Ethereum’s price rally: What makes THIS level a make-or-break point

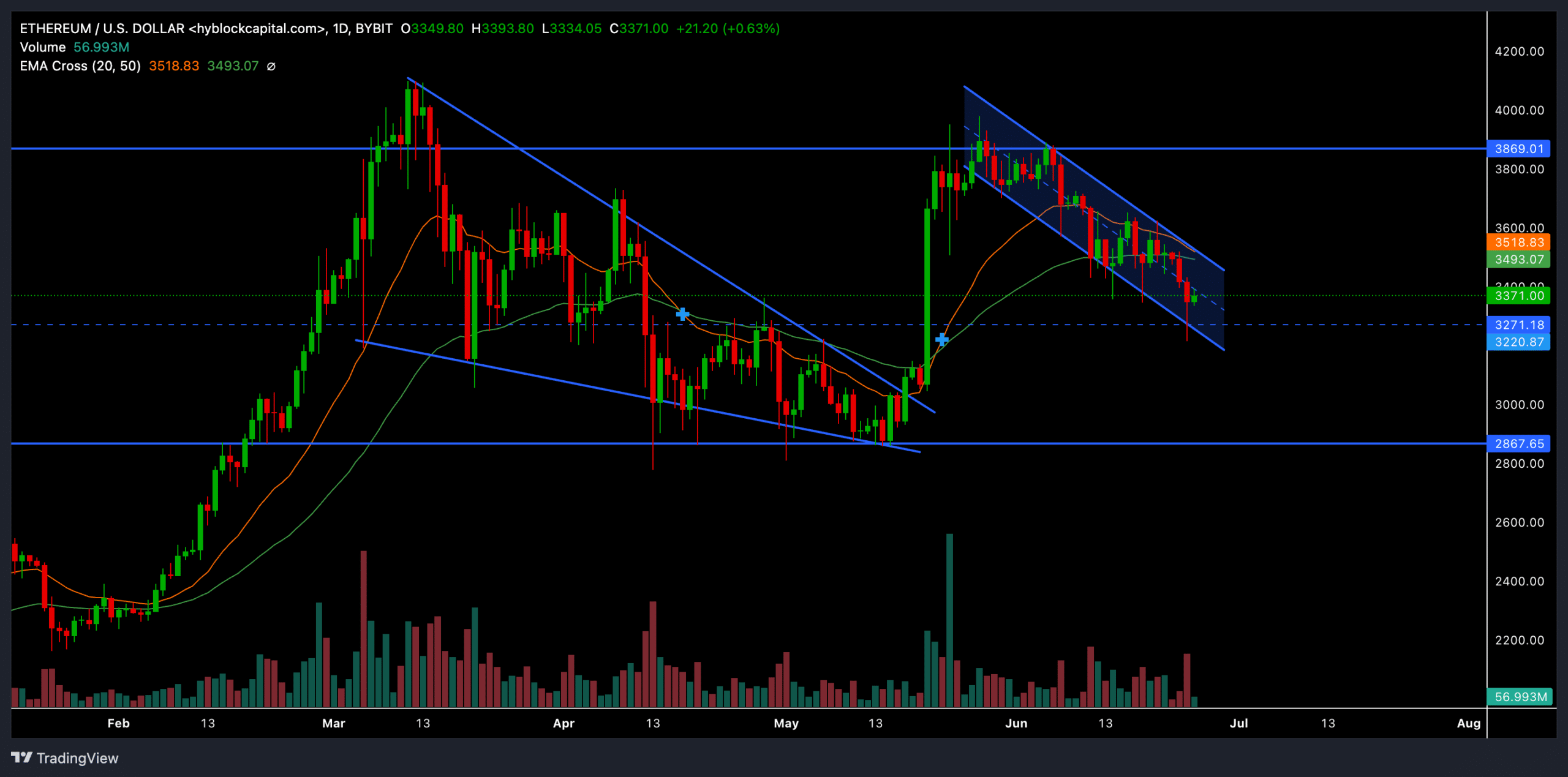

- Ethereum chalked out a basic descending channel sample on the every day chart, confirming a bearish edge.

- The rapid help vary on the $3,200 stage can decide ETH’s near-term trajectory.

Ethereum’s [ETH] reversal from the $3,900 resistance stage over the previous month has set the stage for the bears.

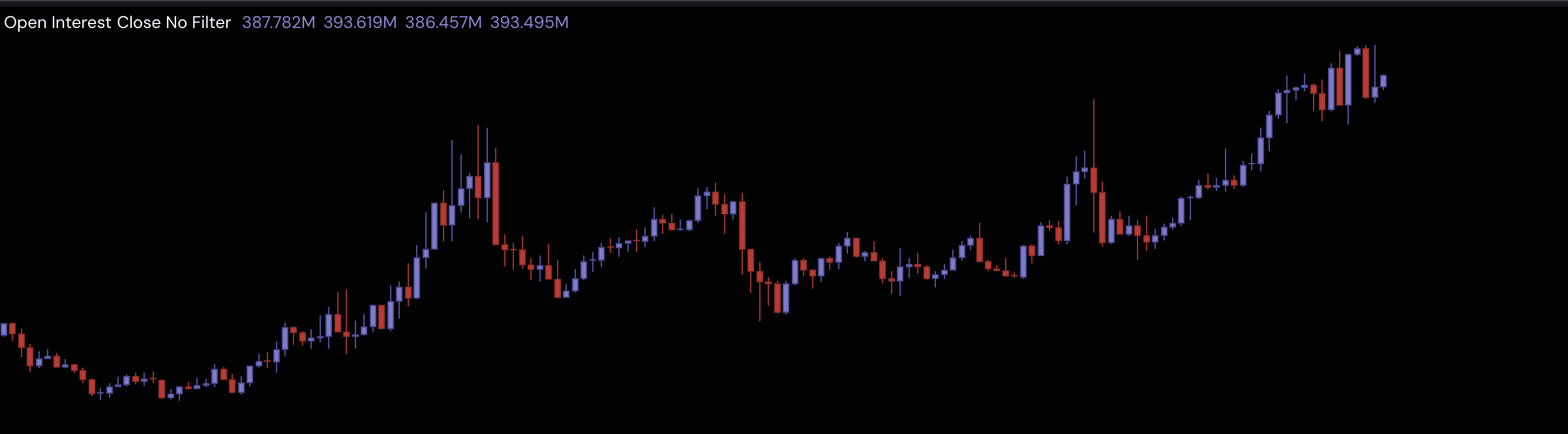

The altcoin’s rising Open Curiosity pattern throughout this time has additional raised questions on its capability to carry the rapid help stage.

Ought to the sellers proceed to extend stress from its press time stage, ETH might invalidate a bullish rally and see a downward breakout. A rebound from the $3,260 stage might help the consumers regain some momentum.

On the time of writing, ETH was buying and selling at $3,362, up by almost 3% up to now 24 hours.

Can ETH bulls reverse the bearish pattern?

Supply: Hyblockcapital, ETH/USD

ETH sellers have constantly held the resistance stage close to the $4,000 mark because the altcoins for over three months. The $3,900 ceiling blocked ETH’s 35% rally final month and pulled the value under the 20-day and 50-day EMAs.

The ensuing worth motion chalked out a basic descending channel sample on ETH’s every day chart.

Ought to the higher trendline of this descending channel proceed to withstand bull runs, ETH might proceed its downtrend within the quick time period. On this case, the $2,800 area might assist provoke a bullish rebound.

However, a possible shut above the present sample can set the stage for bulls to set off a rally. In such a case, The primary vital resistance stage for the consumers could be within the $3,900 area.

The Stochastic RSI confirmed extraordinarily oversold readings on the time of writing. Patrons ought to look ahead to a possible bullish crossover to gauge ETH’s near-term bullish potential.

Worth motion rising above the 20/50 EMA and a bullish crossover on stochastic RSI collectively might create a robust purchase sign for merchants.

Ethereum: Bearish edge emerges

Supply: Hyblockcapital, ETH/USD

In response to knowledge from Hyperblockcapital, ETH’s Open Curiosity indicator marked an uptrend (increased highs) over the previous month.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Nevertheless, the value motion noticed decrease highs throughout this time. This studying sometimes suggests a bearish divergence– the place extra merchants are coming into quick positions relatively than lengthy positions.

Additionally, the overall internet change flows over the previous day elevated by almost 140% to reaffirm the general bearish sentiment. ETH’s rebound from the $3.2K–$3.3K help vary could be essential to interrupt the bearish narrative.