More Ethereum investors start to sell: What should you know?

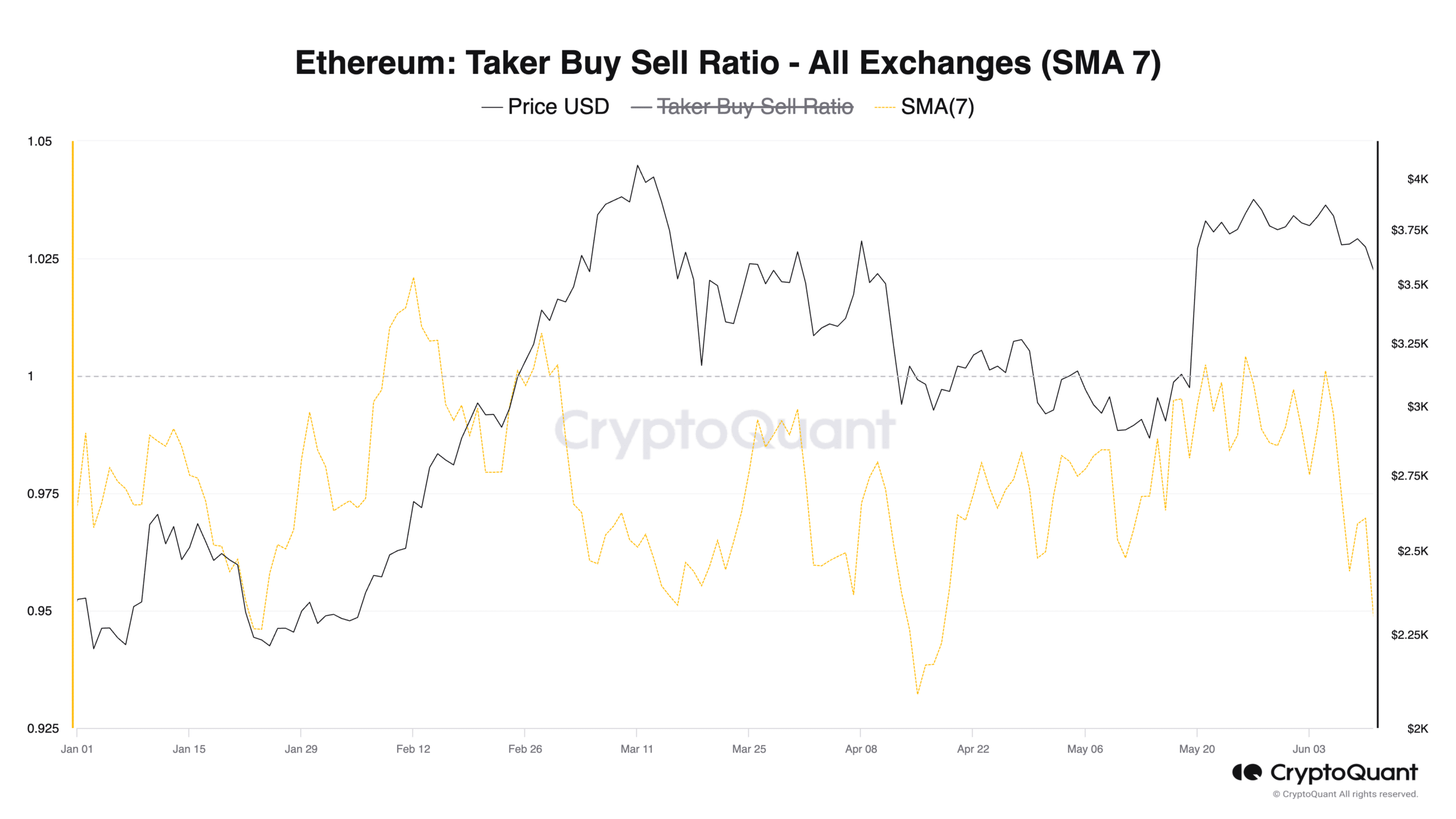

- Ethereum’s Taker Purchase Promote Ratio has remained under 1 for the reason that fifth of June.

- This implies there may be extra promote quantity than purchase quantity in its Futures market.

Ethereum’s [ETH] Taker Purchase Promote Ratio, assessed utilizing a seven-day easy shifting common (SMA), has trended downward for the reason that fifth of June, knowledge from CryptoQuant has proven.

In response to the on-chain knowledge supplier, the metric has returned values lower than one since then. As of this writing, ETH’s Taker Purchase Promote Ratio was 0.96.

Supply: CryptoQuant

An asset’s Taker Purchase Promote Ratio measures the ratio between its purchase and promote volumes within the Futures market. A worth better than 1 signifies extra purchase quantity, whereas a worth lower than 1 signifies extra promote quantity.

When the worth of this metric declines on this method, it means that the Futures marketplace for the asset in query has seen extra promote orders than purchase orders.

In a latest report, pseudonymous CryptoQuant analyst ShayanBTC commented on the affect of this on ETH’s worth. In response to ShayanBTC,

“This pattern suggests that the majority futures merchants have been promoting Ethereum aggressively, both for speculative functions or to comprehend income. This important drop within the metric is a bearish sign, suggesting that the present downward retracement may persist if this pattern continues.”

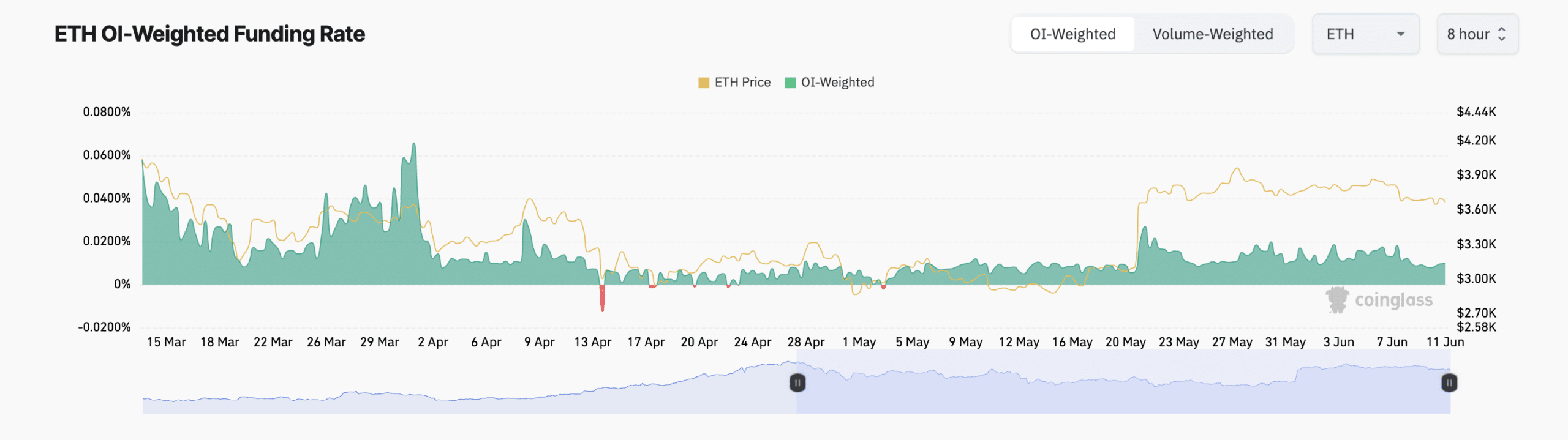

ETH Funding Charge stays optimistic

The transient decline in ETH’s Futures Open Curiosity, for the reason that fifth of June, confirmed the place above.

At press time, ETH’s Futures Open Curiosity was $16.37 billion, having declined by 2% since then, based on Coinglass knowledge.

The coin’s Futures Open Curiosity measures the entire variety of excellent Futures contracts or positions that haven’t been closed or settled.

When it drops this manner, it means that some Futures merchants are closing their positions with out opening new ones. That is usually seen as a shift in sentiment from bullish to bearish.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Nevertheless, regardless of some market individuals’ bearish bias towards the coin, nearly all of ETH’s Futures merchants have opened positions in favor of continued worth development.

That is based mostly on the readings from the coin’s Funding Charge, which has returned solely optimistic values for the reason that third of Might, per Coinglass knowledge.

Supply: Coinglass

Funding Charges are utilized in perpetual Futures contracts to make sure the contract worth stays near the spot worth. When it’s optimistic, it suggests a big demand for lengthy positions.