Ethereum Open Interest gains by $1B – Impact on ETH?

- Whereas Open Curiosity elevated, Funding Charge stalled.

- The value of the altcoin would possibly hold swinging between $3,400 and $3,600 within the quick time period.

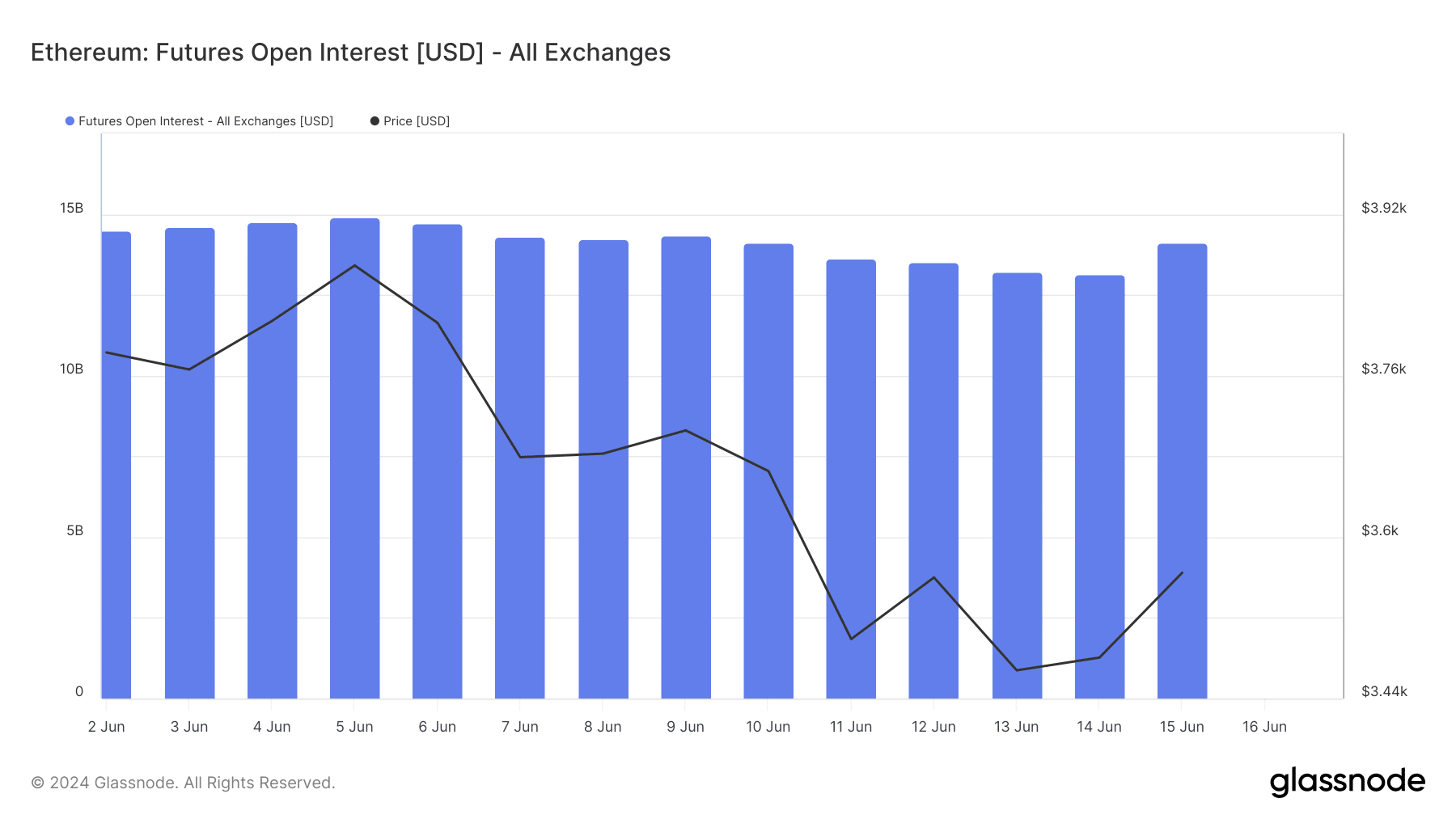

At some point after Ethereum’s [ETH] Open Curiosity dropped to $13.14 billion, it added one other billion to its worth. At press time, the Open Curiosity (OI) was $14.10 billion, in accordance with knowledge from Glassnode.

OI is the worth of excellent futures contracts available in the market. At any time when it decreases, it implies that merchants are closing positions associated to the cryptocurrency. Nonetheless, a rise suggests in any other case.

Hypothesis is a ticket to a brand new excessive

Thus, the rise in Ethereum contracts signifies increased speculative activity relating to the altcoin. In lots of cases, a rise in OI presents power to the worth route.

For ETH, it won’t be completely different. As of this writing, ETH modified arms at $3,563, representing a slight 1.10% enhance throughout the final hour.

By the look of issues, this may very well be the beginning of a big uptrend for the cryptocurrency.

Supply: Glassnode

Nonetheless, the buying and selling quantity had decreased by 35.36% within the final 24 hours. The decline in buying and selling quantity is an indication that exercise involving ETH was decrease within the spot market.

If spot market exercise continues to drop whereas buying and selling within the derivatives market will increase, ETH’s value would possibly stall across the $3,500 to $3,600 area.

But when shopping for strain within the spot market will increase, the altcoin would possibly leap within the $3,800 route.

Skepticism lingers

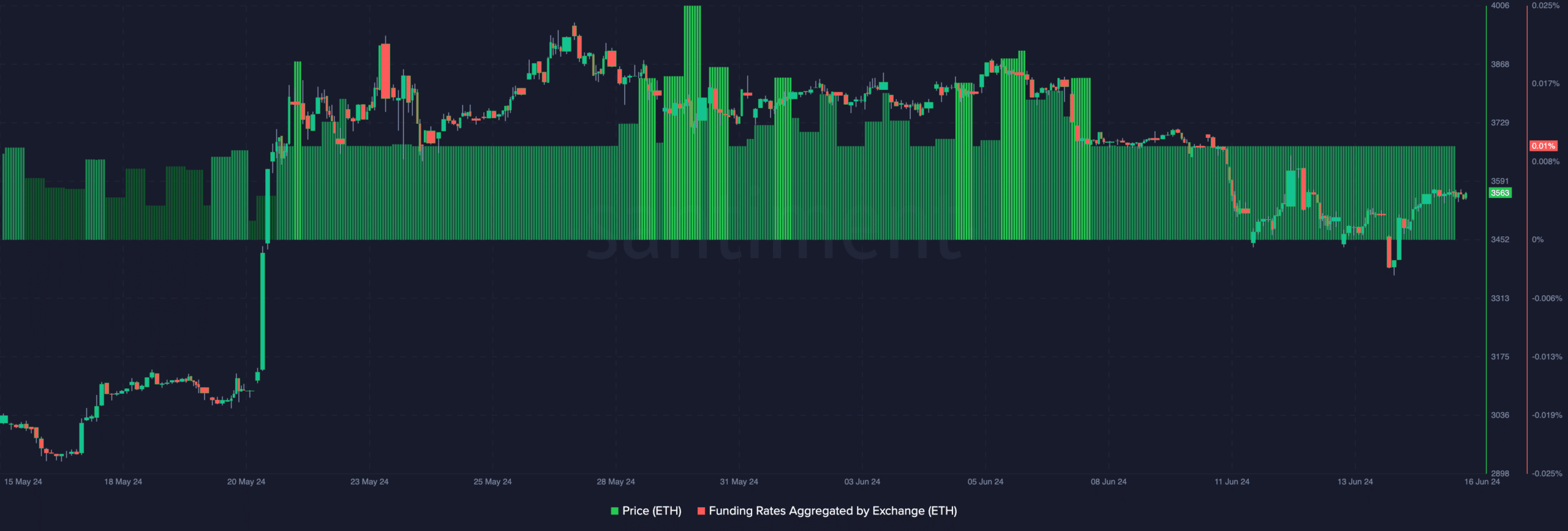

Regardless of the outlook, Ethereum’s Funding Charge has remained stagnant for the reason that eighth of June. Funding Charge is the price of holding an open place within the derivatives market.

If funding is optimistic, it means the contract value is buying and selling at a premium to the spot value. In a state of affairs like this, longs pay quick to maintain their positions open.

Then again, a destructive funding implies that shorts are paying longs. Additionally, the contract worth of the cryptocurrency is at a reduction.

For ETH, the low Funding Charge and excessive value means that spot quantity would possibly quickly start to choose up.

If so, the affordable inference may very well be a bullish transfer for Ethereum. Nonetheless, the worth of the cryptocurrency would possibly fail to hit $4,000 within the coming week.

Supply: Santiment

As well as, AMBCrypto regarded on the Taker Promote Ratio. To get this ratio, we have to divide the promote quantity by the entire perpetual swaps.

When the ratio is decrease than 0.5, it implies that promoting strain has decreased. Nonetheless, a price increased than 0.5 point out the selling is dominant available in the market.

Practical or not, right here’s ETH’s market cap in BTC phrases

As of this writing, Ethereum’s Taker Promote Ratio was 0.50, in accordance with knowledge from CryptoQuant. If the situation stays the identical, ETH’s value would possibly battle to shut in on $4,000 as talked about earlier.

Within the coming week, the worth of the cryptocurrency would possibly commerce between $3,400 and $3,600 because it did in earlier weeks.