Etheruem’s next price target: ETH can cross $3700, IF…

- Ethereum has a bearish market construction on the each day chart however nonetheless targets the subsequent key resistance zone.

- The quantity has been sub-par in latest days, therefore a retracement subsequent week is feasible.

Ethereum [ETH] clambered again above the $3k stage, and in an attention-grabbing flip of occasions for the bulls, the $3.1k former resistance zone was flipped to help.

The balancing act between whale deposits and alternate reserves confirmed that the latest deposits have been minor in comparison with the outflows of the previous two months.

The Ethereum community’s gasoline price reached Could’s lows, an indication of decreased community exercise. This was not a optimistic signal and mirrored decreased on-chain demand and gradual progress.

Quantity indicators ambivalent regardless of the breakout

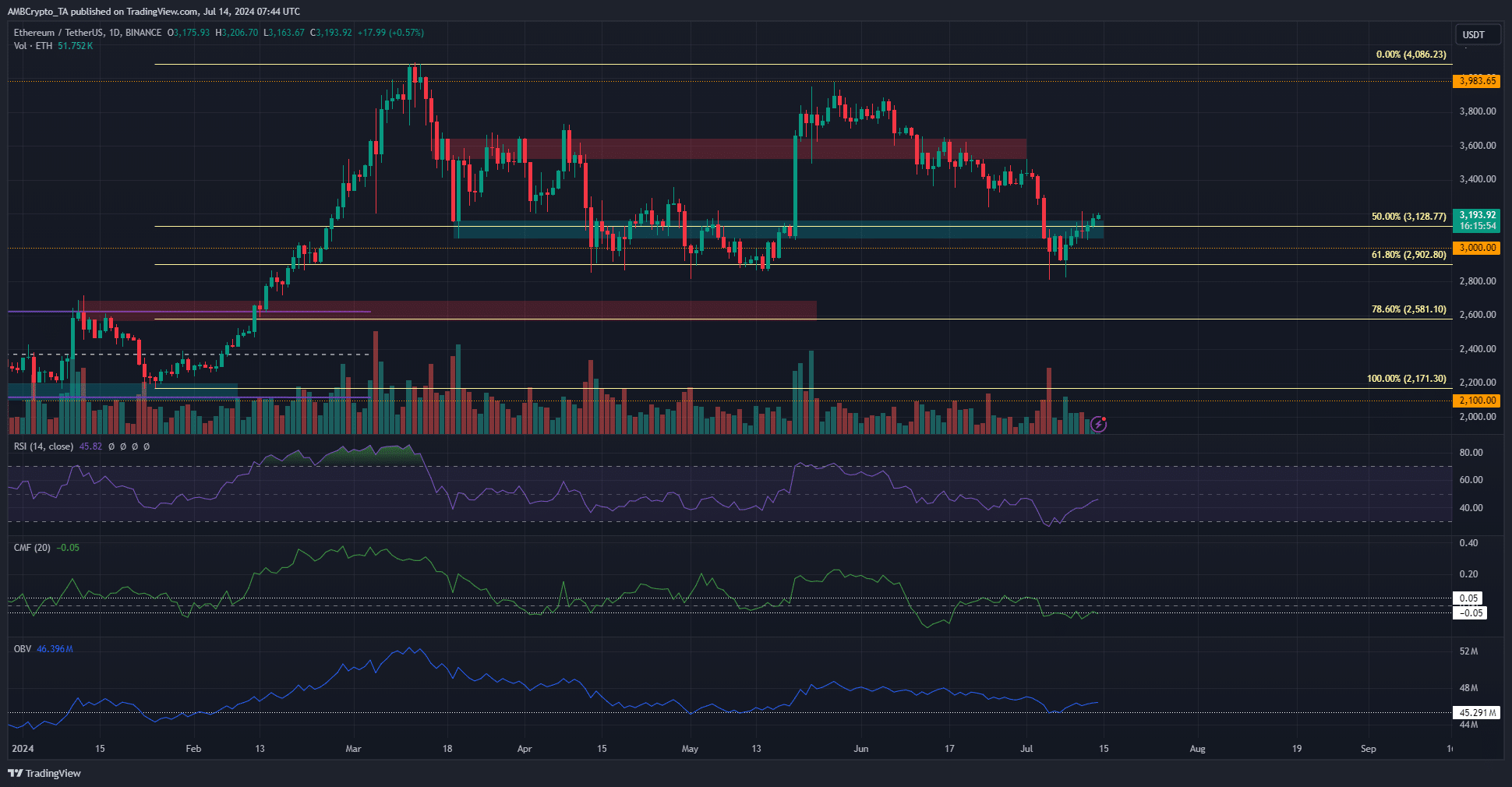

Supply: ETH/USDT on TradingView

On Saturday the thirteenth of July, Ethereum closed a each day buying and selling session at $3,201, breaking out of the resistance zone within the $3.1k space. Regardless of this achievement, the market construction and momentum have been bearish within the each day timeframe.

Furthermore, the CMF confirmed a studying of -0.05 which signaled notable capital movement out of the market. The OBV was unable to begin an uptrend as shopping for quantity stuttered over the previous ten days. This meant that the amount was too weak to be taken as a transparent sign of bullish energy.

The each day RSI was at 45 to sign bearish momentum however has crept greater over the previous week. As issues stand, Ethereum may not be prepared for a swift upward transfer except extra quantity enters the market.

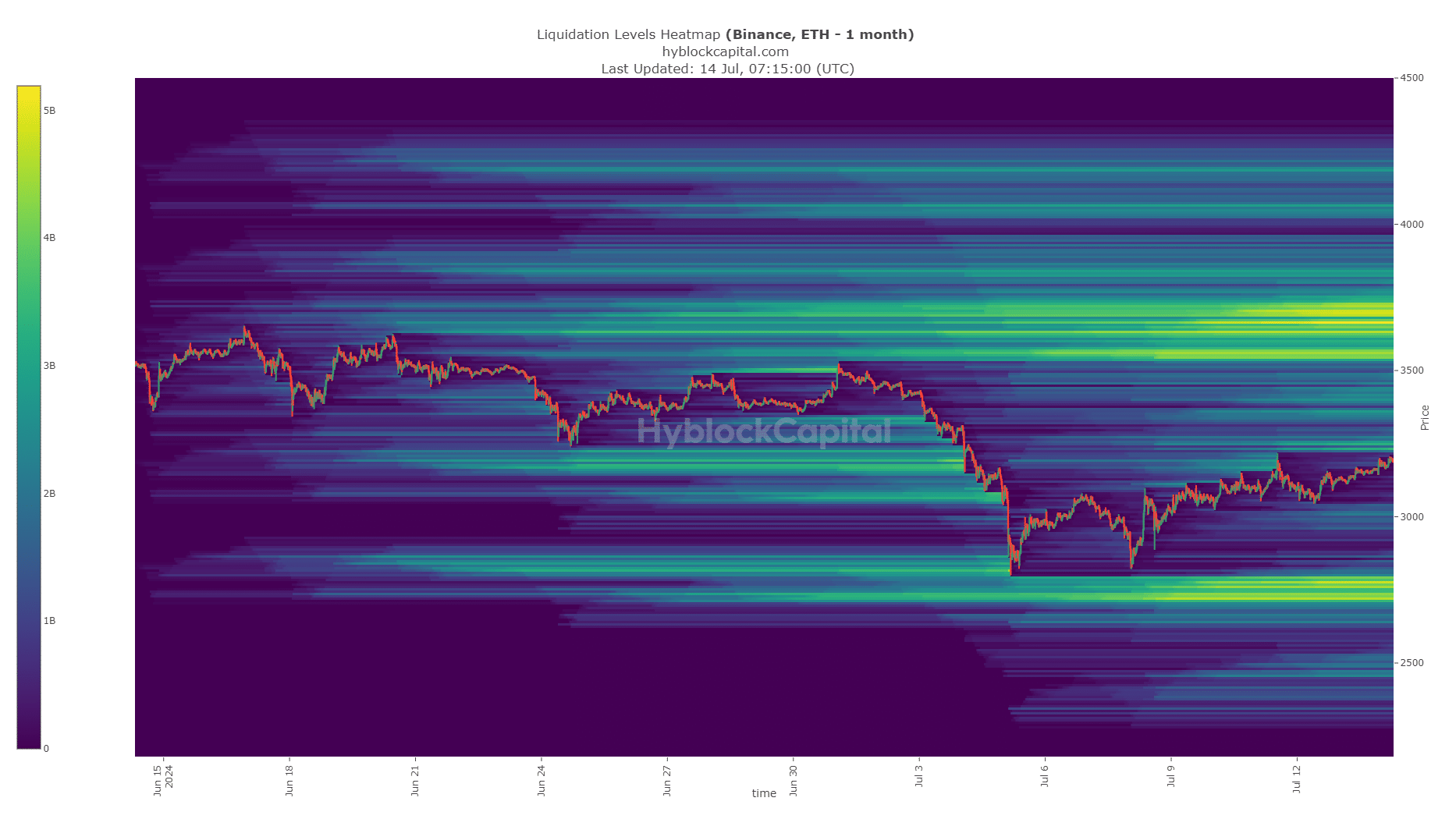

Liquidation heatmap’s clues on the subsequent resistance

Supply: Hyblock

The $2.7k-$2.8k zone to the south was a pretty pool of liquidity. It was examined within the first week of July however not wholly swept.

The next worth bounce above $3.1k meant the subsequent liquidity cluster at $3.5k-$3.7k could be the goal for bulls.

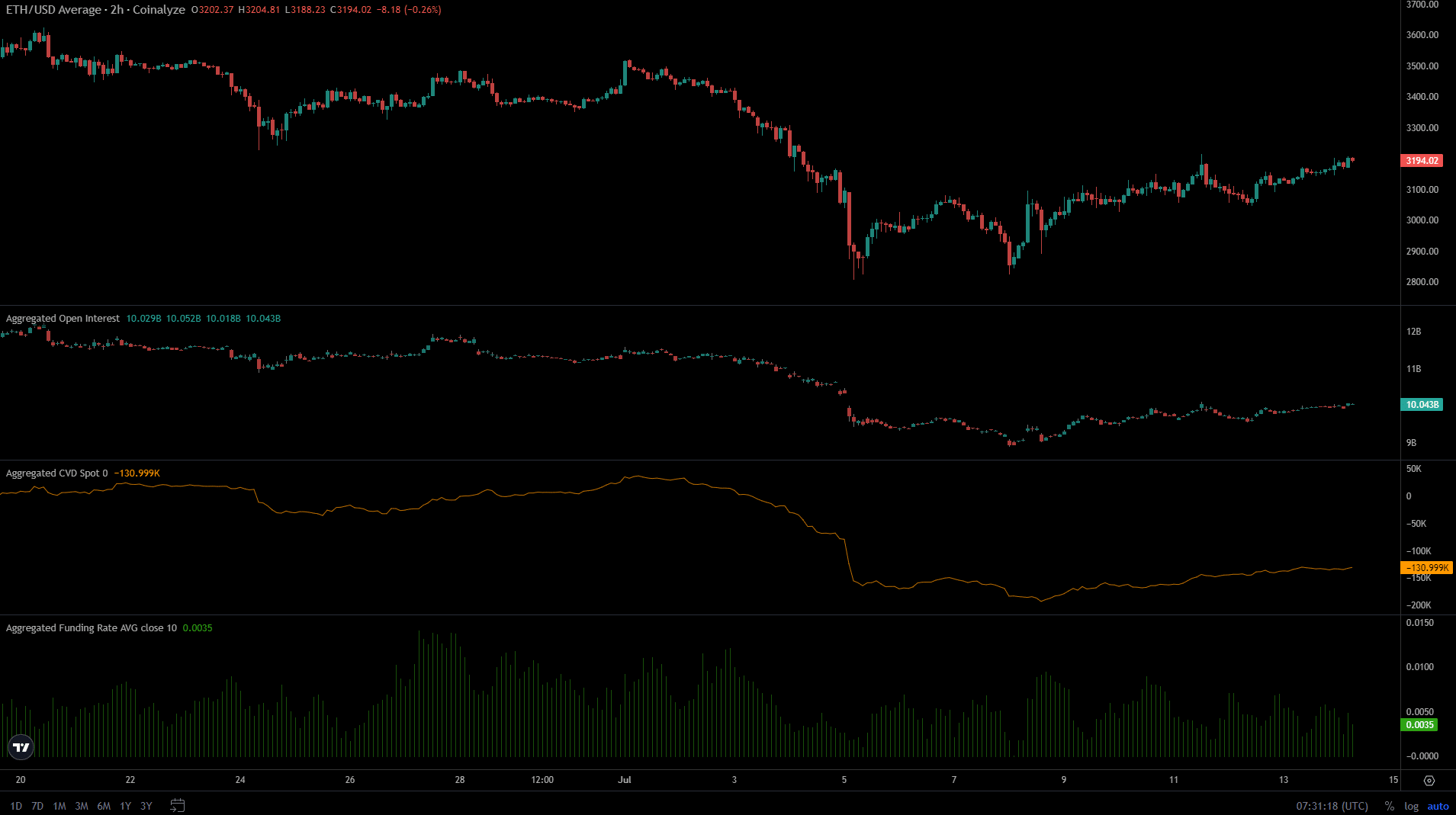

Supply: Coinalyze

Is your portfolio inexperienced? Test the Ethereum Revenue Calculator

The Open Curiosity has climbed alongside the costs and the funding charge was optimistic. The sentiment was strongly bullish, and the spot CVD was recovering too.

If the development remained intact, the probabilities of an ETH transfer towards $3.6k would turn out to be more healthy.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.