Why Ethereum saw long liquidations worth $62M in 24 hours

- ETH’s lengthy merchants have witnessed vital liquidations previously 24 hours.

- The coin’s choices quantity and Open Curiosity have additionally declined.

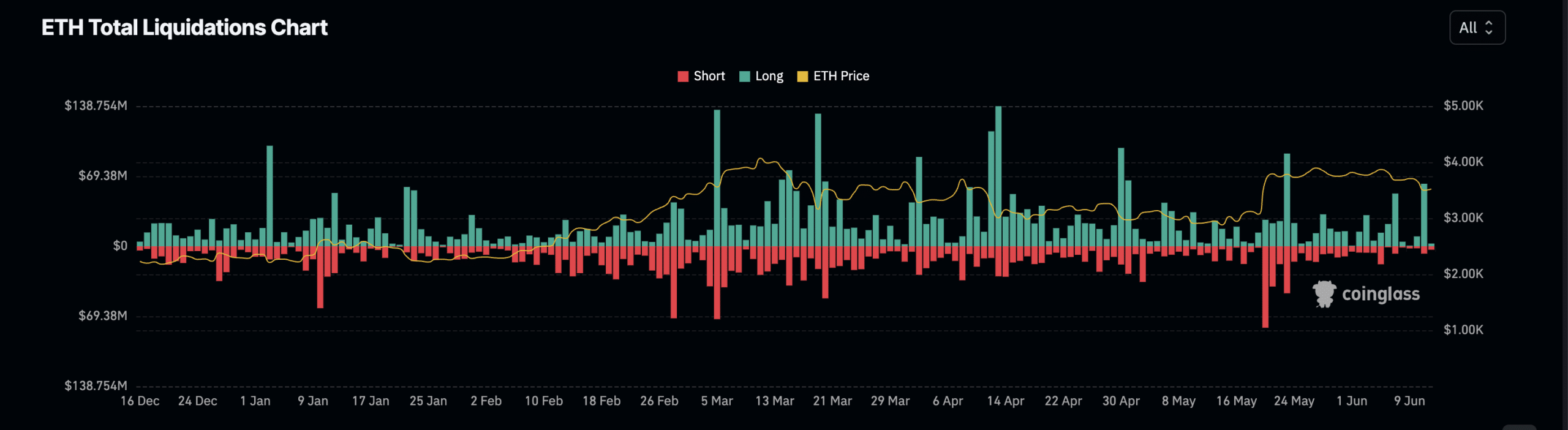

Ethereum [ETH] witnessed a spike in lengthy liquidations on the eleventh of June, in response to Coinglass.

Data from the derivatives market information supplier confirmed that the altcoin’s lengthy liquidations on that day represented its highest because the twenty third of Might.

Supply: Coinglass

In an asset’s derivatives market, liquidations occur when a dealer’s place is forcefully closed attributable to inadequate funds to take care of it.

Lengthy liquidations occur when an asset’s worth drops unexpectedly, forcing merchants with open positions in favor of a value rally to exit.

On the eleventh of June, ETH lengthy liquidations totaled $62 million, whereas brief liquidations amounted to $7.3 million.

Decline in ETH’s derivatives market

The previous 24 hours have been marked by a decline in ETH’s derivatives market exercise. For instance, the full quantity of trades executed within the altcoin’s choices market has dropped by 52%.

Throughout that interval, choices buying and selling quantity totaled $321 million.

A decline in an choices buying and selling quantity suggests fewer contributors are shopping for or promoting choices.

At any time when fewer trades are accomplished in an asset’s choices market, it turns into much less liquid. This typically leads to wider bid-ask spreads, making it probably harder for contributors to execute trades at desired costs.

As well as, the coin’s Open Curiosity has additionally dropped. At $15.73 billion at press time, it has fallen by 2% through the interval below evaluate.

An asset’s Open Curiosity measures the full variety of excellent contracts or positions that haven’t been closed or settled. When it declines, extra merchants exit their positions with out opening new ones.

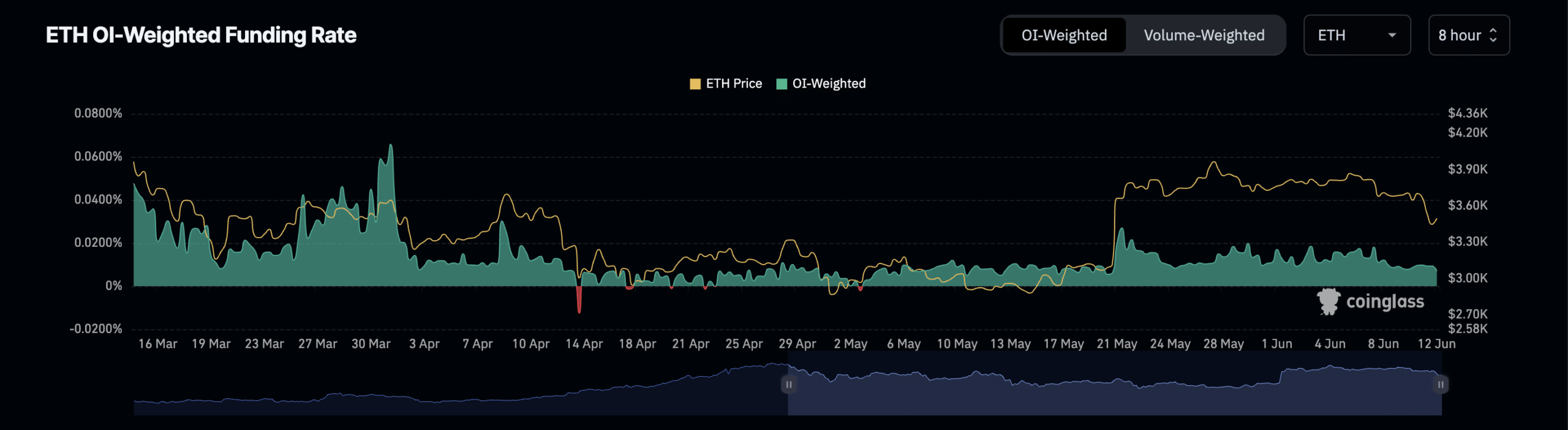

Nevertheless, regardless of ETH’s value decline previously 24 hours, the following lengthy liquidations, and a drop in choices quantity and Open Curiosity, its Funding Charge throughout cryptocurrency exchanges has remained constructive.

At press time, the coin’s Funding Charge was 0.0069%. For context, the final time ETH’s Funding Charge was detrimental was on the third of Might.

Supply: Coinglass

Funding Charges are utilized in perpetual futures contracts to make sure the contract value stays near the spot value.

Learn Ethereum’s [ETH] Value Prediction 2024-25

When an asset’s Funding Charge is constructive, it suggests a robust demand for lengthy positions.

This implies extra merchants are shopping for the coin anticipating to promote it at the next value than these buying it in anticipation of a value decline.