Here’s why it’s Ethereum vs Bitcoin in the macro capital markets now

- Ethereum lags behind Bitcoin by way of demand from institutional traders

- Ethereum maintains robust lead towards Bitcoin in a single key space although

Spot Ethereum ETFs could have introduced some pleasure into the market, however the hype has not been anyplace close to what we’ve seen with Bitcoin. That is an final result that aligns with a push for Bitcoin from political elites.

Whereas the remark underscores how Bitcoin overshadows Ethereum, might the latter even have an obstacle by way of liquidity? In truth, a current QCP analysis instructed that Ethereum could also be sidelined from the macro capital markets whereas the market continues to favor Bitcoin.

Since each Bitcoin and Ethereum can be found as Spot ETF property, a efficiency comparability could present a clearer image of efficiency variations.

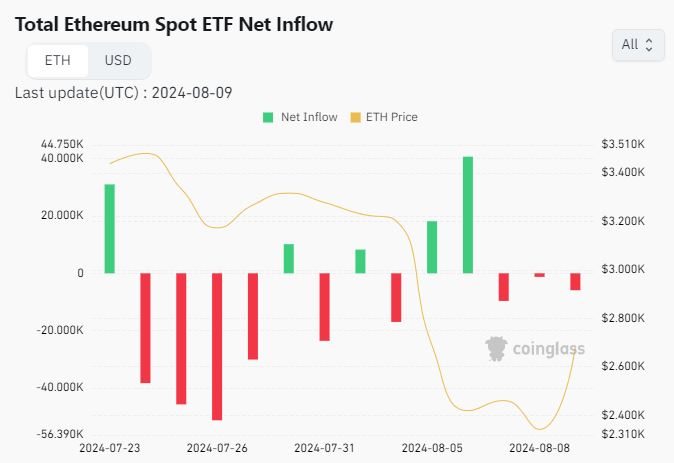

Bitcoin ETFs netflows averaged virtually 300,000 BTC within the final 2 weeks, in line with Coinglass. In the meantime, Ethereum had a complete spot ETF netflow of -114,350 ETH.

Supply: Coinglass

The information disclosed stronger demand for Bitcoin, in comparison with ETH within the spot ETF phase.

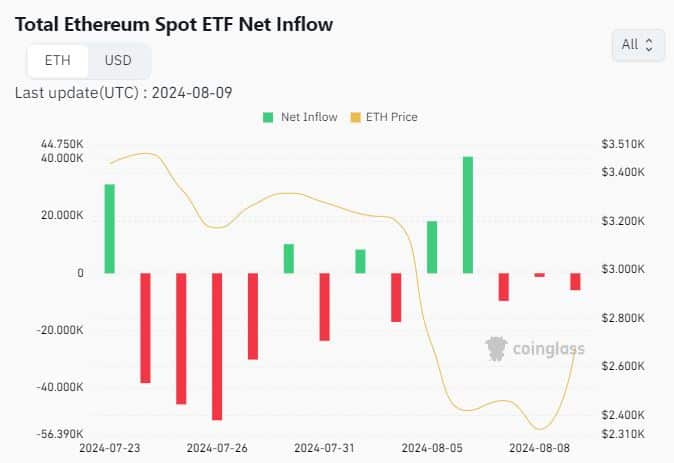

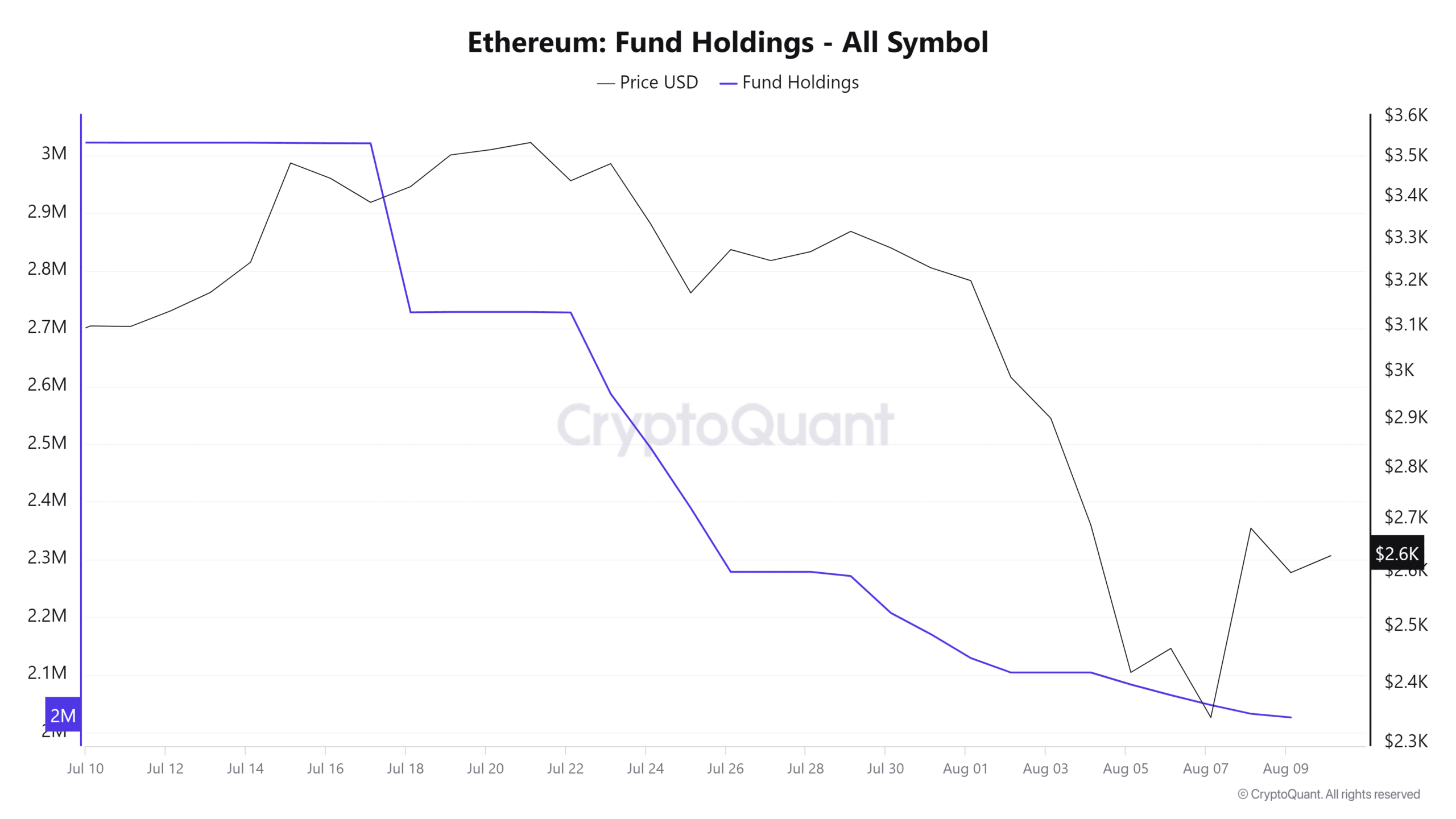

Our evaluation additionally revealed the identical for fund holdings. In line with CryptoQuant, ETH fund holdings amounted to 2,026,328.5 ETH, value $5.32 billion at ETH’s press time value.

Supply: CryptoQuant

Right here, additionally it is value noting that ETH fund holdings have been nonetheless on a downward trajectory on the time of writing, regardless of the market’s restoration.

In the meantime, Bitcoin fund holdings amounted to 280,951.35 BTC, which at press time worth have been value $17.07 billion – Slightly over 3 instances greater than ETH. This, regardless of BTC fund holdings additionally declining over the past 4 weeks.

A good comparability?

The aforementioned information confirmed that Bitcoin is extra preferable within the capital markets, in comparison with Ethereum.

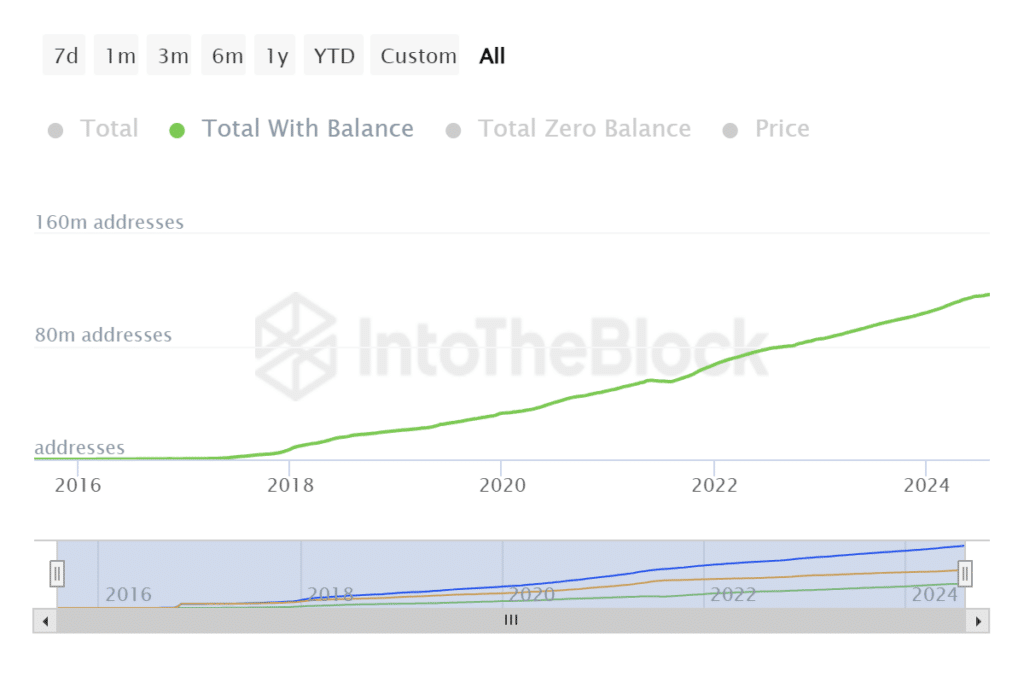

This will likely clarify why funds maintain extra in Bitcoin than Ethereum. Nevertheless, Ethereum additionally wins in different key areas too. For instance, it has a a lot increased complete deal with rely with stability at 116.97 million.

Supply: IntoTheBlock

As compared, Bitcoin had a complete of “simply” 52.67 million complete addresses with stability – Lower than half of the overall Ethereum addresses.

This highlighted one in every of Ethereum’s strengths as an increasing ecosystem. Maybe one of many greatest the explanation why Ethereum just lately obtained Spot ETF approvals.

There’s little question that Bitcoin’s early lead towards Ethereum affords a transparent benefit. Nevertheless, Ethereum additionally presents a chance that the institutional class of traders are beginning to embrace. Apart from, Ethereum ETFs are only some weeks previous, whereas Bitcoin ETFs have been round for months.

The remaining months of 2024 ought to present a clearer image of how Ethereum will fare within the macro capital market. Nonetheless, the findings affirm that Ethereum is at a little bit of an obstacle towards Bitcoin by way of securing institutional liquidity.

It could clarify the variations between BTC and ETH’s value motion too.