Assessing Fed rate cut odds and its impact on Bitcoin

- The CME FedWatch Software has indicated a low likelihood of a lower.

- Senator Warren’s letter hinted at Bitcoin’s bullish scenario.

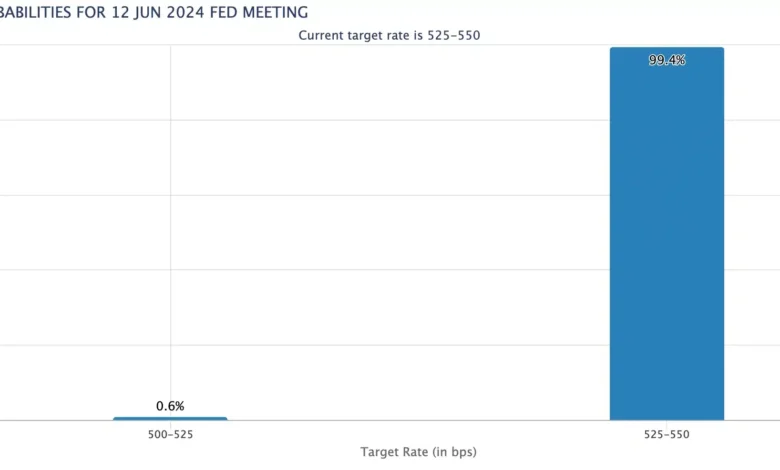

With the Federal Open Market Committee (FOMC) assembly scheduled for the twelfth of June, the crypto neighborhood is abuzz with hypothesis about its impact on market dynamics.

Present indications counsel that rates of interest will doubtless stay unchanged. In reality, the CME FedWatch Tool indicated at a mere 0.6% likelihood of a quarter-point fee lower on the assembly.

Supply: CME FedWatch Software

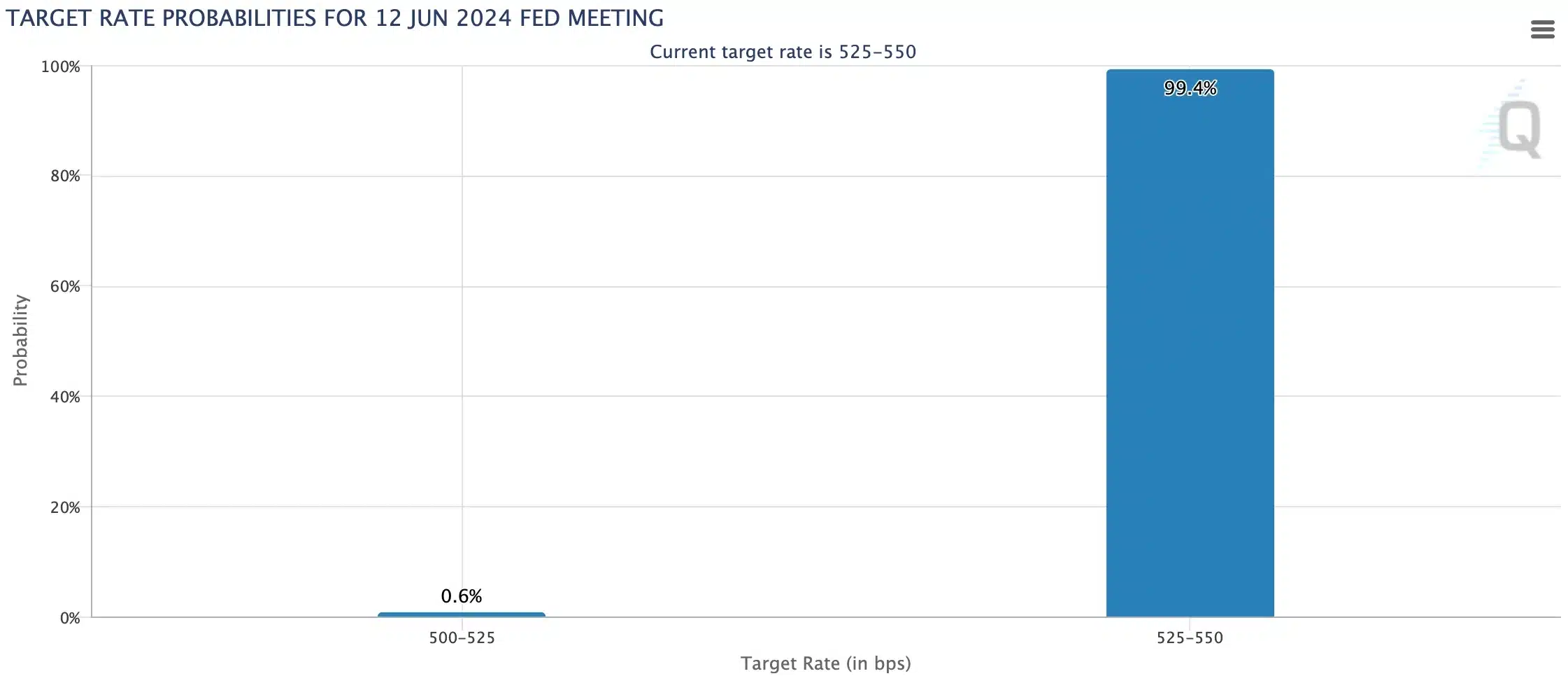

In different information, Senator Elizabeth Warren wrote a letter to Federal Reserve Chair Jerome Powell on the tenth of June, urging for rate of interest cuts. The letter urged,

Supply: Warren.senate.gov

Impression on the crypto market

In keeping with CoinMarketCap, the worldwide crypto market was down by 0.45% during the last day on the time of writing, reflecting FUD (Worry, Uncertainty, and Doubt).

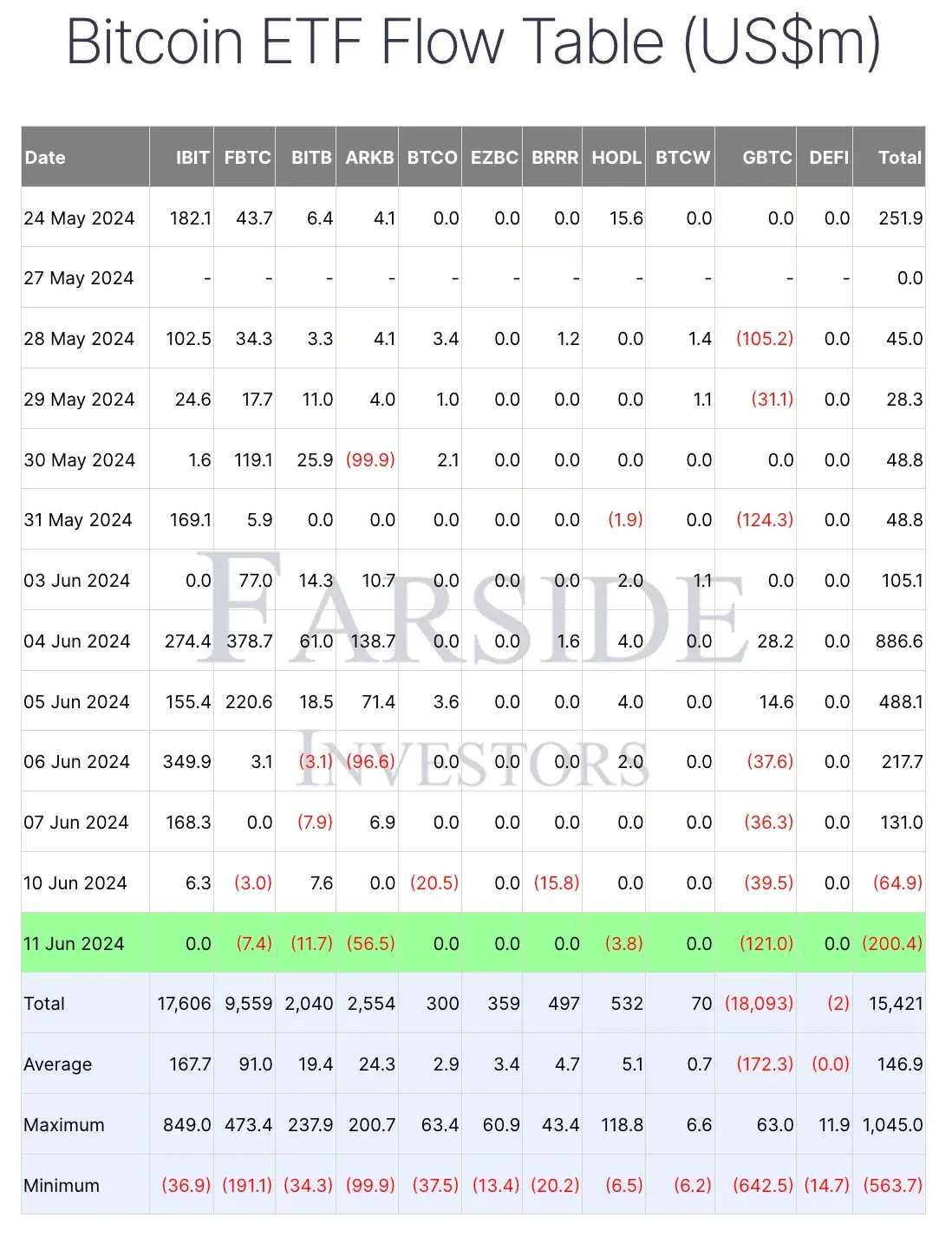

Furthermore, on the eleventh of June, Bitcoin [BTC] spot exchange-traded funds (ETFs) skilled important outflows of $200.4 million, with Grayscale Bitcoin Belief ETF (GBTC) main the pack as per Farside Investors.

Supply: Farside Traders

Right here, it’s necessary to notice that fee cuts usually result in bullish momentum for risk-on property like Bitcoin and cryptocurrency. So, Senator Warren’s attraction might find yourself serving to Bitcoin and the crypto market usually.

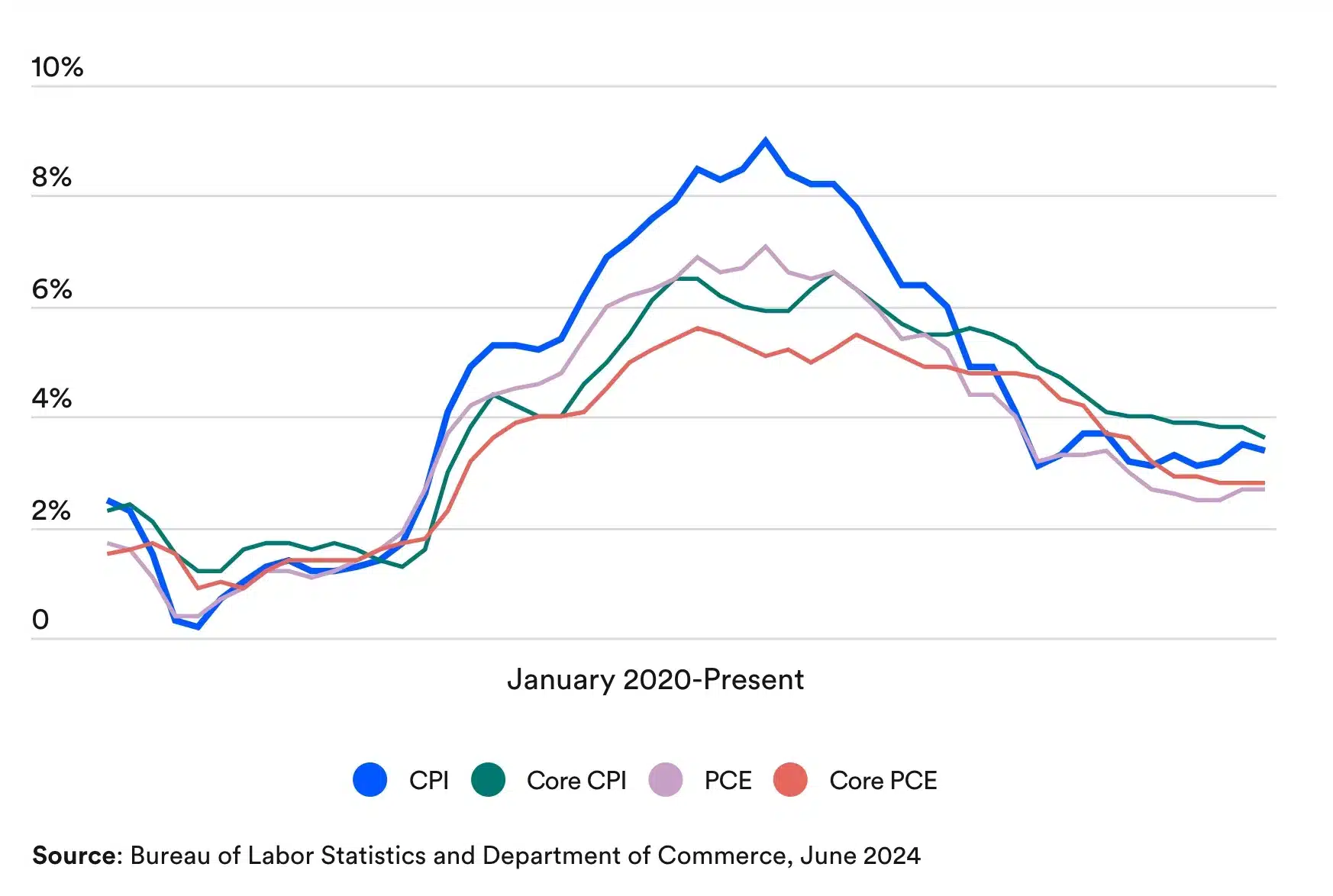

Inflation stays sticky

For sure, the inflation fee within the US has been a matter of concern for fairly a while.

In keeping with the Bureau of Labor Statistics and the Division of Commerce, the Federal Reserve’s most popular inflation measure, the Private Consumption Expenditures (PCE) index, has proven quicker enchancment in comparison with the Client Worth Index (CPI).

Nonetheless, each indicators point out persistent inflation.

Supply: Bureau of Labor Statistics and Division of Commerce

Optimism persists

Regardless of considerations, Michaël van de Poppe took to X (previously Twitter) and famous,

“It’s necessary to notice that value motion could be trappy. If the speed choice is unchanged, the markets might need an preliminary response downwards, however normally, the true transfer occurs at a later level.”

Additional elaborating on his viewpoint, he mentioned,

“Bitcoin rallied by greater than ten % after earlier FOMC occasions. Ethereum rallied by greater than twenty % after earlier FOMC occasions. Each of them corrected by the identical quantity earlier than the occasion, so a repricing again upwards appears affordable to count on.”

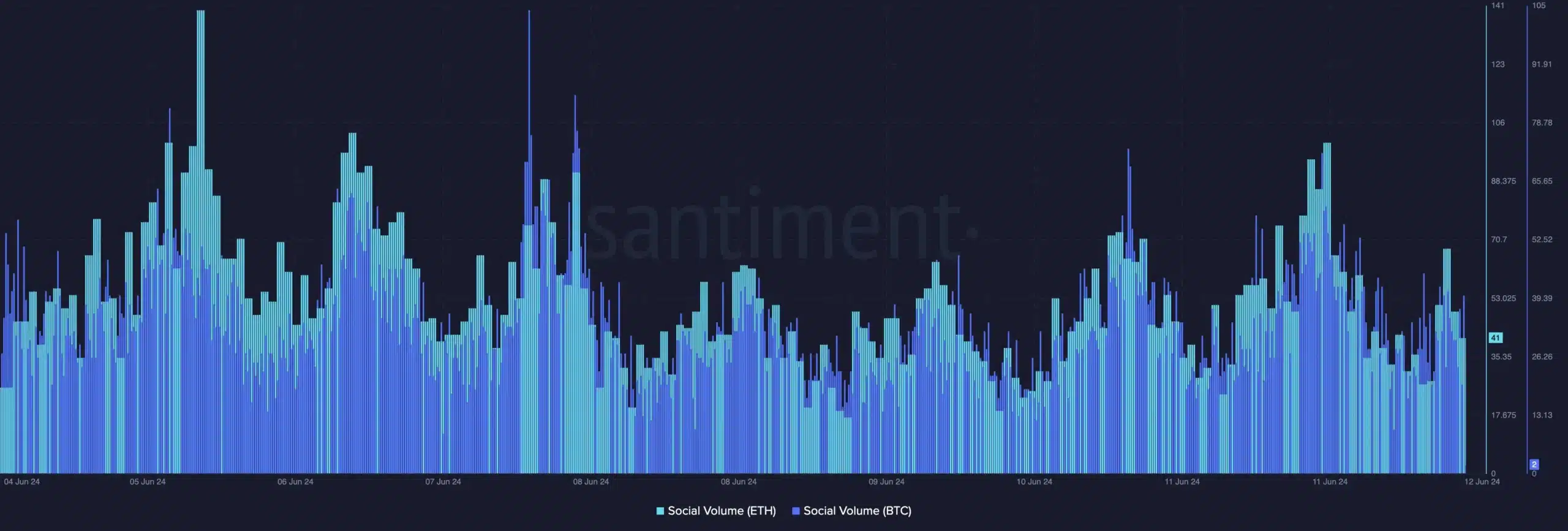

AMBCrypto’s evaluation of Santiment information additional confirmed this, revealing a major spike in social quantity for Bitcoin and Ethereum [ETH].

Supply: Santiment

Therefore, as everybody waits for the Fed’s choice on rates of interest, it will be attention-grabbing to see if historical past would repeat itself or if the market will undergo the influence of the FOMC assembly.