Crypto week ahead: Will Bitcoin, Ethereum hit new highs?

- Bitcoin has appreciated by over 4% within the final seven days.

- Most market indicators hinted at a worth correction quickly.

Bitcoin [BTC] and Ethereum [ETH] displayed bullish efficiency during the last seven days as their weekly charts have been inexperienced. Right here’s an in depth have a look at the highest two cash to learn the way the crypto week forward can be.

Bitcoin and Ethereum’s goal

In line with CoinMakrtetCap, BTC’s worth elevated by over 3% within the final seven days. Likewise, the king of altcoins additionally witnessed a 2% worth rise.

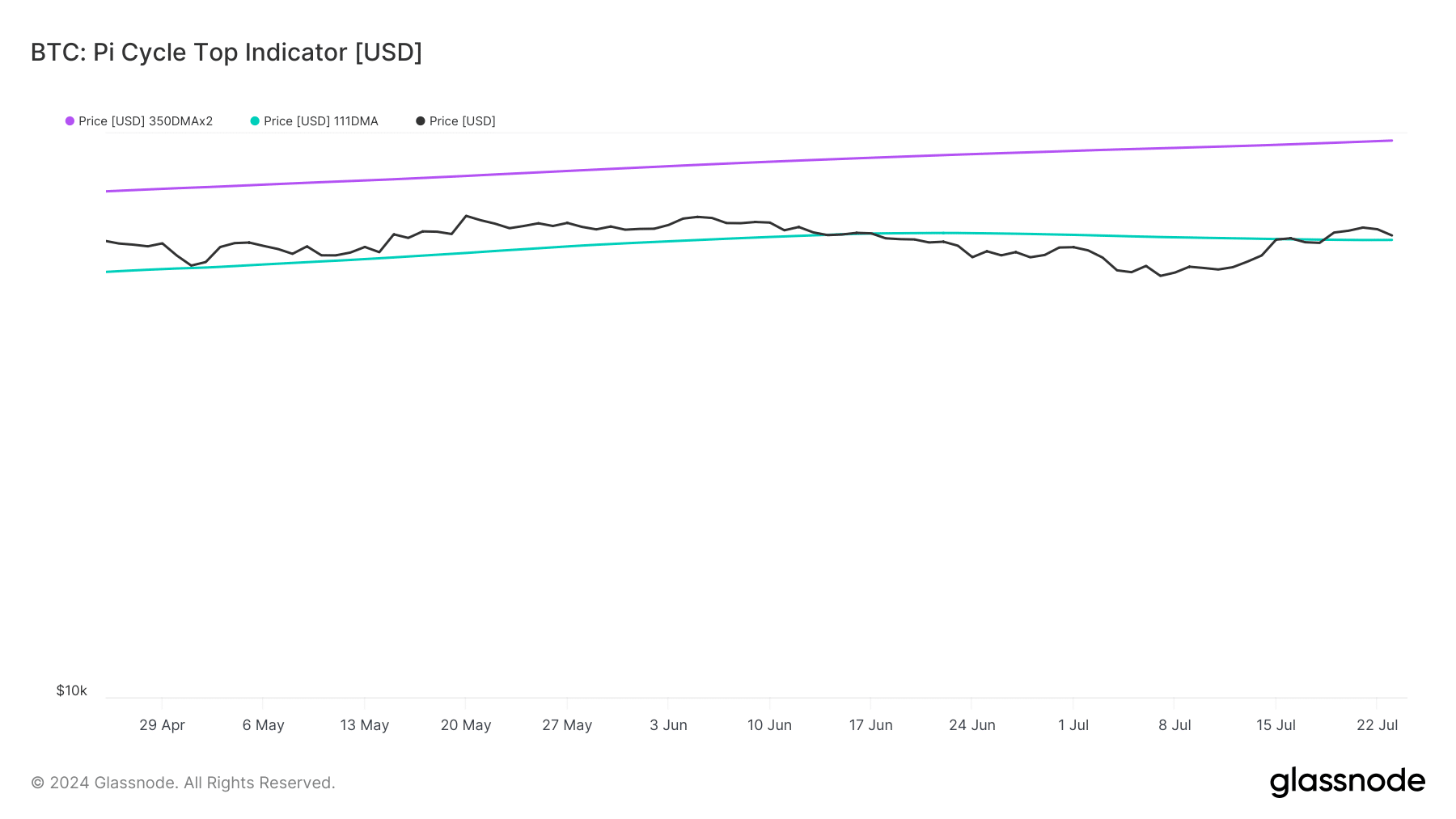

On the time of writing, BTC was buying and selling at $64k whereas ETH was buying and selling at $3.5k. AMBCrypto’s evaluation of Glassnode’s data revealed that BTC was buying and selling manner beneath its market high. As per the information, BTC’s doable market high was round $97k.

Supply: Glassnode

In the meantime, Ethereum’s worth considerably gained bearish momentum as its worth was touching the market backside. As per the Pi cycle high indicator, ETH’s worth would possibly hit a market high at $5.2k.

If the week forward goes bullish, then these two high tokens would possibly attain their targets.

What to anticipate from BTC and ETH

AMBCrypto then planed to take a look at each of those cash’ metrics to higher perceive whether or not the upcoming week will likely be bullish or bearish.

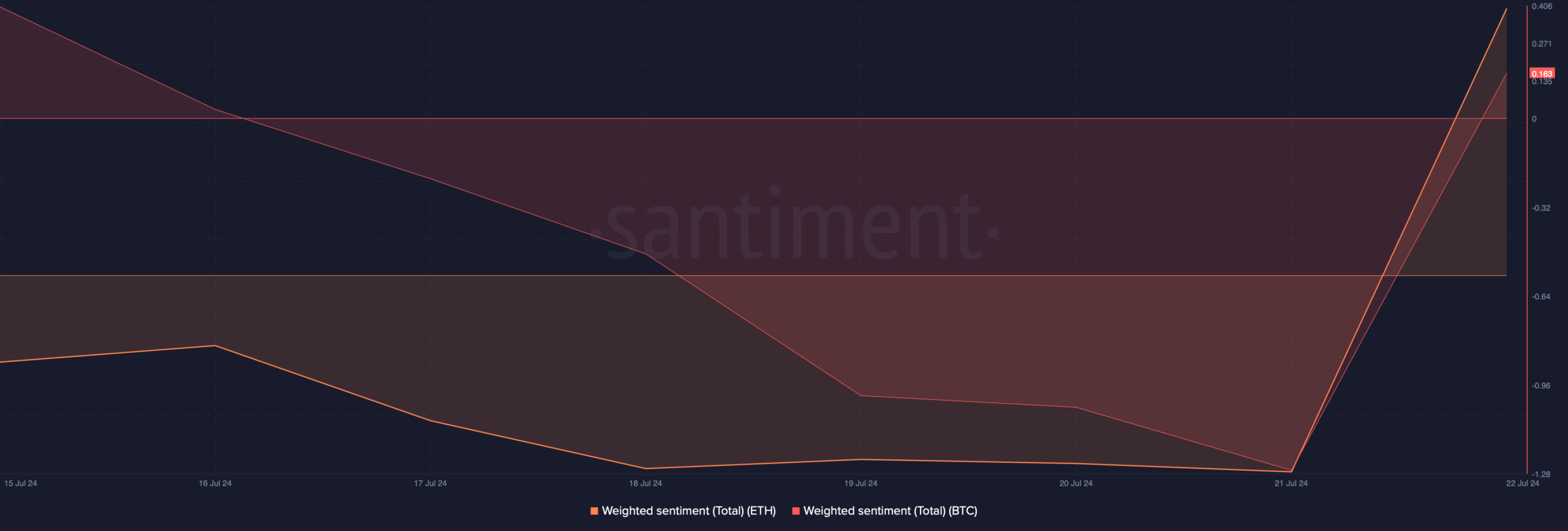

As per our evaluation of Santiment’s knowledge, sentiment round BTC and ETH turned bullish. Each the tokens’ weighted sentiments went into the constructive zone, which means that bullish sentiments have been dominant available in the market.

Supply: Santiment

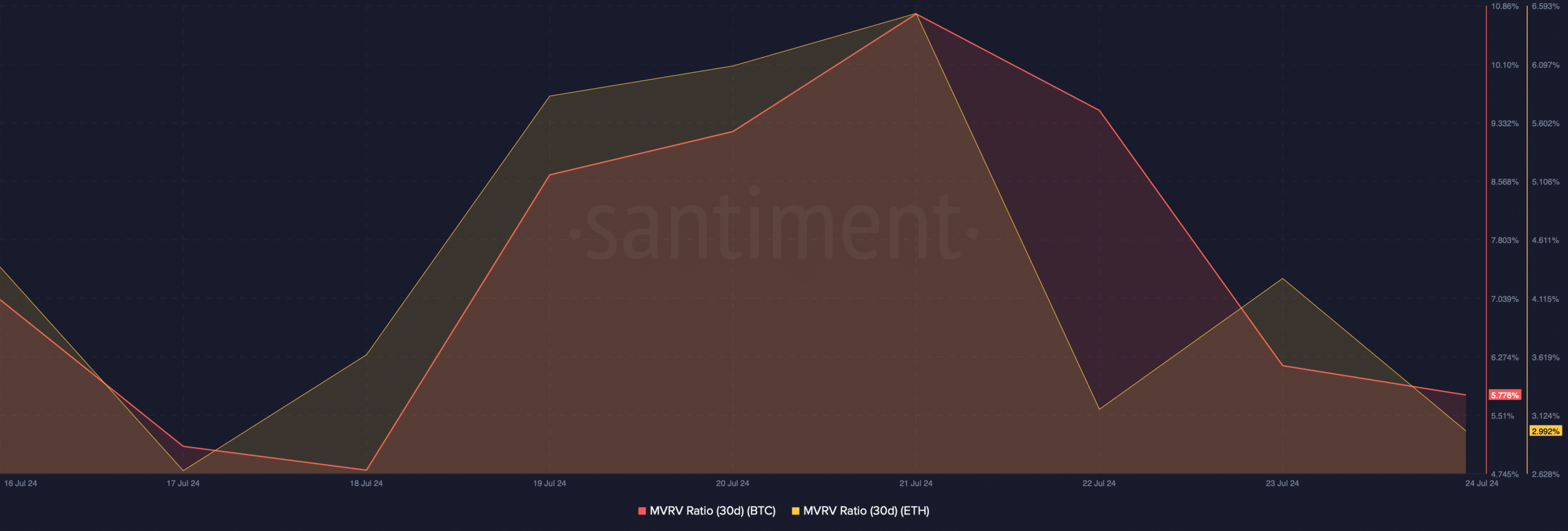

One other bullish sign was the MVRV ratio, because it registered an uptick during the last seven days. It signifies that the probabilities of a bull rally are excessive.

Supply: Santiment

Let’s take a look on the each day charts of BTC and ETH to higher perceive what to anticipate from them within the coming days.

BTC and ETH worth chart evaluation

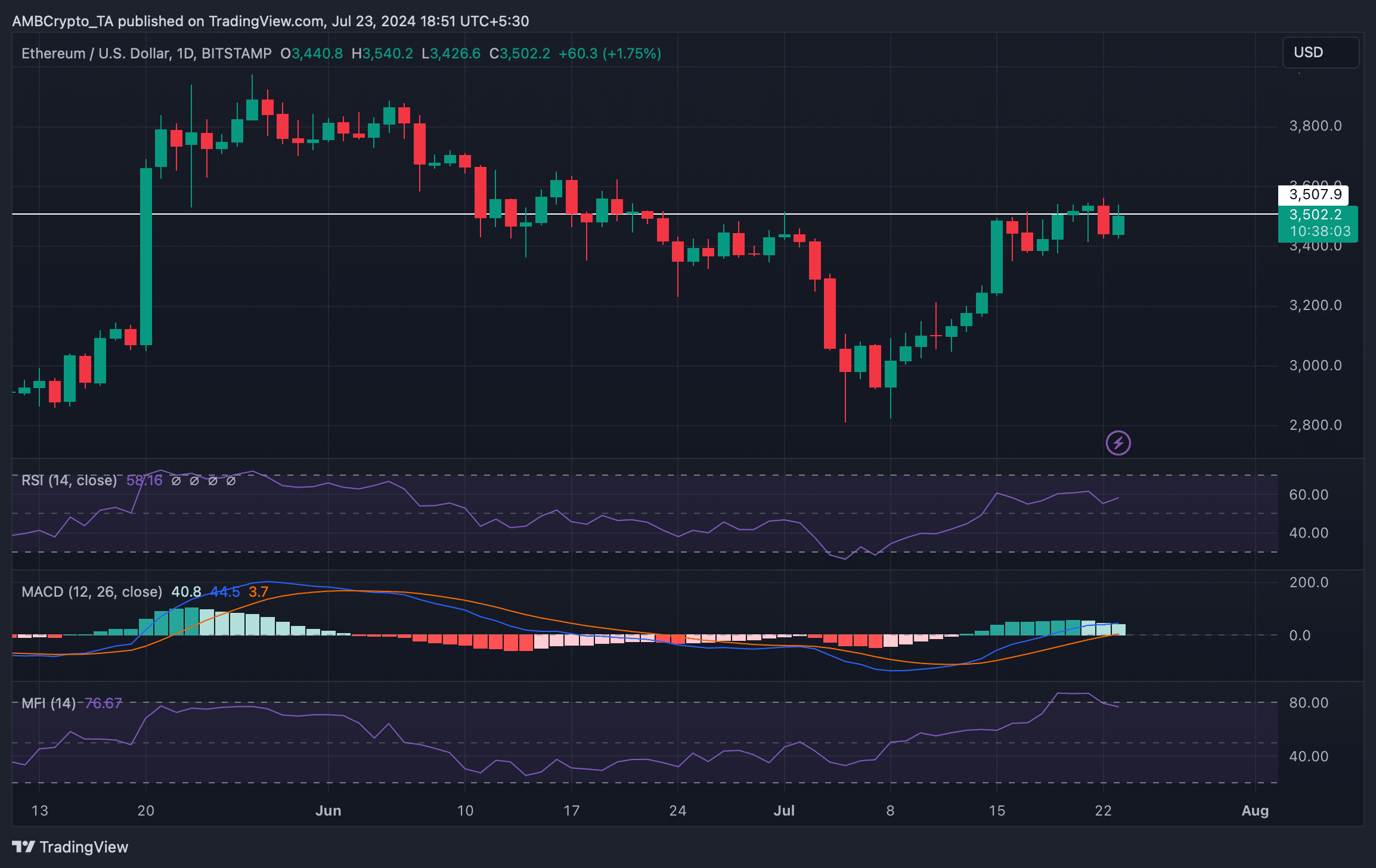

As per our evaluation, the MACD displayed a bullish benefit available in the market for ETH. Nonetheless, the remainder of the market indicators have been bearish.

For example,, the Relative Energy Index (RSI) and the Cash Stream Index (MFI) have been each about to enter the overbought zone. This would possibly improve promoting stress on ETH and, in flip, would possibly push the coin’s worth down.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024-25

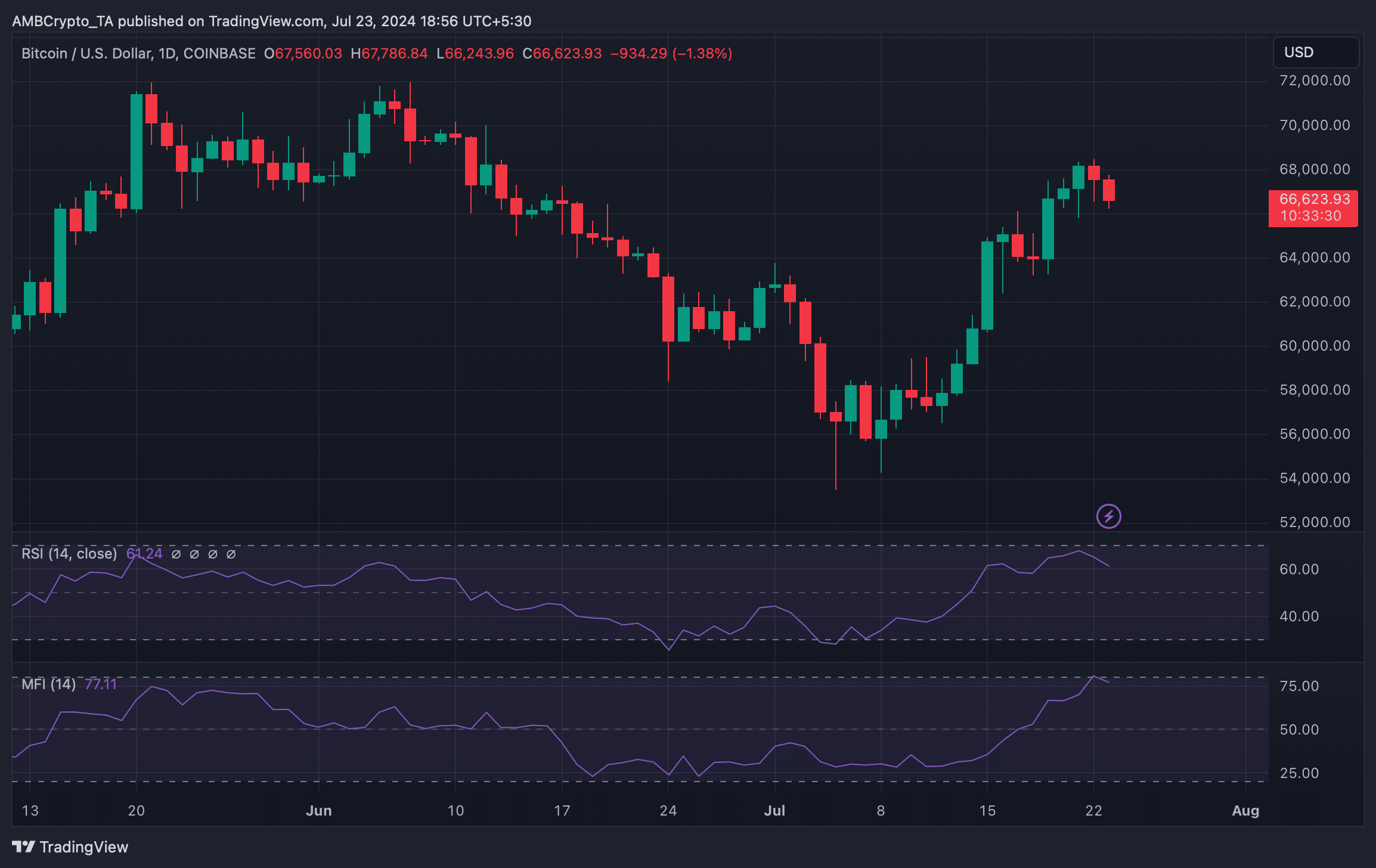

An analogous scenario was additionally famous on BTC’s charts. Each BTC’s Relative Energy Index (RSI) and Cash Stream Index (MFI) registered downticks.

This meant the upcoming week may be bearish for high cryptos like ETH and BTC.

Supply: TradingView