Ethereum: Why ETH’s drop below $2.9K shouldn’t worry you

- Ethereum has a bearish market construction.

- The magnetic zone beneath $2.9k signaled additional losses had been possible.

Ethereum [ETH] was once more buying and selling on the $2.9k help stage. It had beforehand visited this stage on the fifth of July. Within the following weeks, the bulls drove costs as excessive as $3.5k earlier than faltering.

Ought to we anticipate a bounce to $3.5k this time? The community exercise has dropped in latest months, however good cash exercise gave a bullish sign. The technical indicators continued to forecast bearishness.

Potential for short-term volatility and an ETH dip beneath $2.9k

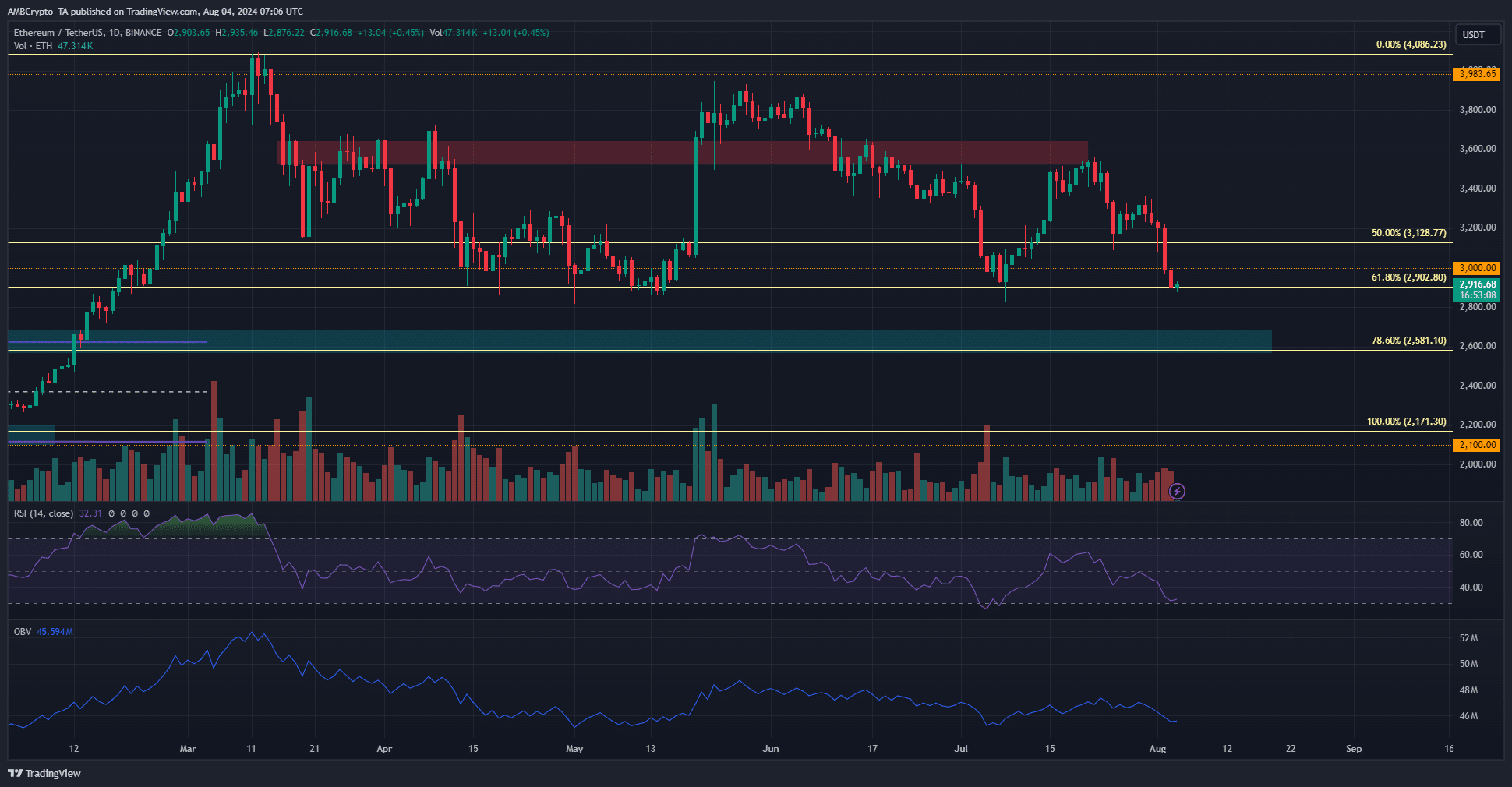

Supply: ETH/USDT on TradingView

At press time, Ethereum was buying and selling at $2916. It had a bearish market construction on the each day timeframe. Under the $2.9k stage, the following vital help zone is at $2.6k. The value motion confirmed that such a dip is feasible.

The each day RSI was simply above oversold situations and the OBV has steadily slid downward since June. Collectively they indicated additional losses had been coming.

The $2.9k help can be the 61.8% Fibonacci retracement stage and has been defended since April. Therefore, there’s a good probability that the bulls handle to defend it once more.

Potential for volatility resulting from a liquidation cascade

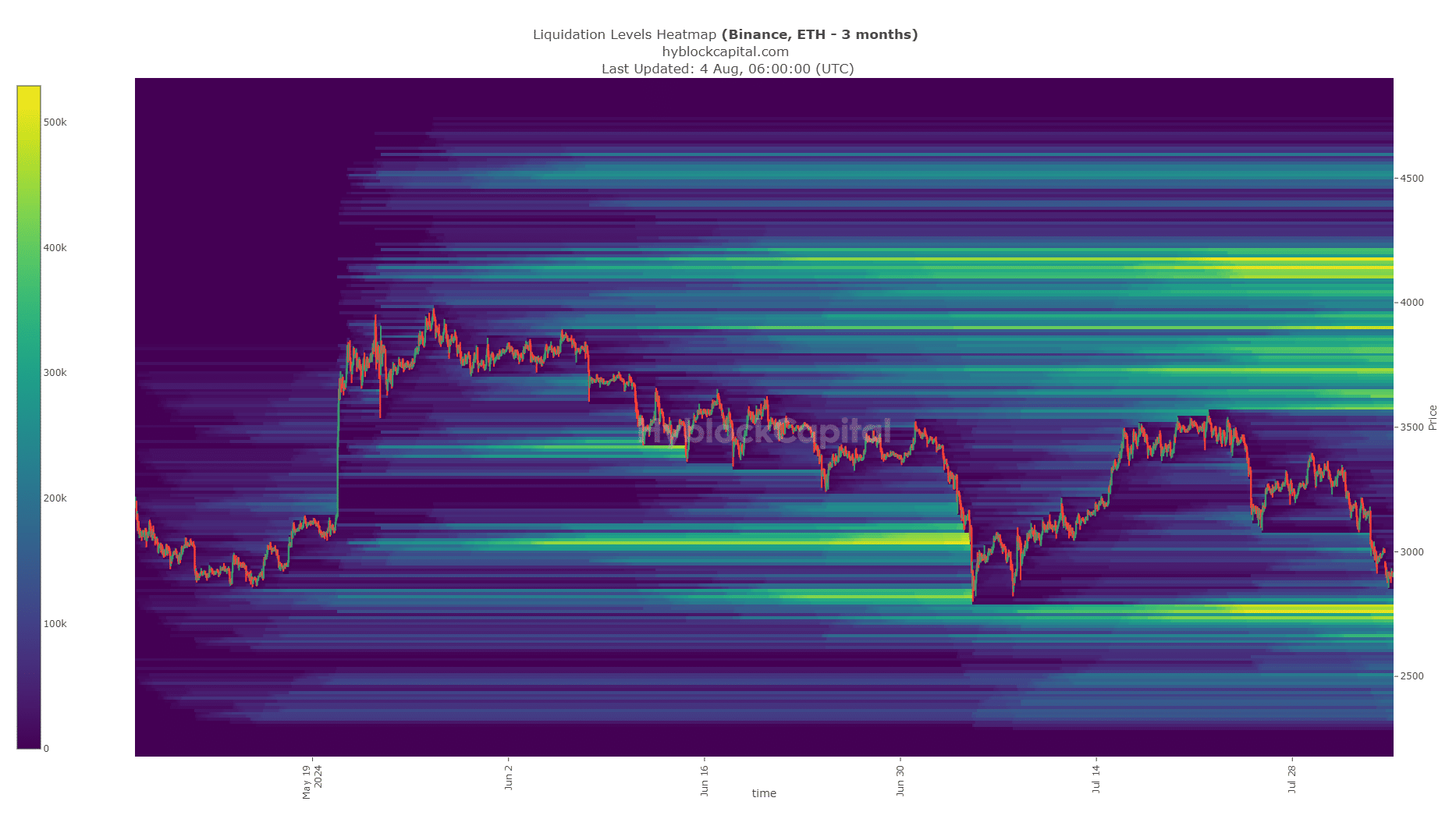

Supply: Hyblock

Over the previous six weeks, the cluster of liquidation ranges on the $2.8k zone has elevated. Costs are inevitably attracted to those liquidity swimming pools, making them magnetic zones. Despite the fact that $2.9k is a robust help, it’s extremely possible that the $2740-$2800 area is visited.

Learn Ethereum [ETH] Worth Prediction 2024-25

A bullish reversal from there may be anticipated, however merchants needs to be cautious of decrease timeframe volatility.

A day or two of buying and selling to determine $2.7k-$2.8k as help alongside an inflow of demand might encourage swing merchants to go lengthy.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.