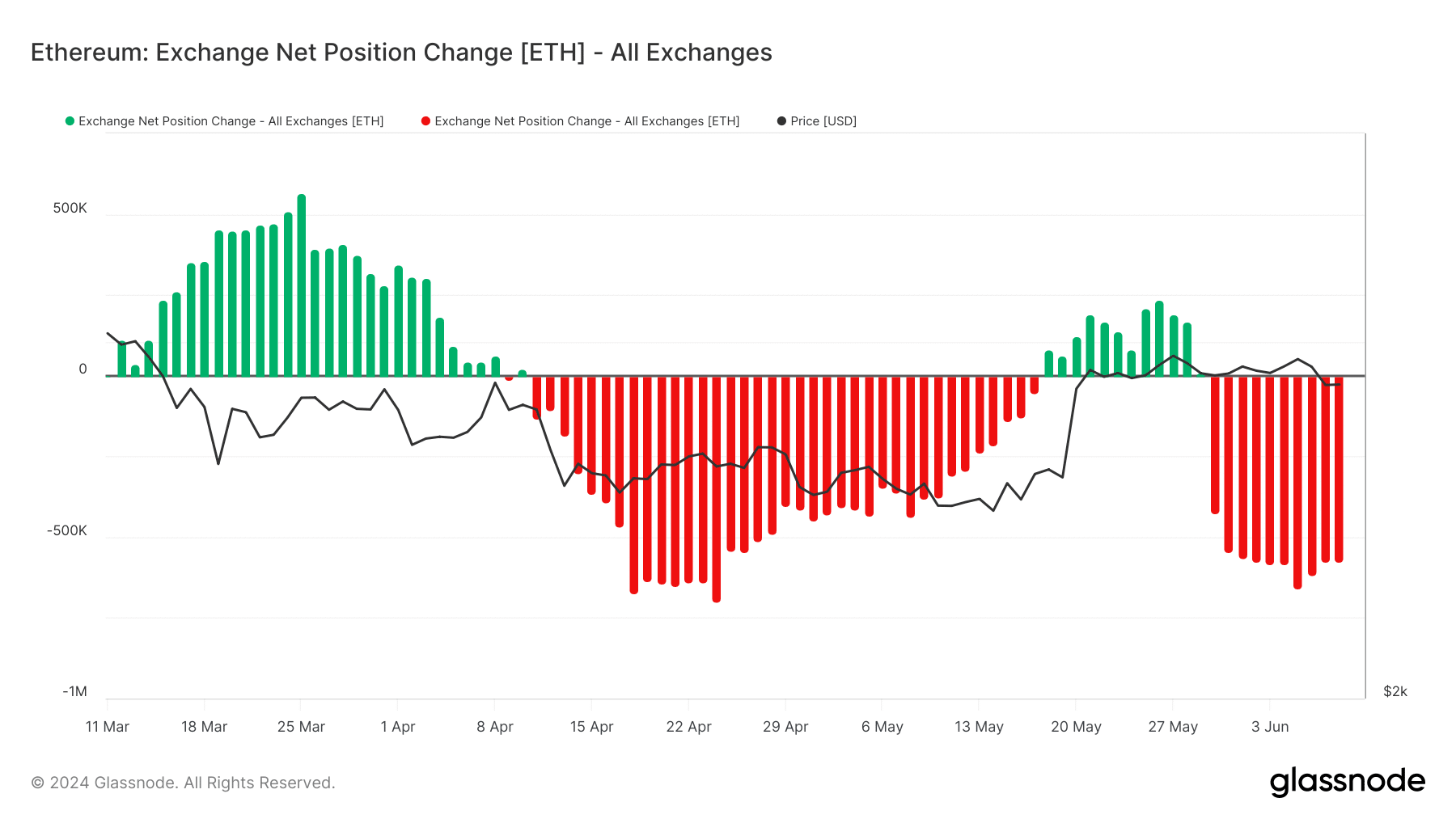

An analysis of the identical metric with ETH indicated a rise in cash taken ofd exchanges. In keeping with Glassnode, about 576,851 ETH was withdrawn from exchanges on the identical day 733,683 UNI tokens flowed in.

Supply: Glassnode

UNI is ready to fall additional

Due to this fact, it’s doable to see the value of UNI fall whereas ETH may very well be in line for a swift restoration.

If validated, this may very well be opposite to the value efficiency of the cryptocurrencies when the U.S. SEC accepted spot Ethereum ETFs.

Within the build-up to the announcement, ETH’s value jumped, and UNI’s reference to the blockchain ensured it adopted in the identical path. However how low can UNI go this time?

To test the doable targets, AMBCrypto analyzed the Weighted Sentiment, which reveals the notion market members have round a venture. At press time, the Weighted Sentiment was -0.173.

This adverse studying suggests that almost all feedback about Uniswap tilted towards the bearish facet of issues. Thus, demand for the token might drop, and will trigger a value lower.

As well as, the Market Worth to Realized Worth (MVRV) Z Rating which was 27% a couple of days in the past was all the way down to 23.58%. When the MVRV Z Rating is constructive, it implies that the token is in a bull section.

Supply: Santiment

Practical or not, right here’s UNI’s market cap in ETH phrases

Then again, a adverse ratio suggests {that a} fall into the bear cycle. Nonetheless, the latest lower doesn’t imply that UNI is dropping right into a bear section. However it’s a signal that the value might slip down the charts.

By the look of issues, a drawdown to $9.20 appears fairly doable.