Ethereum: Is $4k close as SEC changes its stance on ETH?

- Ethereum reputation elevated materially in response to latest knowledge.

- Staking participation was on the rise as costs remained steady.

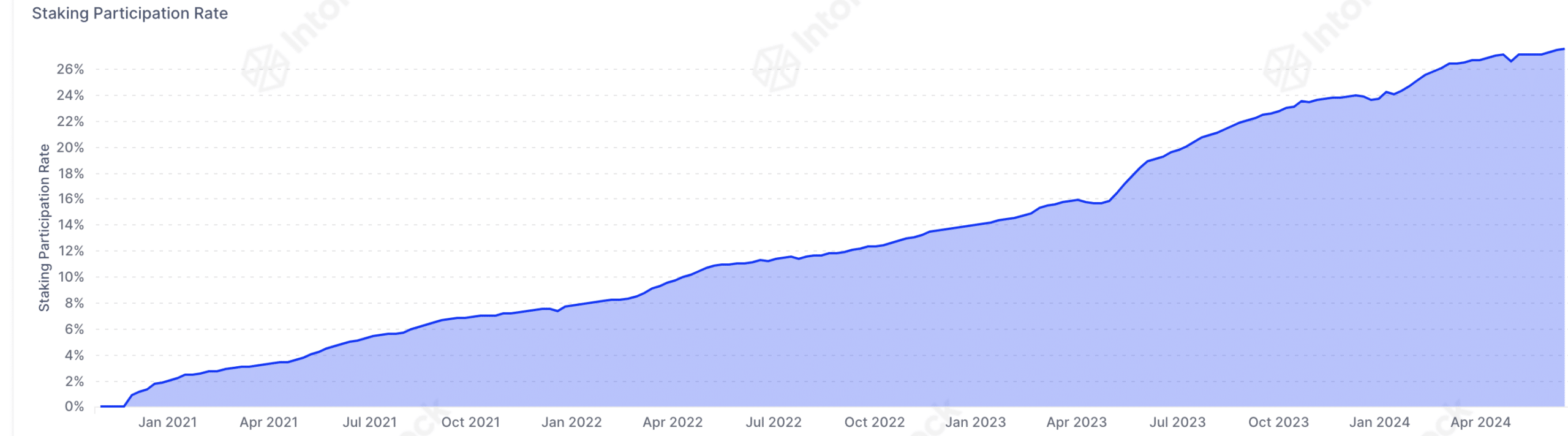

Ethereum’s [ETH] value has remained stagnant over the previous few days. Regardless of this merchants have been displaying curiosity within the altcoin.

Ethereum’s reputation grows

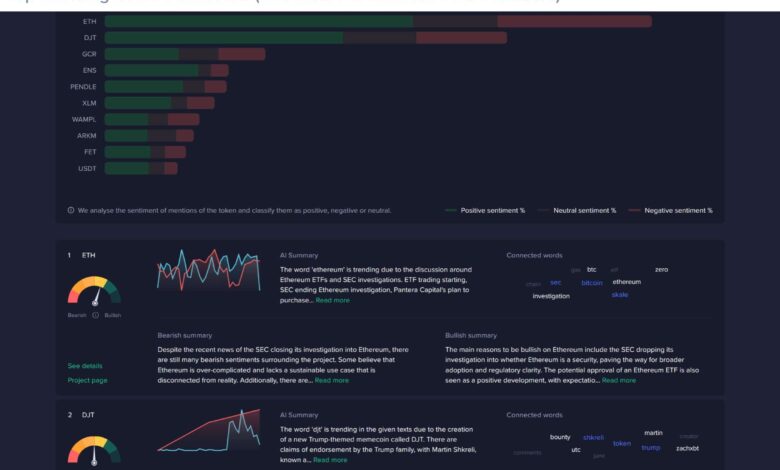

In accordance with Santiment’s knowledge, the recognition of ETH had soared considerably over the previous couple of days.

The present discussions surrounding Ethereum ETFs, SEC investigations, regulatory developments, and Consensys’ advocacy efforts for Ethereum’s standing are probably contributing to this elevated consideration.

There have been each bearish and bullish views that may be had across the reputation of the rising curiosity in Ethereum.

Santiment’s knowledge steered that the bearish issues stemmed from the potential classification of Ethereum as a commodity by the SEC.

Regardless of SEC dropping the investigation, the truth that it’s prepared to go after the coin may cause issues for the community. It may additionally pose a hurdle for the approval of different Ethereum ETFs, a key driver of present curiosity.

Moreover, the continuing regulatory battle between Ripple and the SEC casted a shadow, as comparable actions in opposition to ETH may dampen market sentiment.

The uncertainty surrounding Ethereum’s regulatory standing and its potential limitations act as headwinds for the venture.

From the bullish perspective, there have been loads of factors in favor of Ethereum. As an example, the SEC dropping its investigation, successfully clearing ETH gross sales of being securities, has been a significant increase.

This information has led to a surge in ETH-related altcoins and a extra steady market atmosphere.

Moreover, the event of cross-chain bridges connecting Ethereum to different blockchains showcased continued development and adoption inside the Ethereum ecosystem.

Supply: Santiment

State of staking

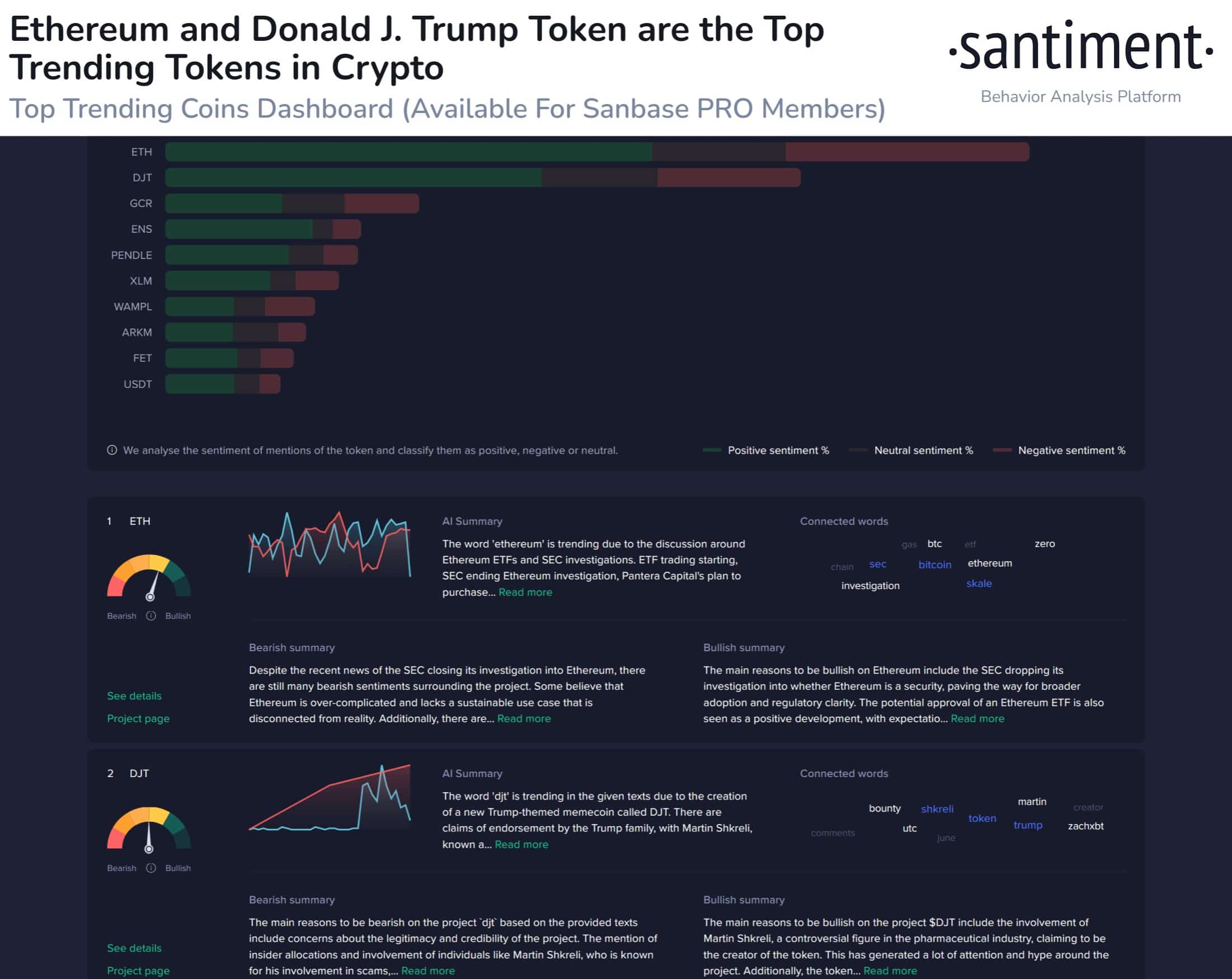

By way of staking, it was noticed that the staking participation fee elevated considerably for ETH. Nevertheless, staking yield volatility had surged materially.

Whereas a better participation fee is usually good, excessive volatility in yields could be a deterrent for some stakers looking for predictable returns.

Learn Ethereum’s [ETH] Value Prediction 2024-2025

This volatility may very well be on account of elements like fluctuations in community charges (MEV) or modifications within the complete quantity of staked ETH.

Supply: Intotheblock

At press time, ETH was buying and selling at $3,587.52. Over the past 24 hours, the value of ETH grew by 0.67%. Nevertheless, the amount at which ETH was buying and selling at had fallen by 27% throughout the identical interval.

Supply: Santiment